Off to strong start to 2016

Get out if it doesn't feel the same

Keep your discipline

Make sure you're getting trade update via SMS

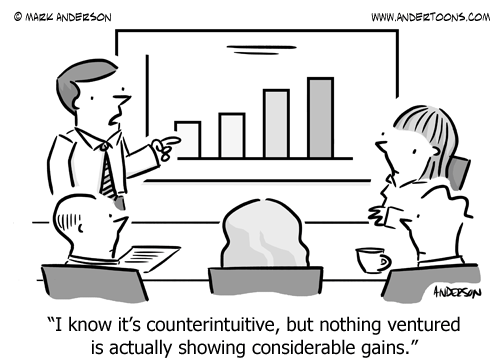

15%! - Another great performance in February and we are off to a bang in 2016. January's incredible +9% gains were followed up in February with returns of over 5%. That puts the JKonFX portfolio at just under 15% YTD and we are only in the first day of March! Trade has been steady throughout and despite some volatility in early January, drawdowns have also been quite low. Back at the end of 2015 I committed to trying to limit hold times on positions this year and so far things have gone well. Market conditions continue to show plenty of opportunity out there and I will keep my head down and keep looking for what I believe to be are the best trades.

MAXIMUM CONVICTION - Of course, trading isn't easy by any stretch and it requires a lot of discipline and good sense to know when to exit when something isn't feeling right. Sometimes this can be a frustrating process, but this process always pays off in the long run. Last week, I tried to trade 2 positions that showed no follow through into the close of the respective days on which I traded these markets. But each time, with the market showing no follow through into the daily close, I exited, avoiding the stress of holding into the next day with what would have been lesser conviction. It is imperative when trading that you always have the same strong feeling about a trade. Otherwise, you need to get out.

THE LUCKY ONES - There will always be plenty of missed opportunities when trading markets. The trick is to understand and embrace this fact and not get caught up with it. At the end of the day, as many missed opportunities as there are out there, there are even more opportunities for disaster if you aren't disciplined and decisive. It's NEVER about one trade and if you think like that, you are better off going to a casino. Stay focused. Make the right decisions. Know that when you are wrong, it's ok and to get out. Have confidence in the fact that if you do this, you will be right more than you are wrong and will ultimately give yourself a long career trading markets. Trading is about preserving your capital and protecting against the downside. The lucky thing for you is that 99% of people out there can't and NEVER will figure this out. This leaves you with incredible upside if you can just stay focused and stay disciplined. Your strategies are completely secondary.

STRATEGY - As I scan the markets early Tuesday, I'm not seeing anything out there that would compel me to take a position. But the markets don't usually let us down and before we know it, there is something out there that looks real sweet, that we never saw coming. As a contrarian, I am watching the Euro drop and would consider buying a sharp pullback from current levels. But we aren't anywhere close at this point. I would also love to buy GBPUSD lower down, but we aren't anywhere close yet. I'm keeping my eye on EURCHF and USDJPY as well, both markets have come under pressure and are approaching critical support. USDCAD is another one, hovering just above some major previous resistance turned support in the 1.3400's. But again...nothing out there yet and just watching right now. Stand by and I'll let you know if I see anything.

SMS NOTIFICATIONS! - As a reminder, if you are a PRO member, you can add SMS notifications for all my trades in your settings. Just click on the top right of the JKonFX site where it says 'Hi, XXX,' and select the 'My Account' option in the dropdown. Select 'Notifications,' scroll down and input your cellular number in the 'By Text Message' field. This way, any time I take a position, you will be notified right away. Always cross reference and check back with the 'Trade Journal' page for clarity and confirmation. Sometimes I will exit a portion of a position and it will be good to use the Trade Journal page for added clarity. The Trade Journal page updates in real time. There will be many days where it is quiet and the some days where I am jumping in and out and building into a position. We are completely transparent and want you to have every benefit of the trading. We are very excited about this service and are so glad to be sharing.

This analysis is for informational and educational purposes only. This is not a recommendation to buy or sell anything. MarketPunks is not a financial advisor and this does not constitute investment advice. All of the information contained herein should be independently verified and confirmed. Please be aware of the risks involved with trading in currencies, stocks, commodities, cryptocurrencies and sports. Do not trade with money you cannot afford to lose. It is recommended that you consult a qualified financial advisor before making any investment decisions.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.