New Zealand Dollar Highlights

Chinese HSBC Manufacturing PMI

UK Retail sales

Sterling - New Zealand Dollar (GBPNZD) FX Technical Analysis

US markets came under pressure yesterday as retail sales raised less than expected for November and Fiscal Cliff negotiations seem to have reached stalemate. Retail sales rose 0.3% last month, disappointing the market that had expected a figure of 0.5%. This is key retail sales figure as it includes the Thank Giving Holiday and black Friday. Whilst posting a smaller than expected gain, the figures are likely to have been impacted by Hurricane Sandy and heavy holiday discounting by retailers. White House spokesman Jay Carney blamed the GOP for not budging on "the fundamental issue". He said the GOP has not shown "any difference in the stated position by the speaker of the House when it comes to revenue." The Republicans, however, said that the Democrats "only moved backwards since the beginning". The negotiation is now in a deadlock as Boehner returned home to Ohio for the weekend. At the press conference of the December FOMC meeting, Fed Chairman Ben Bernanke expressed his concerns over the fiscal cliff and indicated that the Fed would not be able to avert the crisis if the White House and the Republicans failed to agree on a deal. He also warned that, "Clearly the fiscal cliff is having effects on the economy".

FXstreet.com (Córdoba) - The Rating agency Standard and Poor's decided on Thursday to put UK's AAA rating on negative outlook from stable.

S&P expects the government debt/GDP ratio to rise in 2015 before declining. The agency also said the employment or growth shocks could pressure further the government finances.

This confirms a negative view that Moody's and Fitch have already announced on the UK, putting the country's AAA rating in jeopardy.

The HSBC manufacturing PMI rose to a 14-month high of 50.9 in December, up from November's 50.5. Also, that's the fifth straight month of gain. HSBC said that the recent surveys showed that "ongoing growth recovery is gaining momentum, mainly driven by domestic demand conditions". Nonetheless, it also mentioned that “the drop of new export orders and the downside surprise of November exports growth suggest the persisting external headwinds." Also, it noted that "calls for Beijing to keep an accommodative policy stance to counter-balance the external weakness, provided inflation stays benign".

Over the Christmas period with the majority of traders and market participants away there’s much thinner trading volumes which can mean increased volatility and we always recommend placing limit orders over the next 2 weeks to take advantage of any favourable moves in the exchange rate. Your Halo FX consultant will be happy to suggest levels if you’re keen.

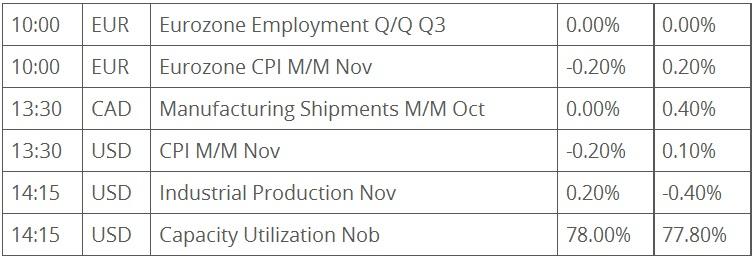

Data Releases

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.