Ukraine talks make carry attractive It sometimes seems as if the markets are happily oblivious to what’s going on in the wider world, but the action Friday and at the opening Monday shows this isn’t entirely so. Friday was characterized by a large-scale “flight to safety” on reports that Ukraine had attacked and destroyed a Russian convoy in Ukrainian territory, a report that Russia deemed “fantasies.” Stocks fell, carry retreated as the dollar strengthened, USD/JPY moved lower, but EUR/USD was relatively little affected (down 30 pips at most) even though the DAX fell 2.7% from its peak. In any event the Russian reassurances calmed the market and over the weekend, the foreign ministers of Ukraine, Russia, Germany and France met for talks to arrange a cease-fire.

While the talks were not immediately successful, simply the fact that they are meeting and talking is progress and is likely to encourage “risk-on” investments today, in my view. So once again the carry trades should be in fashion and I expect to see gains among the EM currencies. Looking at Friday’s price action, TRY, RUB, PLN, ZAR and HUF seem to be poised to recover the most. From a fundamental point of view we are wary about TRY. RUB of course is going to respond quite quickly and closely to the events in Ukraine. The other three have more solid fundamental underpinnings, especially the Eastern European currencies.

GBP is rallying this morning after Bank of England Gov. Mark Carney was quoted in the Sunday Times as saying that the Bank can raise rates even before it sees the “fact” of higher wages. There may be more people who went short around 1.70 who might decide to take profits, or people who have been looking for a bottom to enter into a new long, to keep this rally going longer. See the technical section for more details.

Oil climbed sharply in US trading Friday on the Ukraine news, but is down slightly from its New York closing levels this morning. The events in the Middle East seem positive for oil – Kurdish forces are gaining as the US bombing helps to push back the Islamic State fighters, while Libyan output is rising as the port of Es Sider prepares to ship crude. The fundamental outlook for oil looks bearish to me. Similarly, the fact that gold fell last week despite the rising tensions is not a good sign for the precious metal.

Today’s events: Monday’s calendar is very light. During the Asian morning, the UK Rightmove house price index for August showed asking prices actually fell in August by 2.9%, showing an accelerated decline after July’s -0.8% fall.

During the European day, we get the Eurozone’s trade balance for June, while in the US, National Association of Home Builders (NAHB) market index for July is due out.

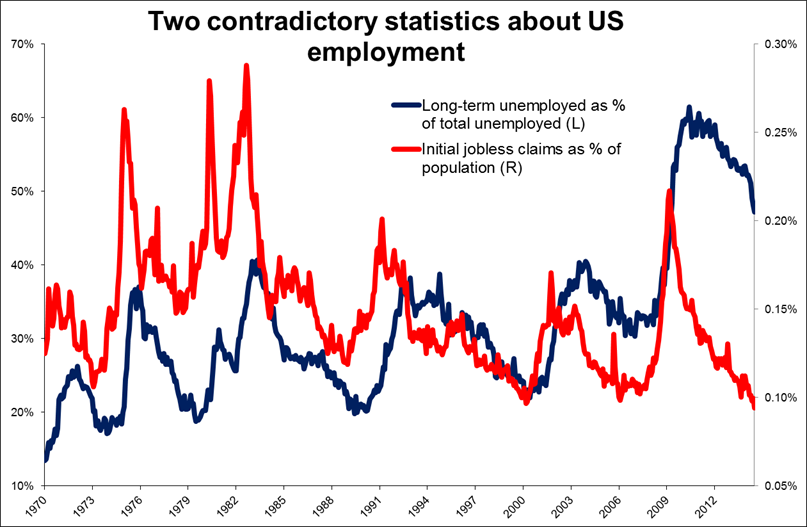

- Rest of the week: central banks in focus (as usual): The highlight will be Wednesday, when the Fed releases the minutes of its July 29-30 FOMC meeting and the Bank of England releases the minutes of its August policy meeting. BoE Gov. Carney said on Wednesday that the committee has a “wide range of views” on the level of slack in the economy, increasing the likelihood that we might see a dissenting vote in the minutes. Thursday through Saturday, the Fed will hold its annual symposium for central bankers at Jackson Hole, Wyoming. The theme this year is “Re-evaluating Labor Market Dynamics.” It is not likely to give any direct clues about monetary policy, but rather, we are likely to get more detail about how the Fed reads the recent labor market conditions, which should give us a better idea of how they will react to future data. Does the drop in the unemployment rate and the extremely low level of jobless claims as a percent of the population mean that the labor market is healthy, or does the unusually large number of long-term unemployed and the low rise in wages mean that demand for labor is still soft? We can hope to get some answer to these kinds of questions when Fed Chair Yellen delivers the keynote speech on Friday. ECB President Draghi will follow later in the day. Finally, to round things out, the Reserve Bank of Australia on Tuesday releases minutes of its latest policy meeting, which voted unanimously to keep rates steady at 2.50%.

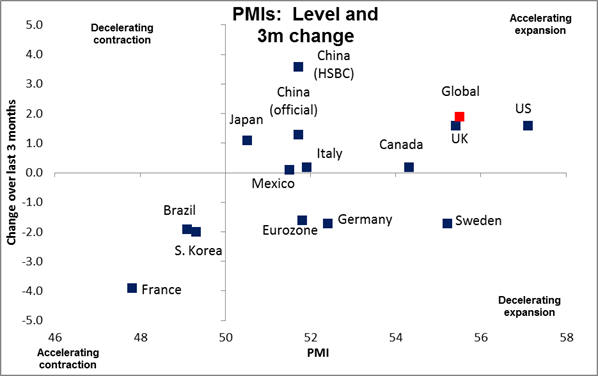

- This week’s indicators: PMIs on Thursday: Tuesday: From New Zealand we get PPI for Q2, while in the UK, CPI and PPI for July are due out. US housing starts and building permits for July are both are expected to rise. Wednesday: get Japan’s trade deficit is expected to have narrowed a bit in July. Thursday is PMI day! We have China’s preliminary HSBC manufacturing PMI for August as well as Japan’s preliminary manufacturing PMI for the same month. During the European day we get Eurozone’s preliminary PMIs for August, just after the two largest countries of the bloc, Germany and France, release their figures for the same month. Later in the day, the US preliminary Markit manufacturing PMI will be released along with existing home sales for July. From the UK, we get retail sales for July. Friday: Canada’s CPI for July and retail sales for June.

THE MARKET

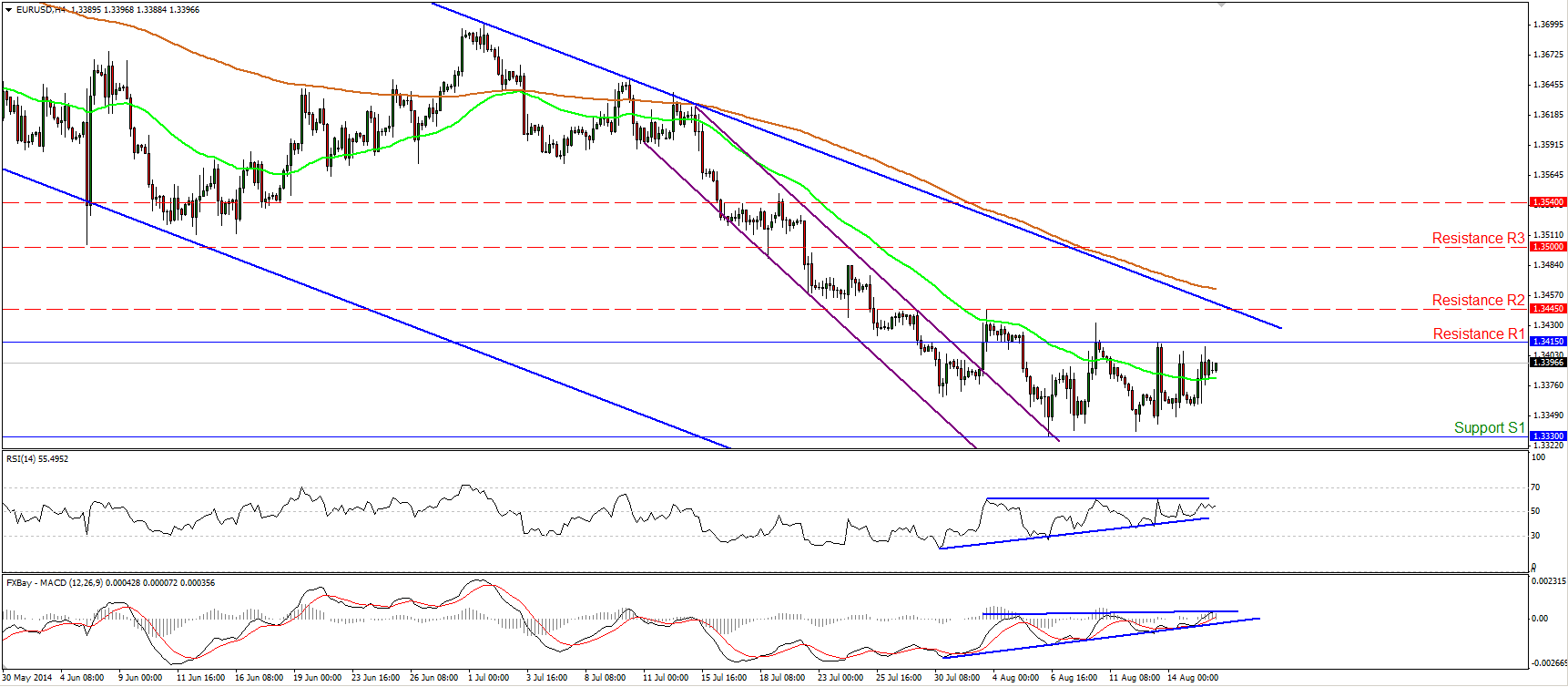

EUR/USD somewhat higher

-

EUR/USD moved somewhat higher on Friday, but stayed within the recent range between the support line of 1.3330 (S1) and the resistance of 1.3415 (R1). Although the rate remains within the long-term blue downside channel, connecting the highs and the lows on the daily chart, I would maintain my neutral stance and I will repeat that I would like to see a dip below 1.3300 (S2) before regaining confidence in the downtrend. Moreover, I still see positive divergence between the 14-day RSI and the price action, while the daily MACD lies above its signal line and is pointing up. This adds to my flat view as the pair could be preparing for a rebound and the beginning of a corrective phase.

Support: 1.3330 (S1), 1.3300 (S2), 1.3200 (S3).

Resistance: 1.3415 (R1), 1.3445 (R2), 1.3500 (R3).

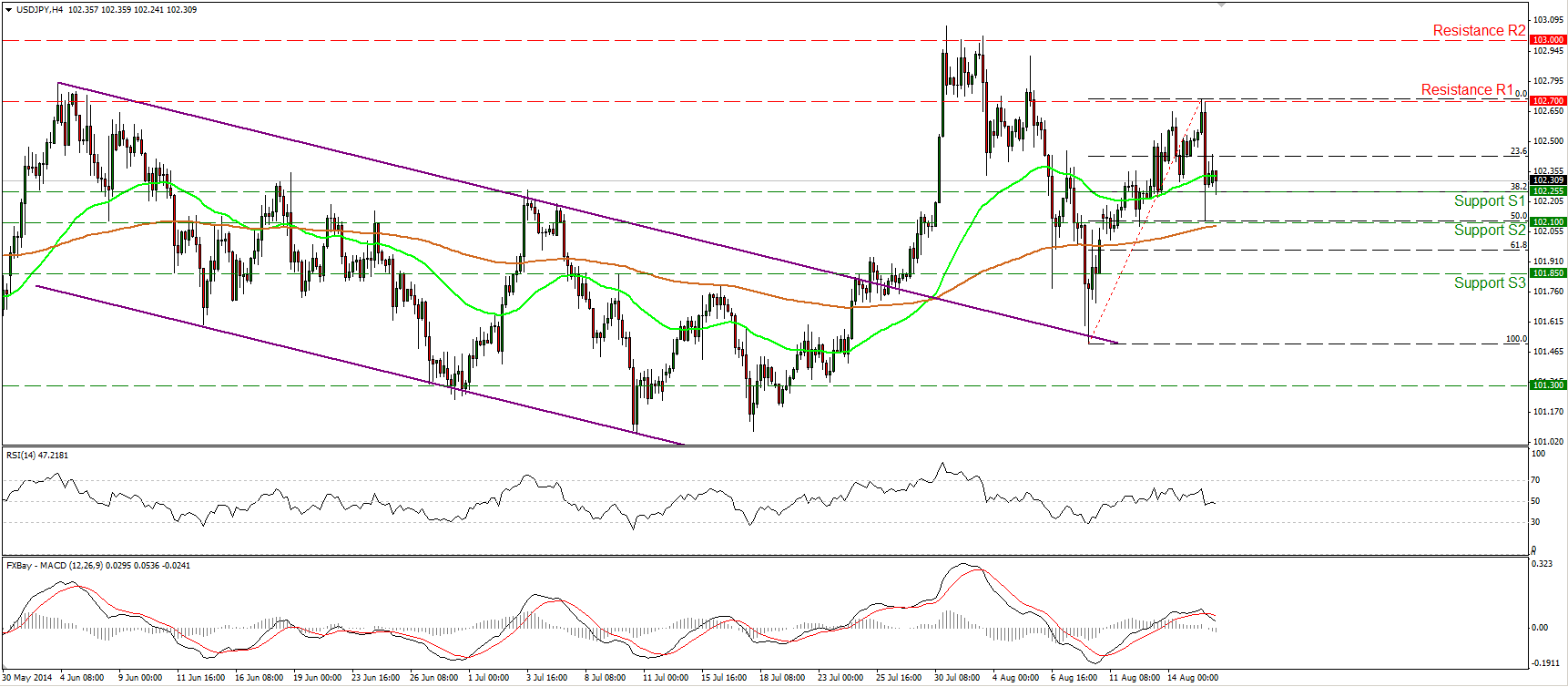

USD/JPY tumbles after hitting 102.70

-

USD/JPY fell sharply after finding resistance at 102.70 (R1), but the rate was stopped by 102.10 (S2), the 50% retracement level of the 8th – 15th August upside move and rebounded somewhat. Considering that the RSI remains below its 50 line, while the MACD fell below its trigger line, I cannot rule out further declines, perhaps for another test at the 102.10 (S2) support. Nevertheless, as long as the possibility for a higher low still exists and as long as the pair is trading above the upper boundary of the prior downside channel, I would still consider the outlook cautiously positive. But I still believe that in the bigger picture, we need a close above the 103.00 (R2) zone to have a higher high on the daily chart and a possible newborn long-term uptrend.

Support: 102.25 (S1), 102.10 (S2), 101.85 (S3).

Resistance: 102.70 (R1), 103.00 (R2), 104.00 (R3).

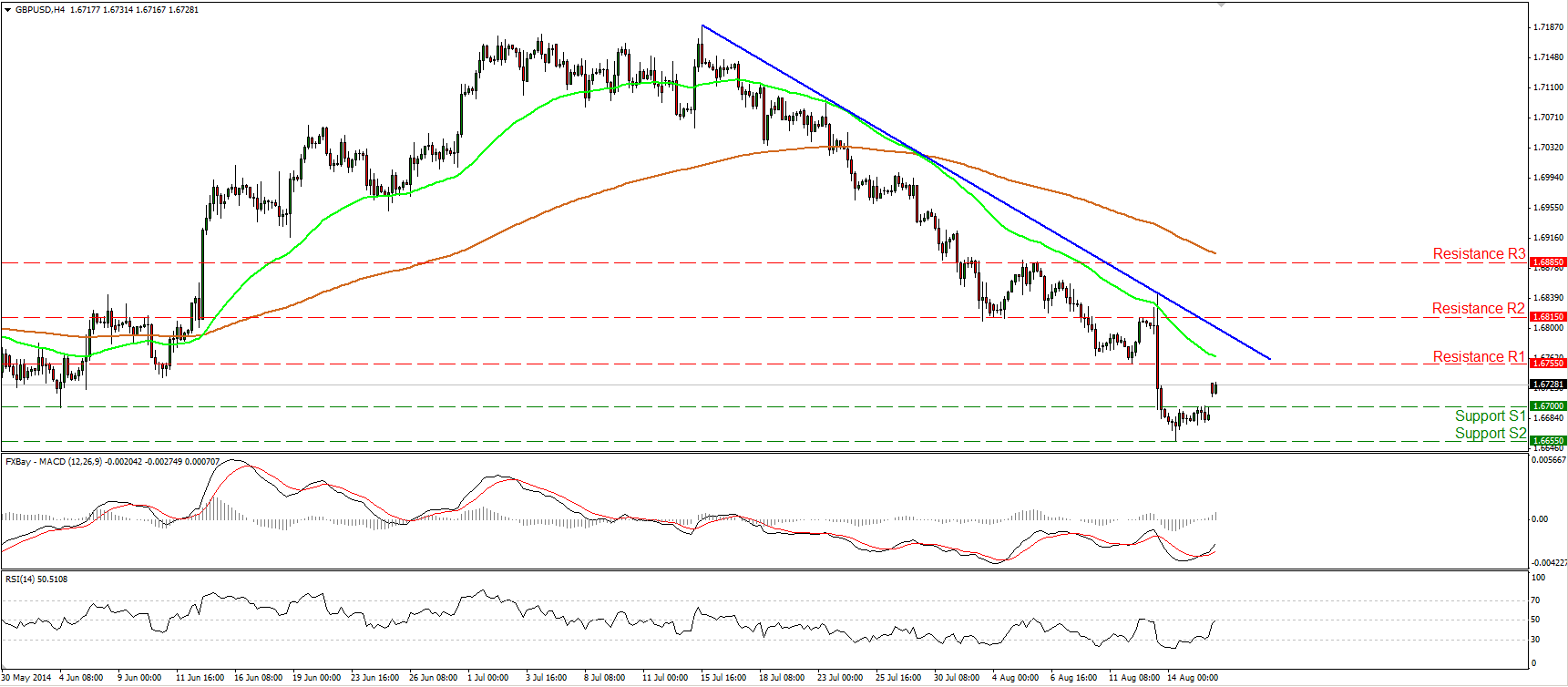

GBP/USD gaps up

-

GBP/USD opened the trading session Monday with a bullish gap after BoE Governor Carney was quoted in the Sunday Times as saying that the Bank doesn’t have to wait for wages to rise before starting to hike rates. The pair is back above 1.6700, but remains below the short-term blue downtrend line. The RSI exited its oversold zone and moved higher, while the MACD, although negative, crossed above is signal line. Having that in mind, I would expect the corrective wave to continue and challenge the resistance of 1.6755 (R1) or the blue trend-line. On the daily chart, the rate remains below the 80-day exponential moving average, and as long as it does so, I would see any further advances as a retracement.

Support: 1.6700 (S1), 1.6655 (S2), 1.6600 (S3).

Resistance: 1.6755 (R1), 1.6815 (R2), 1.6885 (R3).

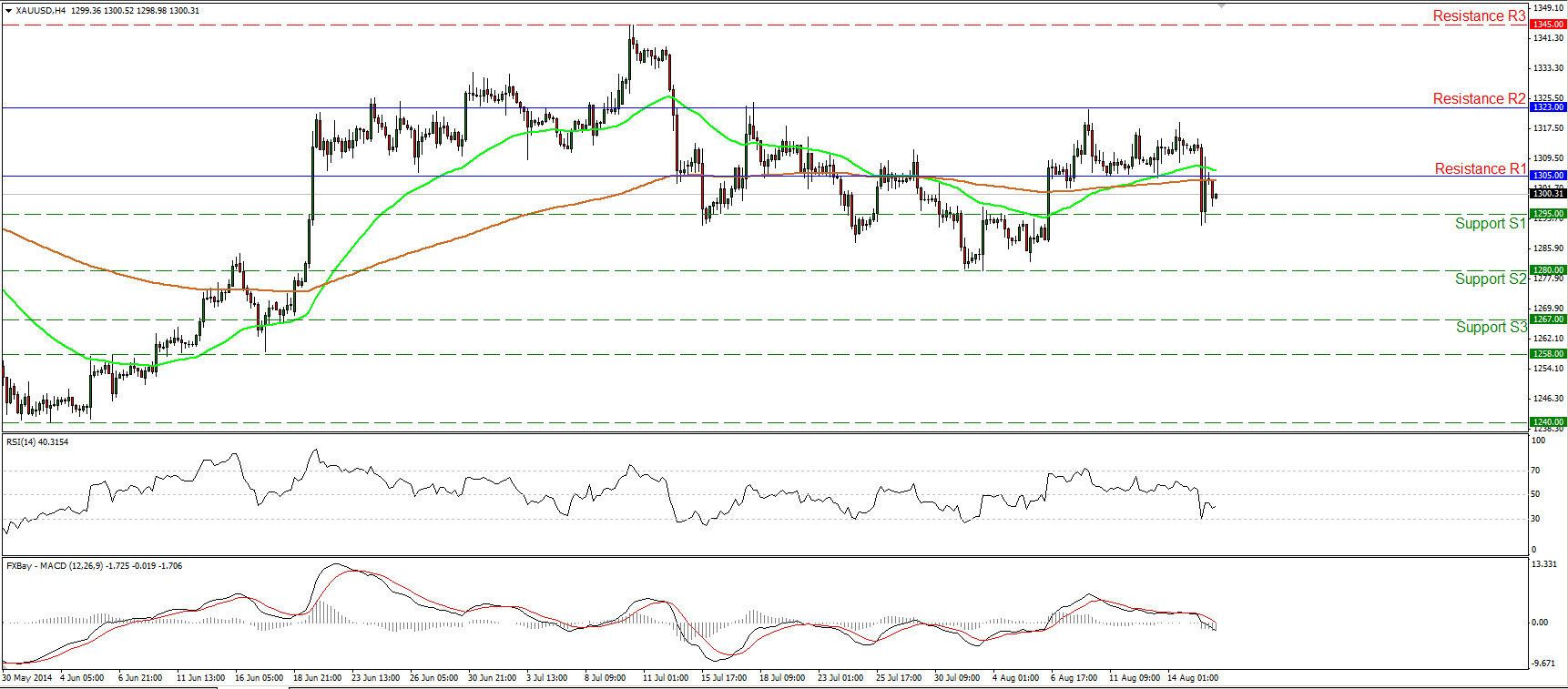

Gold exits its near-term range

-

Gold declined on Friday, falling below the lower boundary of the range it’s been trading in, between the lines of 1305 (R1) and 1323 (R2). The metal found some buy orders marginally below our support level of 1295 (S1), but the rebound was limited by the 1305 (R1) zone. As a result, the near-term outlook is cautiously to the downside, in my view, and a clear dip below the 1295 (S1) line could extend the bearish wave, perhaps towards the next hurdle at 1280 (S2). However, on the daily chart, I still see a trendless picture and this is confirmed by the fact that both the 50- and 200-day moving averages are still pointing sideways.

Support: 1295 (S1), 1280 (S2), 1267 (S3).

Resistance: 1305 (R1), 1323 (R2), 1345 (R3).

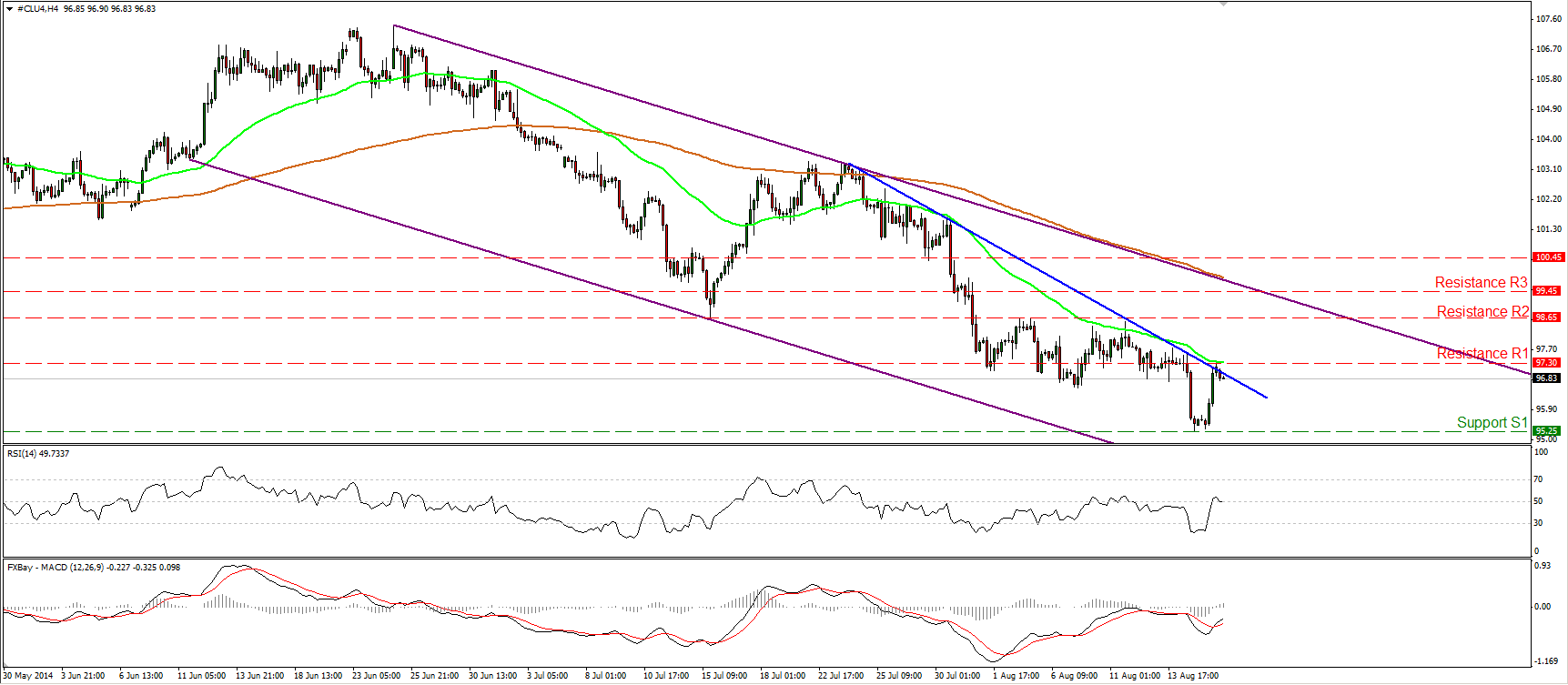

WTI rebounds sharply

-

WTI rebounded strongly on the reports that Ukraine had attacked a Russian convoy, but the rally was halted by the blue downtrend line, near the resistance zone of 97.30 (R1). Although this keeps the near-term downtrend intact, taking into account that the rebound was sharp, I will take the sidelines for now. If the bears are willing to take the reins near the trend-line, they are likely to target once again the recent lows of 95.25 (S1). On the other hand, a decisive move above 97.30 (R1) could pave the way for the next resistance, at 98.65 (R2). In the bigger picture, the price structure remains lower highs and lower lows, thus I would see any short-term reversal as a corrective wave of the longer-term downtrend.

Support: 95.25 (S1), 93.65 (S2), 91.60 (S3).

Resistance: 97.30 (R1), 98.65 (R2), 99.45 (R3).

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

Bitcoin price drops, but holders with 100 to 1000 BTC continue to buy up

Bitcoin price action continues to show a lack of participation from new traders, steadily grinding south in the one-day timeframe, while the one-week period shows a horizontal chop. Meanwhile, data shows that some holder segments continue to buy up.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.