Dollar reversal After a long string of gains for the dollar, the US currency fell against all its G10 counterparts yesterday. On the other hand, it was mixed against EM currencies, as the protests in Hong Kong, polls in Brazil and heavy fighting in Ukraine hit several of the major EM markets. There may be a connection between the two sides – I suspect that the EM tensions caused investors to pare back their positioning, which nowadays would mean closing out some long USD positions. I expect the impact of these events to fade as domestic US factors come to the fore again ahead of Friday’s nonfarm payrolls and I would expect to see the dollar gradually regain the ground that it’s lost.

The Japanese data out overnight was mixed. On the one hand, retail sales picked up notably as the unemployment rate fell and cash earnings rose more than expected. On the other hand, overall household spending fell much more than expected and industrial production unexpectedly plunged. The figures suggest that domestic demand may be picking up (the household spending data is unreliable) but overseas demand remains weak. Added to the slowdown in inflation announced last Friday, today’s news in theory should increase pressure on the Bank of Japan to weaken the yen further to stimulate demand. However, recent reports say that officials aren’t too worried by the trend of slowing inflation, because they believe the main cause is falling oil prices, plus inflationary pressures are rising domestically because of a tighter labor market and higher wages – as today’s data confirm. Personally, I would emphasize the pattern in Japan’s current account surplus, which continues to fall. Until that begins to turn around, I expect the yen to remain weak.

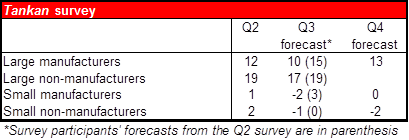

Tomorrow’s Bank of Japan tankan short-term survey of economic conditions will be a key indicator for the yen. The market expects the key large manufacturers’ diffusion index (DI) to fall to 10 from 12 in June. This is a big change from the June survey, when manufacturers forecast that it would have risen to 15 by now. In fact, expectations are that most of the major DIs will fall, reflecting the lack of a rebound from the hike in the consumption tax. Such a result could add to the speculation about further BoJ action and push the yen down.

China’s final HSBC manufacturing PMI for September was revised down to 50.2 from the provisional 50.5, but this had only a momentary impact on AUD/USD, which continued to move higher afterwards.

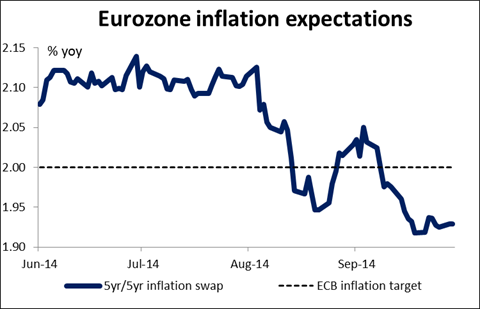

Today’s indicators: Following yesterday’s CPI data for several European countries, the Eurozone’s overall CPI for September will be released. Germany’s inflation rate (yoy basis) was unchanged while Spain’s deflation lessened slightly but Belgium slipped into deflation. Today’s Eurozone-wide figures are expected to show that the bloc’s inflation slowed slightly in September to +0.3% yoy from +0.4% in August. With only two days before the ECB meeting, data showing the risk of deflation continues in the Eurozone could add to hopes for more ECB easing, which would be EUR-negative.

German retail sales for August are forecast to rebound, while the country’s unemployment rate for September is expected to remain unchanged. Eurozone’s unemployment rate for August is also coming out along with the bloc’s CPI estimate for September.

In Norway retail sales excluding volatile items are due out.

In the UK, we get the final GDP for Q2 and Nationwide house price index for September. The former is expected to remain unchanged from the preliminary reading, while the latter is forecast to have slowed.

In the US, Conference Board consumer confidence for September is forecast to remain near its seven-year high, adding to signs of an improved US economic outlook. Chicago purchasing managers’ index for September is forecast to have decreased slightly. S & P/Case-Shiller house price index for July is also coming out.

From Canada, GDP for July is expected to have remained unchanged in pace from the previous month.

We have two speakers Tuesday: Norges Bank Governor Oeystein Olsen and Fed Governor Jerome Powell.

The Market

EUR/USD moves in a consolidative mode

EUR/USD moved in a consolidative mode between our 1.2693 (R1) resistance line and 1.2660 (S1) support level. There were one or two attempts to break above the 1.2693 (R1) zone but none of them found much support and the pair is now back in the aforementioned range. The RSI found support at its 30 line and is pointing up, while MACD poked its nose above the trigger line. These momentum signs increase the possibilities of a moderate rebound before the bears prevail again. In the bigger picture, as long as the pair is printing lower peaks and lower troughs I maintain my view that the overall path remains to the downside. I still expect the rate to challenge the low of the 13th of November 2012, at 1.2660 (S1).

Support: 1.2660 (S1), 1.2500 (S2), 1.2460 (S3).

Resistance: 1.2693 (R1), 1.2760 (R2), 1.2825 (R3).

GBP/USD remains close to 1.6380

GBP/USD declined on Monday but remained slightly below the support-turned-into-resistance line of 1.6280 (R1). The dip below that barrier confirmed that the 9th -19th of September up move was just a 38.2% retracement level of the 15th of July – 9th of September decline, and could trigger extensions towards our support line of 1.6160 (S1). However, looking at our momentum studies, the RSI remains below its 50 line but is pointing up, while the MACD seems ready to cross above its trigger line. This indicates that the downtrend is running out of momentum and increases the possibilities that the rate may attempt another bounce.

Support: 1.6160 (S1), 1.6070 (S2), 1.6000 (S3) .

Resistance: 1.6280 (R1), 1.6400 (R2), 1.6500 (R3) .

USD/JPY fails to close above 109.25

USD/JPY advanced on Monday and tried to rally above the 109.25 (R1) line. However, the pair failed to close above that resistance zone. As long as the price is trading above the blue uptrend line and above both the moving averages, I consider the near-term upside path to be intact. Nevertheless, a clear break above the 109.25 (R1) zone is needed to trigger extensions towards the psychological line of 110.00 (R2). In the bigger picture, I still see a newborn long-term uptrend, since, after the exit of a triangle on the daily chart, the price structure remains higher highs and higher lows above both the 50- and the 200-day moving averages.

Support: 108.25 (S1), 107.40 (S2), 106.80 (S3).

Resistance: 109.25 (R1), 110.00 (R2), 110.70 (R3) .

Gold still trading sideways

Gold remains trapped in a range between the 1208 (S1) support area and the resistance of 1225 (R1). Since the precious metal seems to be oscillating between these two lines, a break in either direction is likely to determine the forthcoming near-term bias. On the daily chart the price structure still suggests a downtrend, but our daily momentum indicators give me an extra reason to remain flat. The 14-day RSI exited its oversold field and is now pointing up, while the daily MACD shows signs of topping and looks ready to cross below its signal line.

Support: 1208 (S1), 1200 (S2), 1180 (S3) .

Resistance: 1225 (R1), 1240 (R2), 1260 (R3) .

WTI breaks above 94.00

WTI moved higher yesterday, breaking above 94.00, the upper boundary of the range it’s been trading since the 8th of September. I would expect the move above 94.00 to have further bullish extensions and target our resistance hurdle of 96.00 (R1) in the near future. The continuation of the bullish wave is also supported by our daily momentum studies, where the RSI moved above its 50 line and is pointing up and the MACD already above its trigger line is approaching its zero line.

Support: 94.00 (S1), 92.00 (S2), 90.60 (S3).

Resistance: 96.00 (R1), 96.70 (R2) , 97.80 (R3) .

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.