Good morning traders.

Here are mythoughts/forecasts looking ahead over the next 12-24 hours.

Quote of The Week: Trade what you see not what you think.

Note: the Intra-Day FX Forecastshighlight price direction and likely price targets/stops designed for traderslooking at trading opportunities over the next several hours. These are not official traderecommendations, merely guidelines and forecasts, which are pretty darn usefuleach trading day.

Intra-Day FXForecasts:

- Dollar Index (DXC): Bullish no change from yesterday: full steam ahead after a successful move higher above key Fib resistance last week (97.42). Near-term target seen at 99.45+ as long as prices hold above 98.14

- EUR/USD: Bearish from yesterday, remains valid: the move higher off of Friday's low at 1.0706 is clearly corrective. Prices are testing the minimum Fibonacci resistance level at 1.0792 and price action looks labored. Below 1.0753 suggests a new leg lower towards 1.0700 and lower

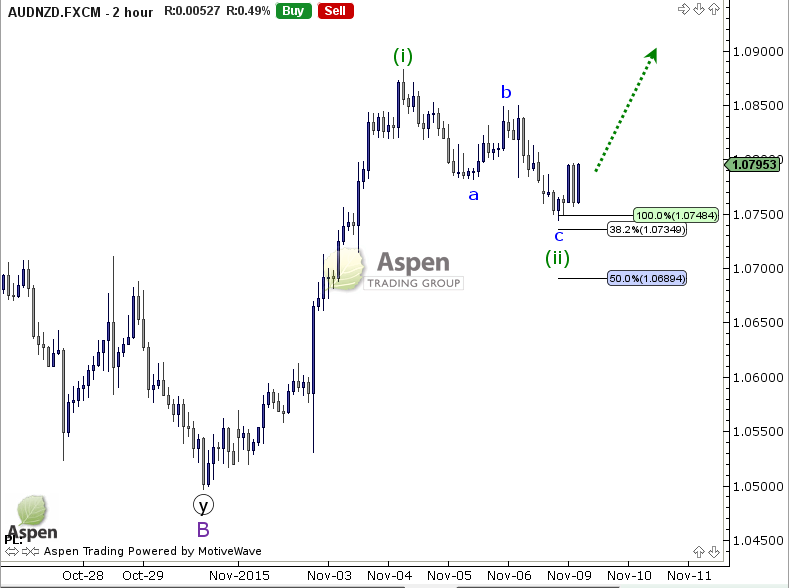

- AUD/NZD: Cautiously Bullish using the chart below as the backdrop for my bullish outlook, we simply need to be patient and wait for the Wave (ii) correction to complete.

- EUR/GBP: Bearish last week's spike higher was only in 3-waves and that suggests the move will not be sustained. Prices are already moving lower and a break below .7040 points to lower levels.

- NZD/CAD: Bearish looks like a triangle has developed here over the last few days and it suggests lower levels once complete. As of now I would be looking at a break below .8640 to kick the downside momentum into gear towards .8456 in the days ahead.

Dave

Aspen Trading Group´s FX Commentary, including any content or information contained within it or Aspen Trading Group´s web site, any site-related service, is provided “as is”, with all faults, with no representations or warranties of any kind, either expressed or implied, including, but not limited to, the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. You assume total responsibility and risk for your use of Aspen Trading Group´s commentary/website, site-related services, and hyperlinked websites.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.