EUR/USD: Asymmetric Risk Ahead Of ECB Statement

US CPI slipped 0.1% after being unchanged in November. Despite the drop last month, the CPI increased 0.7% in the 12 months through December, the biggest increase in a year. The rise followed a 0.5% gain in November. The year-over-year inflation rate is rising as the oil price-driven weak readings in 2015 drop out of the calculation. The boost from the so-called base effects could, however, be limited by lower oil prices, which are near 12-year lows. The market expected CPI at 0.8% yoy.

The so-called core CPI, which strips out food and energy costs, edged up 0.1% after rising 0.2% for three straight months. In the 12 months through December, the core CPI rose 2.1%, the largest gain since July 2012, after climbing 2.0% in November.

Yesterday’s US inflation data were in line with forecasts of our economists.

The soft monthly inflation readings, together with further declines in oil prices suggest it could be harder for inflation to rise toward the central bank's target this year. But the EUR/USD reaction to the US CPI was limited.

The main event today will be the ECB meeting. The central bank is unlikely to announce any new measures, but the governing council will face a complex economic picture and some communication challenges. We expect dovish rhetoric and “readiness” to do what is needed to meet the inflation mandate, although we do not think that there will be any signal of imminent action. In such a scenario the EUR may come under downside pressure but we think it will be limited because the market is becoming increasingly aware of its undervaluation and the previous experience in December (disappointment over ECB action) will mean that investors treat any potential pre-announcement of further stimulus with caution.

ECB rate setters remain wary about taking further action in the coming months, even if that requires them to temporarily turn a blind eye to the impact of falling oil prices or the fact that inflation has been below the ECB's target for three years. Even if some concede that more action will be needed at some point, they are keen to dampen market hopes, avoiding another disappointment after expectations soared too high in December, sending markets into a frenzy when the ECB disappointed.

If Mario Draghi downplays the recent deterioration in inflation outlook, attributing it to temporary falls in oil prices, then the EUR/USD will come under material upside pressure.

Summing up, we think that dovish ECB statement will result in only slightly weaker EUR/USD, but if Draghi gives no hint on further easing, the EUR/USD will probably break above the level of 1.1000.

We raised the stop-loss on our EUR/USD long position to 1.0830. The nearest support is daily cloud base at 1.0860.

USD/CAD: BoC Decision Stopped USD/CAD Rally, As Expected

The Bank of Canada decided not to cut interest rates yesterday but admitted it was not an easy call, as concern about a rapid decline in the currency clashed with an economic slump.

The BoC held its main policy rate at 0.5%, where it has been since its last rate cut in July. But it lowered its GDP forecast for 2016 to 1.4% from 2.0% and nudged expected 2017 growth down to 2.4% from 2.5%. In the days leading up to the bank's decision, markets had priced in nearly a two-thirds chance of a rate cut. The decision was in line with our on-hold forecast.

The central bank acknowledged falling commodity prices represented a "setback" for the resource-rich Canadian economy and estimated that fourth-quarter growth had stalled.

BoC Governor Stephen Poloz said the weak currency and stronger US demand will help spur an economic rebound and noted it had not incorporated in its forecasts the "positive impact" of fiscal measures promised by Prime Minister Justin Trudeau. The bank said the economy was in a process of reorientation to non-resource activity, helped by stronger US demand, the lower Canadian dollar, and accommodative monetary and financial conditions. The bank highlighted the risk that a large and fast depreciation in the loonie could boost inflation expectations.

Let’s take a look at the USD/CAD candlestick chart. Long upper shadows on Monday and Wednesday candlestick bring a temporary halt to the strong rise in the USD/CAD. The risk is growing for a short-term dip to 1.4350/1.4377 (38.2% retrace of 1.3802-1.4689 rise). We will be looking to buy the USD/CAD near this area.

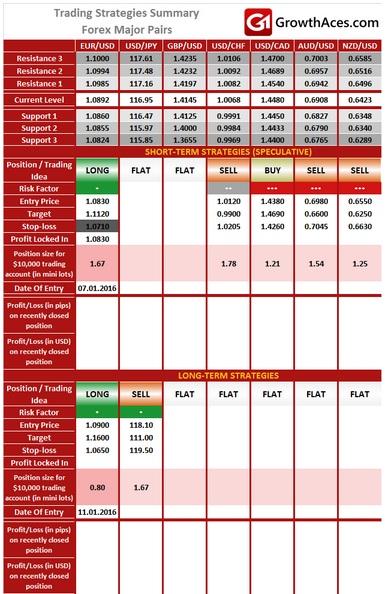

MAJOR PAIRS:

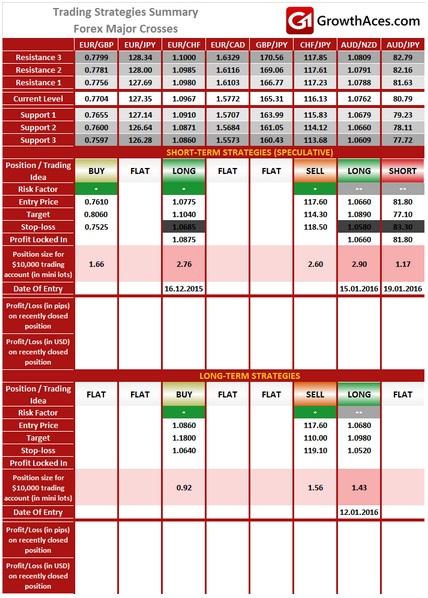

MAJOR CROSSES:

PRECIOUS METALS:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long-term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

Support/Resistance - three closest important support/resistance levels

Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD/USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.