Getting ready for this week: Friday’s market action was largely in preparation for the big week we have ahead of us. Tomorrow sees a Reserve Bank of Australia (RBA) meeting, Japan’s tankan report, and the global manufacturing PMIs. Thursday we have the European Central Bank (ECB) meeting and on Friday the US non-farm payrolls. With all that ahead of the market, investors seemed to be positioning themselves appropriately.

The ECB meeting remains the biggest event. The steady decline in peripheral Eurozone bond yields suggests that there is still some hope that the ECB will stop sterilizing the bond purchases that it made through the Securities Markets Program (SMP). Irish 10-year yields are now only 25 bps or so above US Treasuries! (about 145 bps over Bunds, vs over 1250 bps at the height of the crisis). In that context, the market will be watching this morning’s announcement of the March CPI for the Eurozone closely. The market is expecting it to slow to +0.6% from +0.7% in February. Friday’s surprise plunge in the Spanish CPI into deflation took EUR/USD down to 1.3705, a level last seen the day before the last ECB meeting. But the fact that German inflation wasn’t any lower than forecast caused some disappointment after the surprising Spanish data and a big drop in inflation in the German region of Saxony. I would think we will need to see Eurozone inflation coming in below estimates today to get another challenge of that level.

Elsewhere the dollar was generally higher against the other G10 currencies, particularly vs JPY. It appears that some risk premium is developing in JPY ahead of tomorrow’s tankan report. The current condition indicators are expected to rise, but the outlook figures are expected to show that firms expect some slowdown after the consumption tax hike in April. Also last week’s retail sales figures, which showed only a small rise in spending in February despite the impending rise in the tax, is worrisome for the Japanese economy. Last time the consumption tax was hiked there was a rush to buy ahead of the rise, but with wages depressed and prices rising, families now have little scope to expand their spending. This increases the likelihood of more easing by the Bank of Japan. It also suggests a further squeeze in savings relative to investment and therefore a fall in the current account surplus, perhaps even into deficit, which would be JPY-negative as well.

Other indicators out today include French final GDP for Q4 and Italy’s preliminary CPI for March. In Switzerland, the KOF leading indicator is forecast to have risen to 2.05 in March from 2.03 in February.

From the UK, the Bank of England mortgage approvals for February are estimated at 75.0k vs 76.9k in January.

In the US, the Chicago purchasing managers’ index for March is forecast to have declined to 59.0 from 59.8, while the Dallas Fed manufacturing activity index for the same month is expected to be up to 3.0 from 0.3.

Elsewhere, Canada’s GDP is expected to have risen 0.4% mom in January, after falling 0.5% mom in December.

Overnight the Reserve Bank of Australia meets to set rates. No change in policy is expected but it will be interesting to see whether we will have any statements after the recent appreciation of AUD.

Only one speaker is scheduled on Monday. Federal Reserve Chair Janet Yellen delivers the keynote address at the National Interagency Community Reinvestment Conference.

THE MARKET

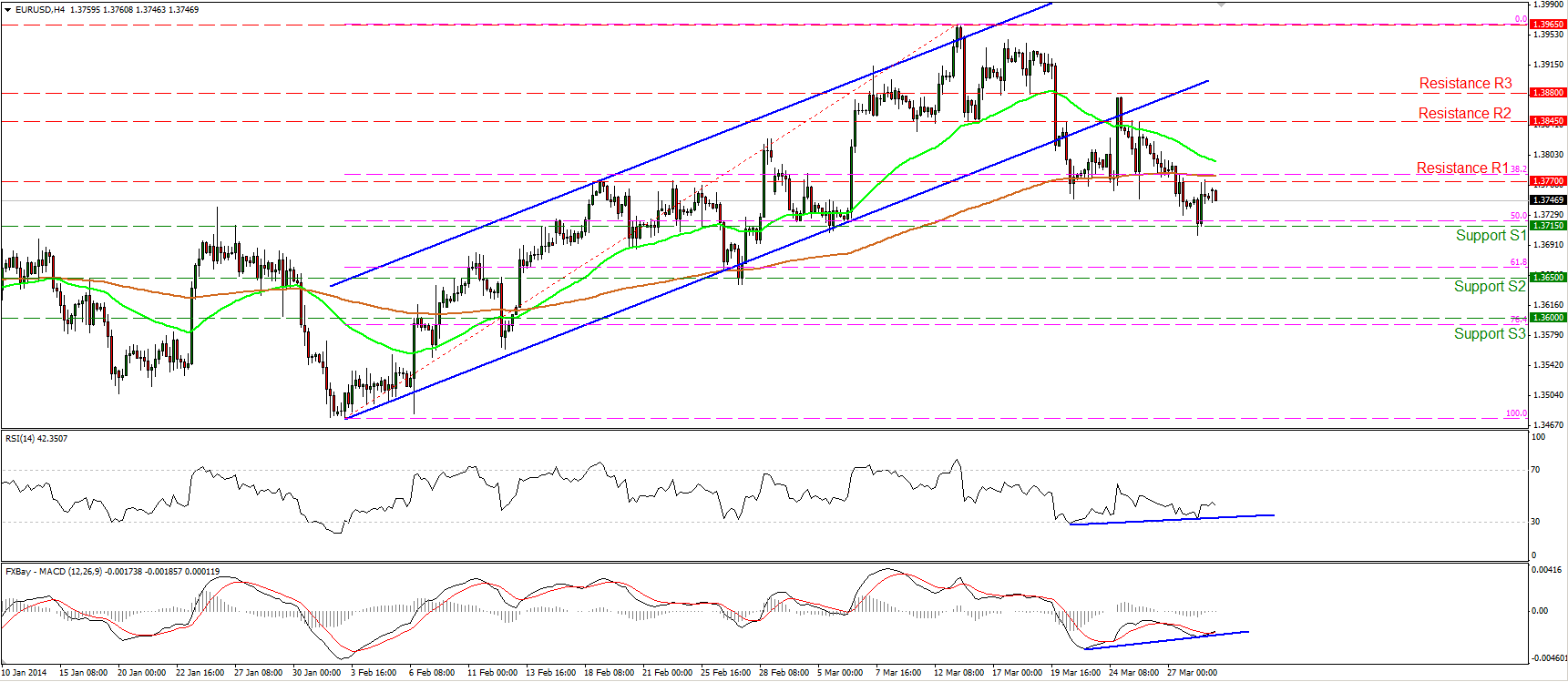

EUR/USD

EUR/USD rebounded from the support at 1.3715 (S1) and moved higher to meet resistance at 1.3770 (R1), slightly below the 200-period moving average. A clear dip below the 1.3715 (S1) hurdle may trigger extensions towards the next support at 1.3650 (S2), near the 61.8% retracement of the 3rd Feb. – 13th Mar. short-term uptrend. Nonetheless, we can identify positive divergence between both our momentum studies and the price action, while the MACD, although in bearish territory, crossed above its trigger line, indicating decelerating bearish momentum for now.

Support: 1.3715 (S1), 1.3650 (S2), 1.3600 (S3).

Resistance: 1.3770 (R1), 1.3845 (R2), 1.3880 (R3).

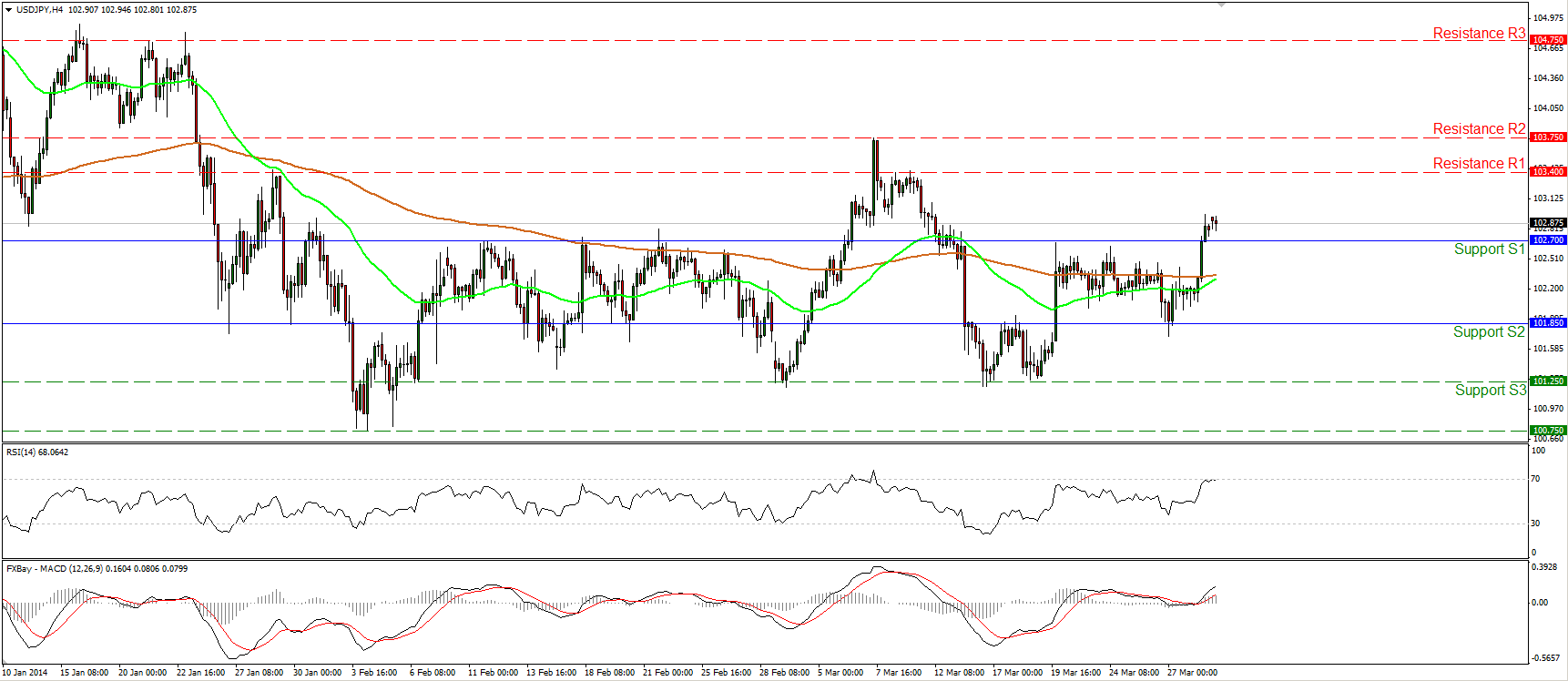

USD/JPY

USD/JPY reached and broke above the 102.70 hurdle. If the longs are strong enough to maintain the rate above that level, I would expect them to extend the advance and challenge the resistance bar at 103.40 (R1). The MACD lies above both its trigger and zero lines, confirming the recent bullish momentum, but the RSI is testing its 70 barrier. Thus, some consolidation before the continuation of the advance cannot be ruled out.

Support: 102.70 (S1), 101.85 (S2), 101.25 (S3)

Resistance: 103.40 (R1), 103.75 (R2), 104.75 (R3).

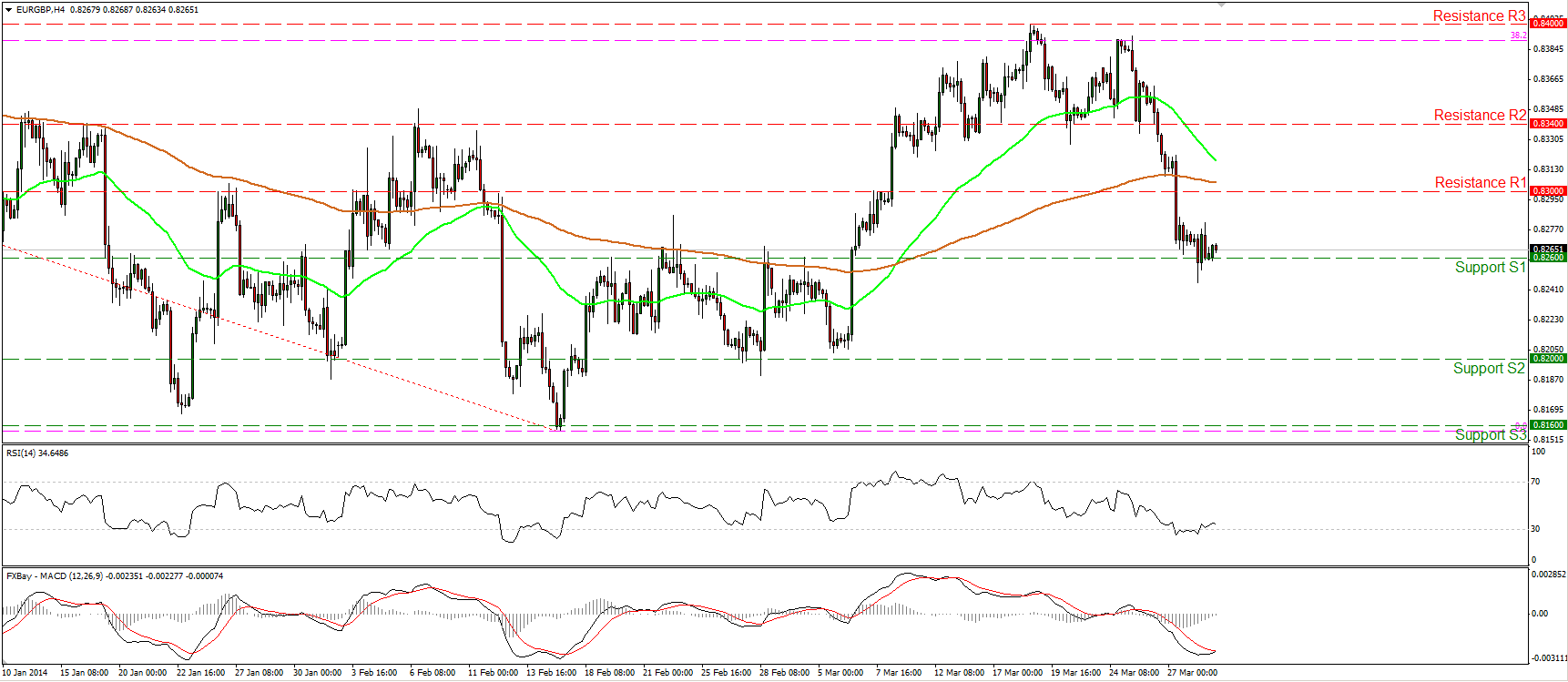

EUR/GBP

EUR/GBP violated the 0.8300 bar and moved lower to reach the support at 0.8260 (S1). A clear close below that obstacle may have larger bearish implications and target the next support at 0.8200 (S2). However, since the RSI crossed above its 30 level and the MACD seems ready to cross above its signal line, an upward corrective wave is possible in my view. The rate is trading below both the moving averages, while the 50-period moving average is getting closer to the 200-period one, thus a bearish cross in the near future may confirm the negative picture of the currency pair.

Support: 0.8260 (S1), 0.8200 (S2), 0.8160 (S3).

Resistance: 0.8300 (R1), 0.8340 (R2), 0.8400 (R3).

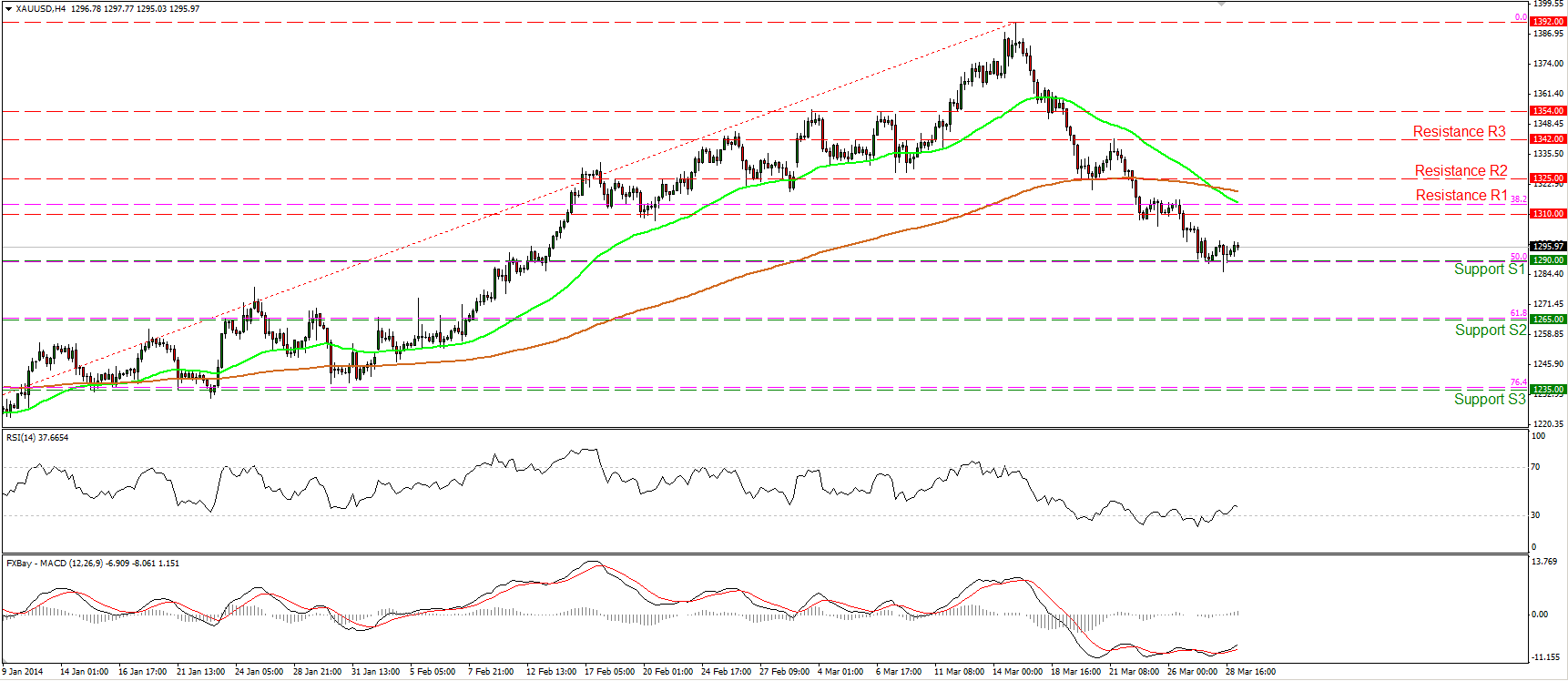

GOLD

Gold moved in a consolidative mode, remaining near the 1290 (S1) support level, which coincides with the 50% retracement level of the 20th Dec. - 14th Mar. advance. A break below that bar may pave the way towards the 1265 support (S2), which lies near the 61.8% retracement level of the aforementioned advance. As long as the metal is printing lower highs and lower lows below both the moving averages, the short-term outlook remains to the downside. Nonetheless, the RSI crossed above its 30 bar and is moving higher, while the MACD, although in its negative area, crossed above its signal line. As a result I still expect an upward corrective wave, maybe to test the 1310 (R1) level as a resistance this time.

Support: 1290 (S1), 1265 (S2), 1235 (S3).

Resistance: 1310 (R1), 1325 (R2), 1342 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.