On June 30th Greece must repay €1.6bn ($1.8Bn) to the International Monetary Fund (IMF). Currently Greece do not have enough funds to make payment and they are relying on emergency funding from the European Central Bank (ECB). However, European leaders will not release funds until an agreement on Greece's austerity measures has been made. Austerity measures include new taxes on businesses and the wealthy, VAT increases and savings on pensions.

The Greek government are looking for relief on austerity terms and see EU leaders as being 'tough on austerity'. Whilst all attempts at reaching a deal have been hampered, euro currency price action has been heating up. Commentary and analysis changes daily; one-day the market is elated on news that a deal is close, only to hear later that the meeting ended badly.

Last night we saw a 'step in the right direction' and it was said key obstacles appear to have been cleared. However, the Greek parliament haven't accepted the 'offer' yet and if they don't it could get messy.Investors are not convinced by the current situation and we have seen euro weaken across the board; overnight during the Asia session, EUR/USD was in free-fall from 1.13s to the 1.12s and further momentum, as the EU market opened, pushed the pair lower. EUR/USD now trades at 1.1160.

On Wednesday June 24th, a fresh round of Euro-group meetings will take place their target is to reach a final agreement. If a deal is made the euro may regain its lost ground but if there is no sign of a positive outcome then the euro may weaken further.

Trading in a volatile market environment involves understanding your level of risk. There are different ways to trade EUR/USD activity. You may take a short-term position through buying or selling EUR/USD directly in the market and managing risk using a stop-loss order. You may also buy EUR/USD options which involves limited risk without having to use a stop-loss order. The latter may be useful in volatile markets since you avoid getting stopped-out and you know your maximum investment size at the point of entering the trade.

The following are EUR/USD option trade examples to trade an UPTREND, DOWNTREND or increase in volatility.

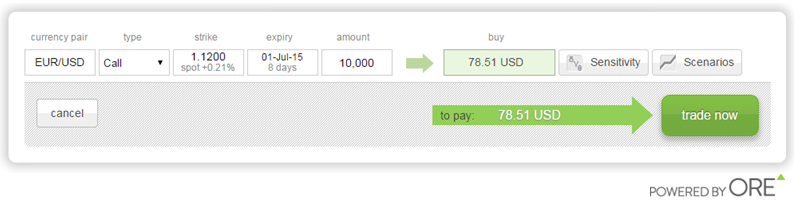

Buying a Call option- Trading an Uptrend

Through buying a Call option you can take advantage of an UPTREND with limited loss. As the market goes UP the related Call option's value rises.

For example, the image below shows a EUR/USD Call option traded from the optionsReasy platform. The option has expiry date July 1st (8 days), for amount 10,000 EUR and strike rate 1.1200. As EUR/USD rate moves UP and above 1.1200, the option's value rises (note that EUR/USD is currently trading at 1.1160). It costs 78.51 USD to buy this option. 178.51 USD is the maximum risk involved in the trade and to view profit potential you may click the 'Scenarios' button on the trade ticket.

To learn more about buying Call options click here

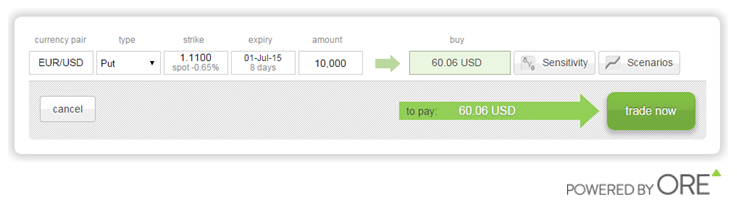

Buying a Put option -Trading a Downtrend

Through buying a Put option you can take advantage of a DOWNTREND in market price. As the market goes DOWN the related Put option's value rises.

For example, the image below shows a EUR/USD Put option with expiry date July 1st (8 days), for amount 10,000 EUR and strike rate 1.1100. As the EUR/USD rate goes DOWN and below 1.1100 the option's value rises (note that EUR/USD is currently trading at 1.1160). It costs 60.06 USD to buy this option. 60.06 USD is also the maximum risk involved in the trade and to view profit potential click the 'Scenarios'button.

To learn more about buying Put options click here

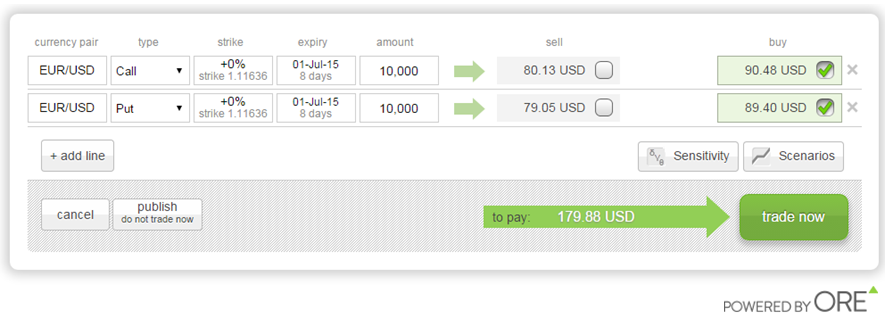

Buying a Call and a Put simultaneously - Trading increase in volatility

Through buying a Call and a Put option at the same time, you can take advantage of a large market move regardless of direction. If the market goes UP the Call's value will increase and if the market goes DOWN the Put's value will increase. This strategy is known as a Long Straddle and it is commonly used over economic news announcements.

For example, the image below shows a position that involves buying a Call and a Put in EUR/USD simultaneously, both with expiry date July 1st (8 days), amount 10,000 EUR and strike rate at 0% (where both strike rates match the current EUR/USD underlying market rate, that is 1.1160).

If EUR/USD rate moves UP and above 1.1160 the Call's value will rise and if EUR/USD goes DOWN and below 1.1160 the Put's value will rise.As one option contract moves into profit the other is at a loss and as the profit of the winning option grows it may cover the losing options. Hence this strategy relies on EUR/USD rate moving far enough away from 1.1160, either up or down!

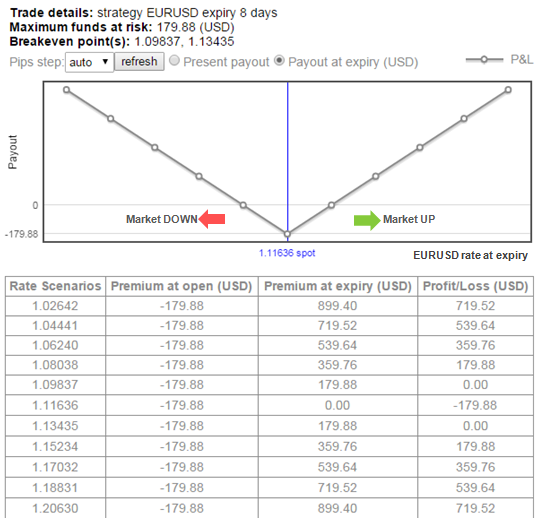

This option costs a total of 179.88 USD to buy (90.48 USD for the Call and 89.40 USD for the Put), this is the maximum risk involved in the position. The profit potential and break-even points, at the trades expiry, can be viewed in the Scenarios chart and table below; the vertical axis is the profit or loss and the horizontal axis is the EUR/USD rate. By expiry, on July 1st, if EUR/USD is trading at 1.1163 the maximum loss will be made. On the-other-hand if the pair is trading at or above 1.1523, or at or below 1.0803 a at least 100% will be made.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.