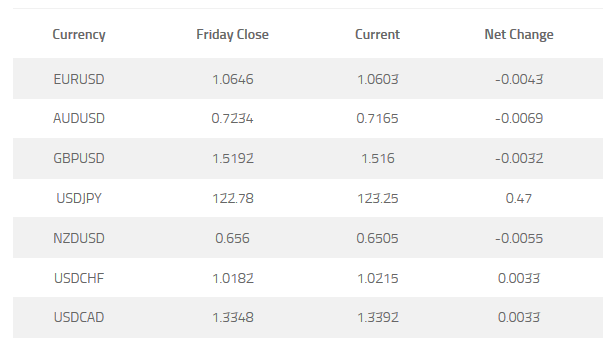

Key to the US dollar’s direction this week a full deck of economic data. It’s all rates in the U.S and clearly any data point which points to the upside, the greater the chance the Fed will increase rates in December. The dollar consolidated recent gains throughout last week, and solid data will represent a good opportunity for a pre-Fed rally, despite the fact its Thanksgiving week which will see lower volumes. We’re already seeing markets bid the dollar higher in the domestic session, with gains across ALL major counterparts.

Highlights this week include manufacturing PMI and existing home sales on Tuesday. Trade balance, 3Q gross domestic product and consumer confidence data on Wednesday. Thursday’s releases include, personal income and spending, consumption expenditure and durable goods orders, new home sales and University of Michigan consumer confidence. Refer to the GO Markets website for a full list of economic data this week.

If you value the opinion of Goldman Sachs, in a research piece released last week their economists’ are making a case for the Fed to start increase rates in December and expect 100 basis points to be added to the Federal Funds Rate in 2016. Given money markets are factoring 55-60 basis points, this view would suggests the greenback still has some legs yet. Although they do concede “the risks to this forecasts as skewed to the downside at the moment.” Read more at the Calculated Risk website.

The thematic remains quite the opposite across the Atlantic, with markets predicting when the European Central Bank will add more stimulus and take deposit rates deeper into negative territory. ECB President Draghi’s mantra is the ECB will do ‘whatever it takes’ to bring inflation back to acceptable levels, and didn’t sway from this commitment once again last week. The Australian covers Draghi’s latest comments in detail.

Much of this week’s data from the European region will be from Germany. Starting with Manufacturing and Services PMI on Monday, market participants will get a view of the health of Europe’s largest economy with GDP and IFO data on Tuesday and retails sales on Friday.

Locally, there’s not a great deal of top tier data on the agenda this week with Thursday’s 3Q Capital Expenditure (Capex) data generally a closely watched data point. The level of investment activity indicated by the Capex data serves as a barometer of sentiment about the economy. It may also provide an indication of confidence in new leadership with Prime Minister Malcolm Turnbull taking over the reins from Tony Abbott in September.

Certainly, there will be some interest around speeches from the RBA’s Glenn Stevens in Sydney, and Guy Debelle in London. At the time of writing the Australian dollar is buying 71.65 US cents.

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.