Introduction

The non-farm payrolls figure on Friday came in at 151k in comparison to 180k anticipated, largely due to the reduction in holiday season jobs that inevitably took place in January. USD did make some ground on Friday afternoon though as the market looked at the lower unemployment rate print, which came in at 4.9%. New year holidays take place in China and Hong Kong today and essentially all week, with holidays taking place in other nations nearby too. Expect low liquidity in CNY, CNH and other related currencies this week and potential moves that consolidate too.

Asian Session

AUD and CAD trade at .7110 and 1.3860 against the greenback at the moment. These are the two currencies that have risen most overnight in a sleep Asian session. ANZ bank released job advertisement info. for January which came in positively at 1.0%.

The Nikkei 225 index trades up over 1.0% as USD/JPY was contained largely within the 117.0 figure. Labour cash earnings data and the eco watchers’ surveys had little impact on markets.

The day ahead in Europe and NY

European investor confidence data is set to be released at 09:30 GMT today with EUR/USD currently trading at 1.1137. The currency pair moved to a 1.1246 high on Friday but calmed relatively soon after the figure release.

Housing starts and building permits data will be released at 13:15 GMT and 13:30 GMT respectively for Canada. BoC governing council member Timothy Lane speaks at 16:50 GMT today too.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1137 | -0.16% | 1.1162 | 1.1128 |

| USDJPY | 117.29 | -0.21% | 117.53 | 116.80 |

| GBPUSD | 1.4535 | 0.23 | 1.4547 | 1.4476 |

| AUDUSD | 0.7107 | 0.55% | 0.7116 | 0.7068 |

| NZDUSD | 0.6635 | 0.54% | 0.6646 | 0.6616 |

| EURCHF | 1.1068 | -0.20% | 0.9942 | 0.9909 |

| USDCAD | 1.3873 | 0.32% | 1.3908 | 1.3857 |

| USDCNH | 6.5741 | 0.001 | 6.5867 | 6.5692 |

FXO

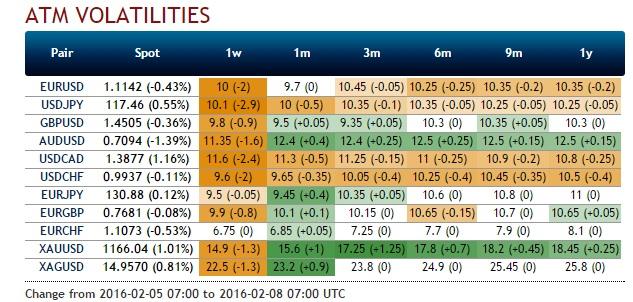

EUR/USD one month straddles kick off this morning with a mid. volatility of 9.5%. This is a reduction on Friday’s level. A number of volatilities have moved higher, particularly in the AUD/USD space.

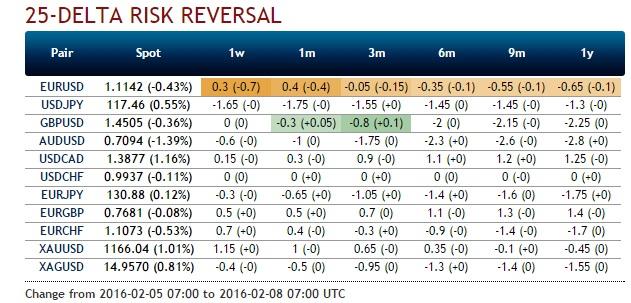

USD/JPY options sentiment within the retail space at Saxo Bank A/S shows a 70% bias for the downside, this is a move higher over the last twenty four business hours of 15%.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.