EUR/USD: All Eyes On US Non-Farm Payrolls

The yuan was fixed higher by the Chinese central bank for the first time in nine days on Friday. The yuan, down by as much as 3% in offshore trading this week, steadied after both outright intervention by China through state-owned banks and temporary bans on Chinese banks selling dollars.

In the background there are questionmarks over whether another bout of turbulence from China, accompanied by a broader "hard landing" for the economy, could stay the US Federal Reserve's hand on further rises in interest rates this year.

Chicago Federal Reserve President Charles Evans said that the US central bank is monitoring China and increased volatility in global stock markets. Evans pointed to last September when the Fed delayed a rate hike to take time to analyze the impact of foreign developments on the US economy. After September, their impact "sort of moderated and we will have to see how things play out from here.” He added: “Our exposure to any of these individual countries is not so large that it should have an outsized effect, but if it were to happen in a big way and among more countries those start to add up into something even worse.” Evans added that for this reason, the Fed should pursue a gradual path of rate increases and that he expects the Fed's benchmark interest rate in the vicinity of one percent at the end of this year. He also said it would be mid-year before the Fed would be able to gauge if inflation, which has remained stubbornly low, is finally moving towards the central bank's 2% target rate.

Richmond Federal Reserve President Jeffrey Lacker said the Fed may need to raise interest rates more than four times this year if oil prices stabilize, the dollar stops appreciating and inflation surges toward the US central bank's 2% target. But if inflation did not soon move back toward 2 percent following a bottoming of oil prices and the dollar's peak, "a shallower path for interest rates would make sense," said Lacker, who is not a voting member of the Fed's rate-setting committee this year although he will participate in its discussions. Lacker said that the Fed is keeping a close eye on this week's turmoil in China's financial markets, although he said it remains unclear if the drop in the value of Chinese stocks and the yuan currency will have a substantial impact on the US economy.

The EUR/USD recovered yesterday from to a day’s high at 1.0940. We went long at 1.830 with the target of 1.1120. The USD rose more than half a percent against the EUR today as measures taken by China to ease this week’s market turmoil helped steady investors’ nerves over market moves there and China's influence on global financial stability.

The market is looking to the US jobs report (13:30 GMT). In our opinion the report is less likely to move the forex market now that the Fed has already started its rate-normalization process: a much stronger job creation report than expected will be needed to offer the USD a strong boost. (on speculation that the Fed will speed up its tightening process). Even so, we think such a boost would be unsustainable given USD overvaluation. We stay EUR/USD bullish.

USD/CAD: Canadian Jobs Report In Focus Besides Oil

Bank of Canada Governor Stephen Poloz extolled the benefits of the Canadian dollar's weakness on Thursday. His speech left investors doubtful he would cut Canada's benchmark interest rate later this month.

Poloz said Canada's monetary policy would be independent of the Federal Reserve, which raised short-term US interest rates in December. He declared that the Fed's rate hike was a welcome sign of recovery in the US economy and that policy divergence between central banks should be expected.

The CAD, which hit a 12-year low in early trade on Thursday, firmed following the speech as investors reduced their bets of a rate cut during 2016. Financial markets are pricing in a 21% chance of a cut on January 20. Markets also see a two-thirds chance of a cut in July, down from over 80% before Poloz's speech. We are still the opinion that the BoC will not change interest rates this year.

Labor data for December are also scheduled for release today in Canada. Employment changes here are likely to rebound after the big contraction (-35.7k) in November, which, however, was entirely due to the slump in part-time workers (-72.3k) that overshadowed the 36.6k increase in full-time employees. New net job creation beyond 10k, which markets expect, together with a steady unemployment rate at 7.1%, are likely to offer the CAD some relief, at least against other commodity currencies.

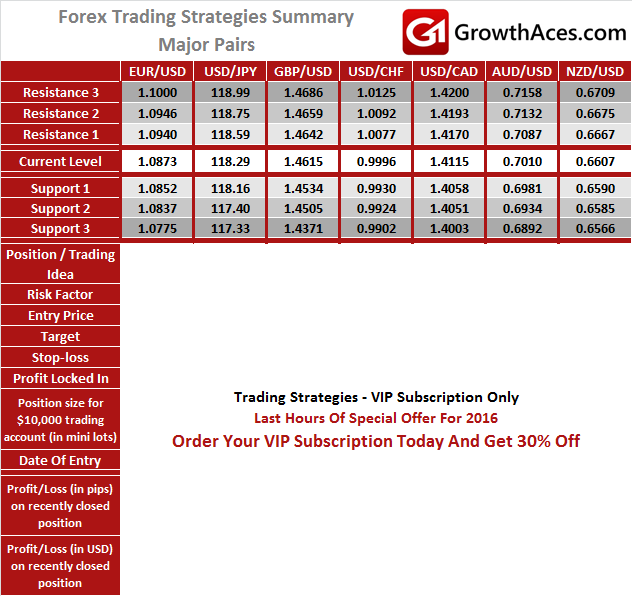

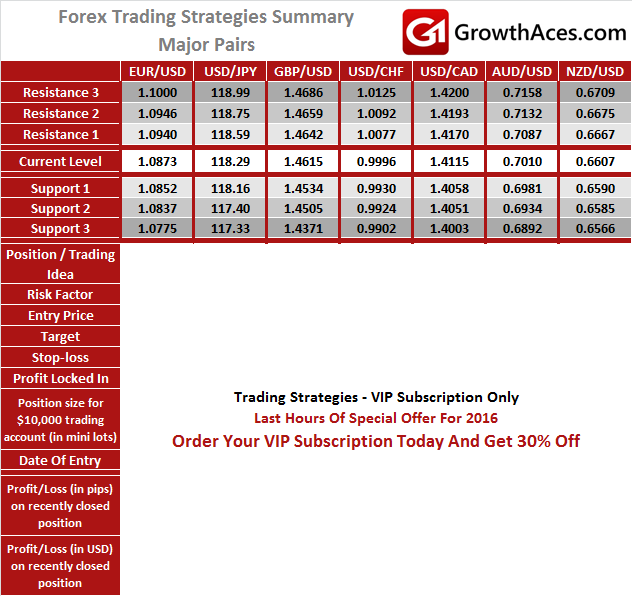

MAJOR PAIRS:

MAJOR CROSSES:

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea: BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level. LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

6. Profit/Loss on recently closed position - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.