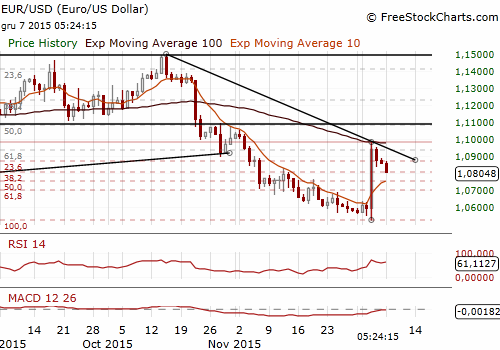

EUR/USD Is Likely To Rise After Fed Hike. Why?

(buy at 1.0720)

Nonfarm payrolls rose 211k last month, the US Labor Department said on Friday. September and October data was revised to show 35k more jobs than previously reported. The unemployment rate held at 5.0%.

The USD recovered a bit of ground after upbeat payrolls data bolstered the case for an imminent hike in US interest rates. However, strong USD is still a concern for US policymakers due to its negative influence on exports.

US trade deficit widened unexpectedly in October as exports fell to a three-year low, suggesting that trade could again weigh on economic growth in the fourth quarter. Trade subtracted 0.22 percentage point from gross domestic product in the third quarter, which expanded at a 2.1% annual rate.

The trade gap rose to USD 43.9 a sign that the worst of the drag from a stronger dollar was far from over. September's trade deficit was revised up to USD 42.5 billion from the previously reported USD 40.8 billion.

Fed funds futures contracts now show that traders see about an 80% chance that the Fed's meeting December 15-16 will end with a decision to lift rates for the first time since 2006. Traders also boosted bets on a second rate hike by March. But we are the opinion that the second rate hike by March will not be signalized in December FOMC statement – this would be a disappointment for investors and may trigger stronger USD sell-off. That is why we are looking to use current USD recovery to get EUR/USD long. We have slightly lowered our bid to 1.0720.

Markets were also watching ECB President Mario Draghi’s speech on Friday. He said he was confident the measures, which included a small deposit rate cut and an extension of its asset purchase programme, would bring inflation back to the ECB's target. He was quick to add that the bank was ready to ease policy further if needed.

Comments by ECB rate setters since the decision suggest there was not enough support for bolder action on the ECB's governing council. The head of Germany's Bundesbank, Jens Weidmann, said he had voted against easing, judging that the current low inflation was mainly due to low oil prices. Latvia's central bank governor Ilmars Rimsevics, who declined to say how he voted, said he questioned some of the measures announced on Thursday during the Governing Council. Executive Board member Yves Mersch, on the other hand, stood by Thursday's decision and even left the door open for more stimulus in the future if needed.

Sign up for GrowthAces.com daily analysis and trading strategies updated twice a day.

Significant technical analysis levels:

Resistance: 1.0887 (hourly high Dec 7), 1.0956 (high Dec 4), 1.0981

Support: 1.0753 (20-day ema), 1.0741 (10-day ema), 1.0523 (low Dec 3)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.