Talking Points:

-Australian inflation data to be this week’s highlight in terms of event risk.

-RBNZ rate decision with a neutral tone could prompt Kiwi selling.

-Japanese CPI data to prompt BoJ speculation?

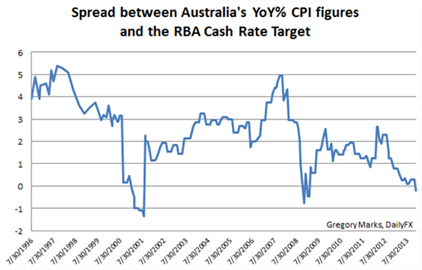

As we have stressed, inflation data out of Australia has become increasingly more important after last quarter’s YoY figure came in at 2.7%, above the 2.5% cash target rate out of the RBA. We have only seen inflation rates above cash target rates a number of times over the past decade and that period has not lasted long (see spread chart below). With that said, if we do see higher inflation out of Australia it is likely that the Aussie is to be well supported on the print. As the Reserve Bank of Australia is hesitant of raising rates in the current environment, higher rates may put pressure on the central bank to take on New Zealand style actions to curb on foreign purchases of domestic homes. Chinese buying of the residential property market has helped push up home prices and contribute to headline inflation figures over the past few months.

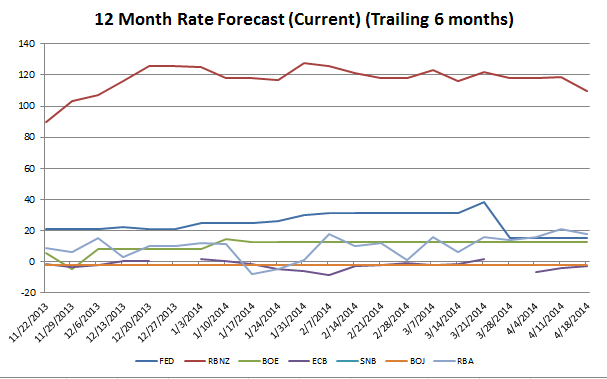

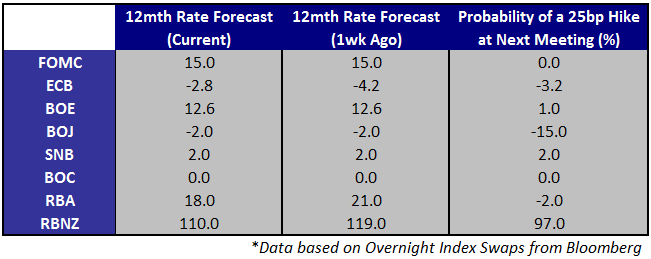

The Bank of England likely had some insight in regards to the inflation and jobs data out last week and we may see some comments on those latest developments. Although inflation came in below market expectations, employment data indicated that the rate dropped to 6.9% in March. As the GBPUSD pair continues to face heavy resistance at the YTD highs, any hawkish tone to the BoE minutes could help the pair achieve fresh highs. Nevertheless, with such a large degree of bullish expectations we may wish to remain cautious and attentive to incoming data.

Although expectations have been at record extremes in regards to rate hike increases, inflation data from last week may be the start of a shift in sentiment. Milk auctions have been light consistently over the past few weeks and with lower inflation as of March, a shift in sentiment could be fast and pronounced in what has been a one-sided move higher in the NZD over the past few months. That move could be especially pronounced in the context of a return of USD strength. Any neutral comments out of the RBNZ over some of the more hawkish rhetoric seen over the past few weeks could prompt further Kiwi selling.

The recent tax hike out of Japan has left market participants wary in regards to incoming data. Mixed messages last week out of the government left market in further confusion as the government detailed recent weakness while the BoJ noted that slowdowns in spending have been less pronounced than first thought. Still inflation data for March below expectations could prompt further speculation of more Bank of Japan measures come summer. It is important to note that Yen crosses as of late have been reacting less and less to Japanese data and more in regards to correlations with US yields.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.