FOMC minutes present dovish view. Well, I was wrong about the FOMC minutes: in fact they presented a more dovish view than people had expected. As a result, Fed Funds futures expectations for 2017 fell almost 6 bps while bond yields declined modestly (from 3 bps in the 2 years to almost 1 bp in the 10 year). The dollar weakened all around, against both G10 and EM currencies.

The FOMC members agreed to wind down their Quantitative Easing program of bond-buying in October, as was widely expected. There was also a technical discussion of how they would manage the money markets as they moved to liberalize interest rates. Without going into the details, it implies that the actual Fed Funds rate (and hence money market rates as well) will be able to trade below the Fed Funds target rate at least until they start hiking rates and perhaps even afterwards, which means that the actual Fed Funds rate is unlikely to rise for at least a year. Moreover, “many participants” also agree to delay ending the reinvestment of maturing mortgage-backed securities until after they had started hiking rates, even though that’s contrary to what the FOMC said when it announced its exit strategy principles in June 2011. Both these measures are seen as relatively dovish, which was one reason for the move down in interest rates.

Another surprise for the markets was just how concerned the FOMC is about inflation remaining too low even while core PCE inflation has accelerated to a recent pace above their 2% target (+2.1% annualized in the past three months). Their emphasis on the risks of too low inflation goes a long way towards explaining why Fed Chair Janet Yellen dismissed the recent rise in inflation as “noise.” Apparently she wasn’t just talking for herself.

It’s true though that there is disagreement among the FOMC members. With regards to inflation, “(s)ome others expected a faster pickup in inflation or saw upside risks to inflation expectations because they anticipated a more rapid decline in economic slack.” There was also disagreement on the employment situation. "Many judged that slack remained elevated," the minutes said, but "several participants pointed out that both long- and short-term unemployment and measures that include marginally attached workers had declined." This divergence in views is one reason why officials keep warning about the extremely low volatility and implied volatility in the markets. What they are saying in effect is that the FOMC itself is uncertain about what’s going to happen, so it’s surprising that the markets are so certain. I expect that as time goes on, this divergence will become more and more acute and more distinct as the two sides make their views public through speeches and interviews. That could help to raise volatility somewhat.

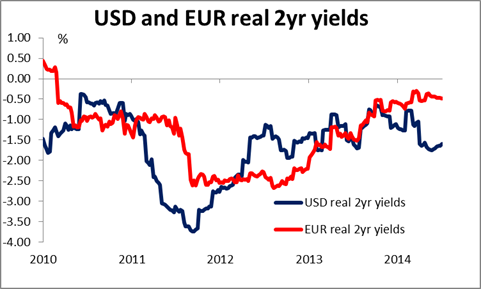

The implications for the dollar are that it is not likely to get much support from the FOMC, at least not immediately. With inflation rising and interest rates falling, US real interest rates are declining, which is likely to prevent the dollar from gaining overall. We will know more after today’s speech by Vice Chair Stanley Fischer (see below) and Yellen’s testimony to Congress next week. In the final analysis, the FOMC is really no better placed to know what’s happening than the market is. Everything depends on the data.

Meanwhile, ECB members are not showing much concern over the stronger euro. ECB Executive Board Member Benoit Coeure said yesterday that the strength of the euro is not the most important issue the Eurozone has to face, while Governing Council member Luc Coene said in a newspaper interview that the euro is not too strong (he reminded us that it was nearly 1.60 before the financial crisis) and said the ECB should not go beyond its mandate to influence the exchange rate. With the FOMC not worried about inflation and the ECB not worried about the higher euro, it looks like EUR/USD is likely to be stuck within its range until something happens to push it out. That something is likely to be an adjustment of Fed policy (eventually), in my view.

Hopes of a rapid recovery in the Japanese economy after April’s consumption tax hike received a blow today after Japan’s machinery orders suffered a record fall in May, suggesting that companies remain cautious about investment. Japanese stocks were down only slightly (-0.4%) and USD/JPY fell marginally, while EUR/JPY rose. News like this is one reason I expect the Bank of Japan to increase its quantitative easing program later this year, although USD/JPY could move lower before then as real interest rates in the US decline.

Today: The Bank of England's Monetary Policy Committee meets. Once again, BOE is unlikely to change policy and the impact on the market, as usual, should be minimal. Last month, sterling rose approximately 15 pips after the release but returned its gains within the next minutes. The minutes of the meeting however should make interesting reading when they are released on 23 July.

As for the indicators, French industrial production is forecast to have slowed in May, while the manufacturing production for the same month is expected to remain unchanged in pace from April.

We have several CPI figures coming out on Thursday. France’s EU harmonized CPI in June is expected to remain unchanged in pace, while Sweden’s CPI pace for the same month is expected to rise to 0.0% yoy, a rebound from the deflation of -0.2% yoy. Norway’s CPI and underlying CPI for June are forecast to have accelerated. That could support NOK, as it is one of the few European countries where the central bank is not confronting below-target inflation.

In the US, initial jobless claims for the week ended on July 5 are expected to have remained unchanged at 315k. This would bring the 4wk moving average to 314k, not much of a change from 315k previously.

From Canada, the new housing price index for May is expected to increase in the same pace as in April.

Thursday’s agenda includes three speakers. We have two Fed speakers, Kansas City Fed President George Esther and Fed Vice Chairman Stanley Fischer. As far as we can tell this is the first time Fischer has spoken publicly since he joined the Fed last month. He will be taking questions so there may be some interesting remarks. BoE Top Banking Supervisor Andrew Bailet also speak.

The Market

EUR/USD higher after the FOMC minutes

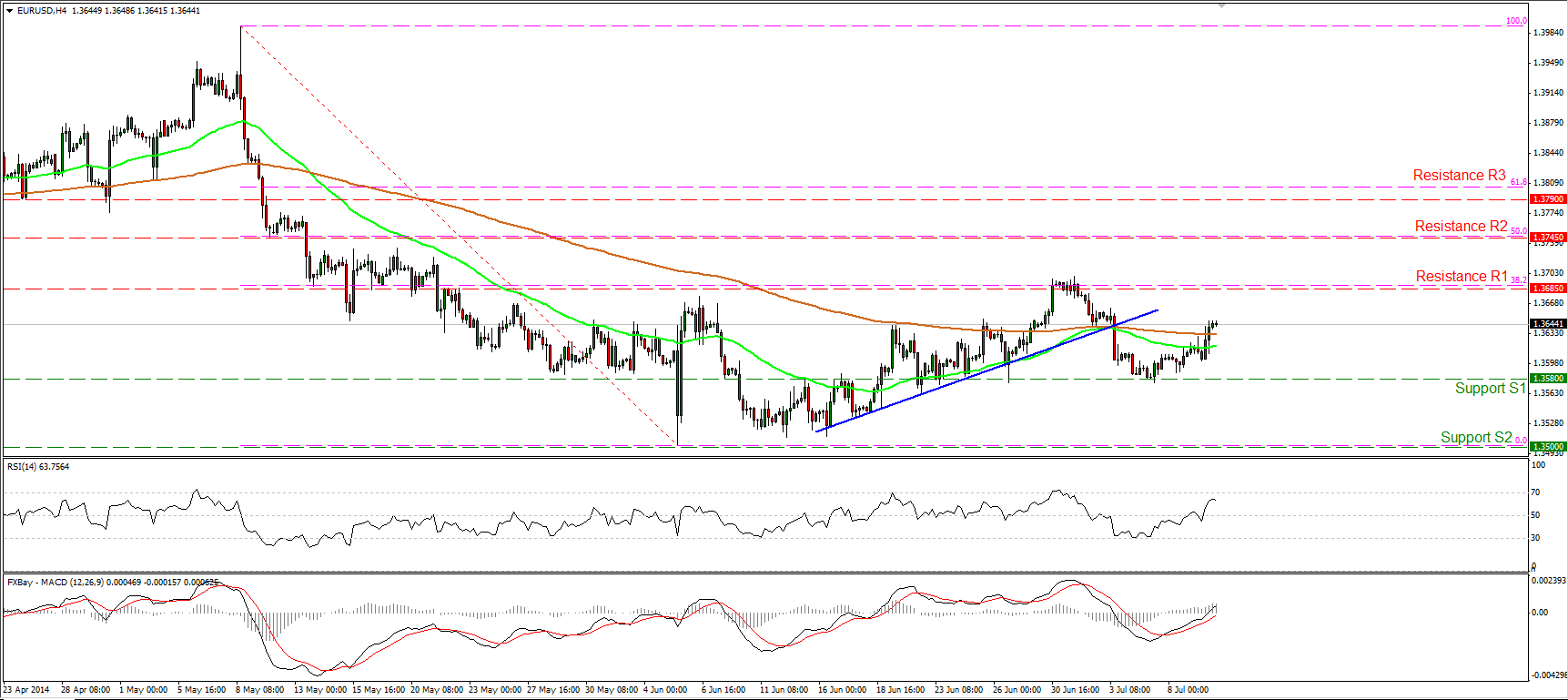

EUR/USD continued moving higher on Wednesday, after the minutes of the latest FOMC meeting showed that Fed officials are still concerned about inflation being too low while ECB officials are not concerned about the euro being too high. I would change my view to neutral for now, because the pair moved above the moving averages, which means it may stage another test near the 38.2% retracement level of the 8th May- 5th June decline at 1.3685 (R1). Our momentum studies support the notion, since the MACD, already above its signal line, entered its positive field, while the RSI is back above 50, corroborating yesterday’s bullish momentum.

Support: 1.3580 (S1), 1.3500 (S2), 1.3475 (S3).

Resistance: 1.3685 (R1), 1.3745 (R2), 1.3790 (R3).

USD/JPY declines after finding resistance at 101.85

USD/JPY moved lower after finding resistance at 101.85 (R1), slightly below the 200-period moving average. At the time of writing, the rate is heading towards the support bar of 101.45 (S1), where a clear dip could target the next support at 101.22 (S2). The MACD remains below both its zero and signal lines, while the RSI moved lower after hitting its 50 level, keeping the momentum to the downside. As long as the resistance of 101.85 (R1) holds, the short-term outlook remains mildly to the downside. Nevertheless, in the bigger picture, the longer-term path of USD/JPY remains to the sideways, since we cannot identify a clear trending structure.

Support: 101.45 (S1), 101.22 (S2), 100.80 (S3).

Resistance: 101.85 (R1), 102.25 (R2), 102.65 (R3).

EUR/GBP reaches the resistance of 0.7960

EUR/GBP continued moving higher, confirming the bullish engulfing candle pattern identified on the daily chart and the positive divergence between our momentum studies and the price action. The advance was halted by the resistance barrier of 0.7960 (R1) and the 50-period moving average, where a clear violation could trigger extensions towards the 0.8030 (R2) hurdle. On the 4-hour chart, the RSI moved above 50, while the MACD entered its bullish zone, keeping alive the scenario for further upside. Nevertheless, as long as the pair is forming lower highs and lower lows below the blue downtrend line drawn from back the 11th of April, I consider the overall outlook to be to the downside and any further advances as renewed selling opportunities.

Support: 0.7915 (S1), 0.7830 (S2), 0.7760 (S3).

Resistance: 0.7960 (R1), 0.8030 (R2), 0.8080 (R3).

Gold near the highs of 1332

Gold continued moving higher on Wednesday, violating the 1325 barrier and reaching the resistance zone of 1332 (R1). As long as the precious metal is trading above the blue uptrend line, drawn from back the 5th of June, the overall technical picture remains positive. A clear move above1332 (R1) would confirm a forthcoming higher high and could pave the way towards the obstacle of 1342 (R2). The MACD continued moving higher after obtaining a positive sign and breaking its blue downside resistance line, while the RSI managed to move above its own downtrend line. This confirms yesterday’s positive momentum and magnifies the case for further upside.

Support: 1325 (S1), 1310 (S2), 1305 (S3) .

Resistance: 1332 (R1), 1342 (R2), 1355 (R3).

WTI falls below 103.05

WTI plunged yesterday, falling below 103.05, the 50% retracement level of the May 1st – June 23rd advance, and reaching 101.70 (S1), slightly below the 61.8% retracement level of the aforementioned uptrend. The price fell below the lower boundary of the purple downside channel and this, alongside our momentum signs, designates accelerating bearish momentum. The MACD, within its negative territory fell below its signal line and is pointing down. I would ignore the oversold reading of the RSI, since it also points down and could remain within its extreme zone for an extended period of time. As long as the price structure remains lower highs and lower lows, I see a negative short-term picture and a clear move below 101.70 (S1) could target the 76.4% retracement level of the May 1st – June 23rd advance, at 100.80 (S2).

Support: 101.70 (S1), 100.80 (S2), 98.75 (S3).

Resistance: 103.05 (R1), 104.60 (R2), 106.05 (R3).

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

MARKETS SUMMARY

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.