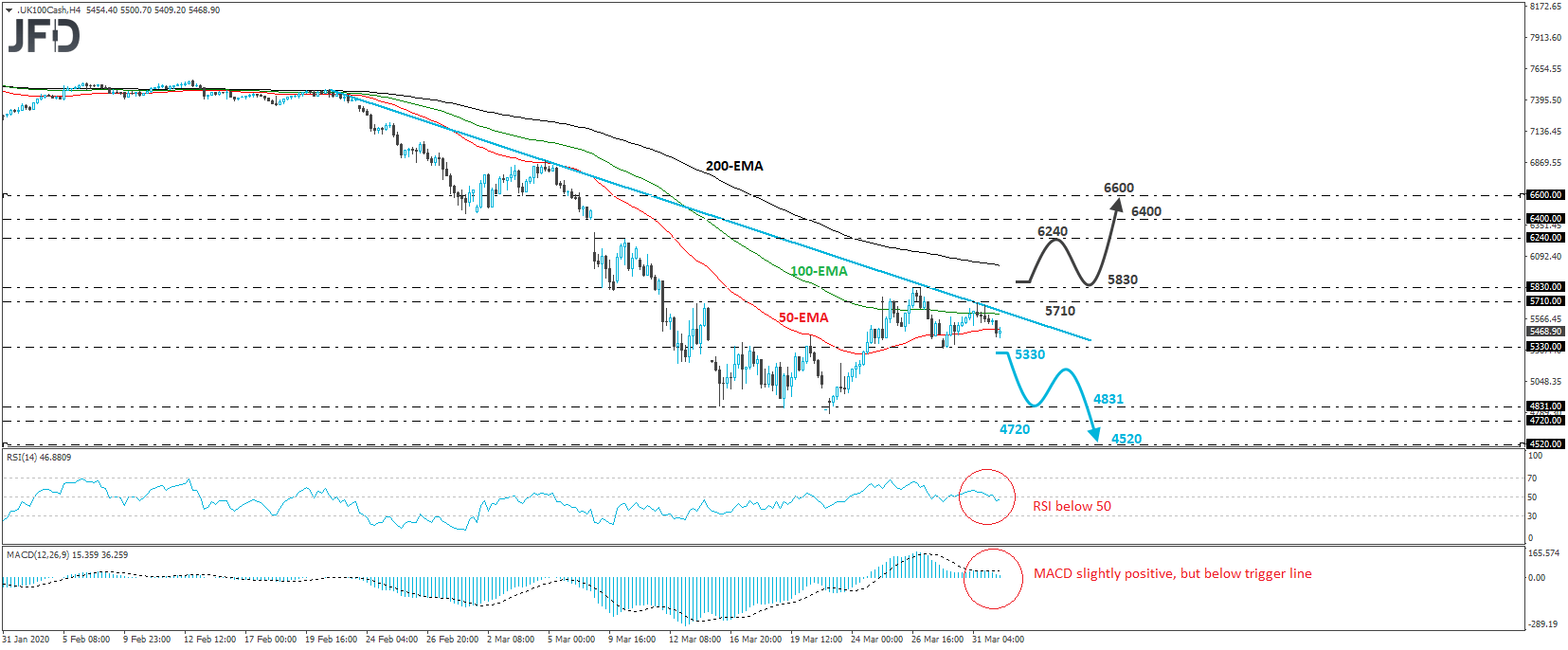

The FTSE 100 cash index traded lower today, after it yesterday hit resistance at the crossroads of the 5710 level and the downside resistance line drawn from the high of February 20th. As long as the index continues to trade below that line, we would see decent chances for the bears to take the reins again.

That said, in order to get confident for larger bearish extensions, we would like to see a decisive break below Monday’s low, at around 5330. That level was also a decent resistance between March 17th and 20th. Such a dip may set the stage for declines towards the 4831 territory, which provided strong support from March 16th until March 23rd, or towards the 4720 barrier, defined as a support by the low of August 2011. Another break, below 4720, could extend the slide towards the 4522 zone, which acted as a strong resistance back in May and June 2009.

Shifting attention to our short-term oscillators, we see that the RSI fell slightly below 50, but turned up again, while the MACD, although positive, lies below its trigger line. Both indicators suggest that the index may start gathering negative speed again soon, but the fact that the RSI turned up enhances our choice to wait for a price-dip below 5330 before we get more confident on that front.

In order to start examining the bullish case, we would like to see a strong break above 5830. Such a move would confirm a forthcoming higher high and may signal the break above the aforementioned downside line. The bulls may then get encouraged to climb towards the 6240 obstacle, marked by the high of March 10th, or the low of March 6th, at around 6400. If they don’t stop there either, then we may see the advance extending towards the 6600 level, defined as a resistance by the inside swing low of March 5th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.