The US dollar has kicked of the week well bid after receiving a bump on Friday’s US jobs data. After a bit volatility that is. Still, the sort of volatility after the Non-farm Payrolls pales in significance to last week’s European Central Bank reaction, which saw the Euro clean up against the greenback. Perhaps the ECB volatility and subsequent Euro strength has squeezed market participants and help moderate what should have been a whole lot movement after the NFP’s.

Whatever the case, the US economy has passed a critical test, and a better than expected jobs print is a tick in favour of argument that the Fed are poised to increase rates on December 16. Markets will get more chances to gauge the performance of the US economy this week with Friday’s Retail Sales and University of Michigan consumer confidence data, among other mid-tier themes throughout the week.

This week its Australia’s turn with November’s unemployment data on Thursday’s docket, but the implications are in reverse. Market participants are of course looking at the domestic data flow in the context of rate cut in 2016. Early forecasts suggest the official unemployment rate my edge up to 6 percent from 5.9 in September. Still, the domestic economy has a habit recently of upside surprises with solid exports and GDP data last week keeping the Aussie well bid, notwithstanding further losses in commodities. It’s worth looking at the Aussie’s recent lack of correlative value with commodities.

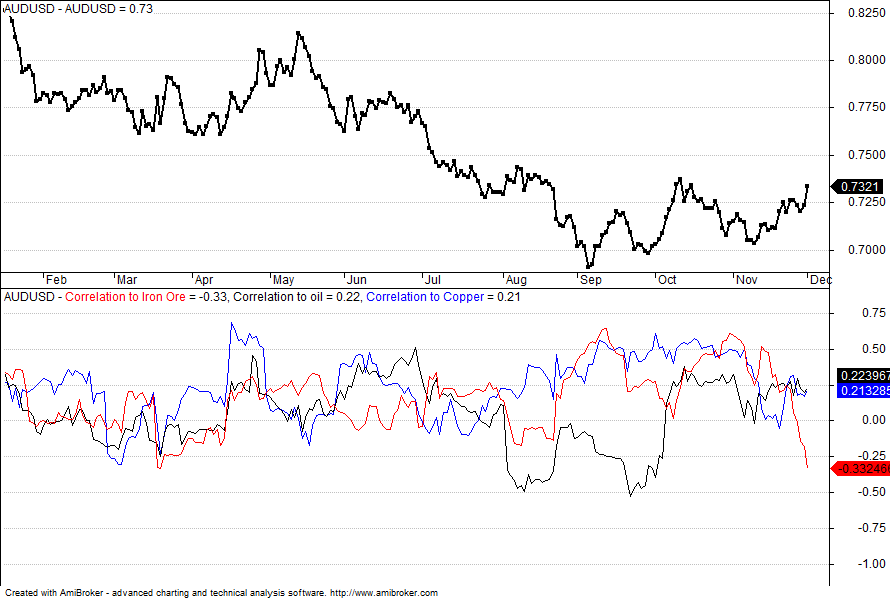

If we take a look at the top section of the chart below, it shows the price of Australian Dollar and bottom section shows the 20 day (approx. one calendar month ) rolling correlation between net changes in daily AUDSUD with net daily changes in prices of Brent oil (Black Line), Copper (blue line) and Iron Ore (Red Line).

As you can see, since the start of November this year, Aussie’s connection with the price of those commodities has noticeably weakened. Of interest is now the negative correlation that now exists between the currency pair and the Iron Ore.

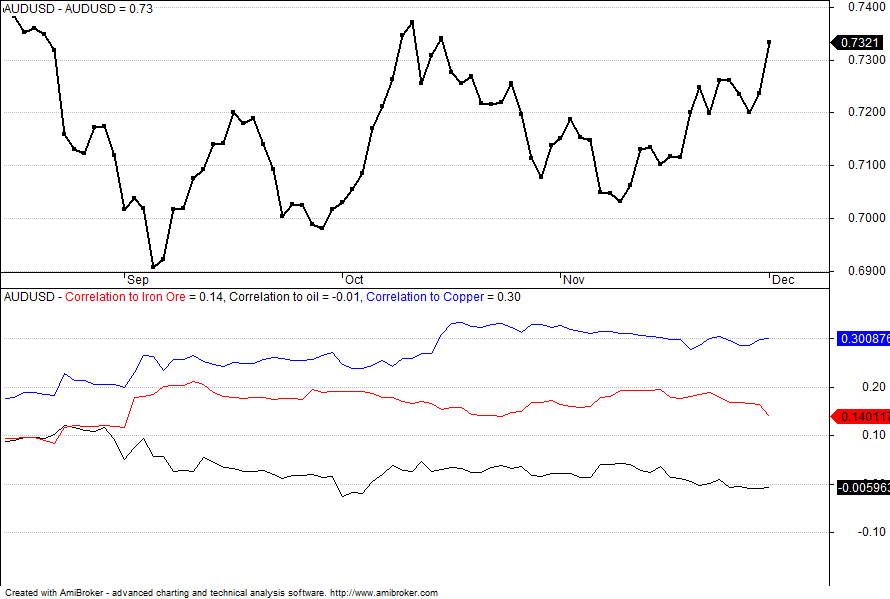

To get a better picture with a longer term view, we changed the correlation parameter to 126 (approximately 6 months) days. As you can see, even from a longer term point of view Australian dollar is becoming less sensitive to the price of commodities.

Given markets are forward looking; this means that the expected future negative outlook for commodity prices might have already been priced in. It also means that traders need to be more focused on Australian domestic monetary and economic conditions (e.g .rates, unemployment, CPI, Business activity in general) rather than commodity activities.

Still it’s worth pondering the ability for a material correction in commodities to shock the correlation back into play, which perhaps lends itself to the view that the Aussie has some catching up to do.

Current market snap shot and Net change

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.