GROWTHACES.COM Forex Trading Strategies

Taken Positions:

EUR/USD: long at 1.0730, target 1.0890, stop-loss 1.0730, risk factor ***

USD/JPY: short at 123.30, target 121.80, stop-loss 124.10, risk factor **

GBP/USD: long at 1.5050, target 1.5190, stop-loss 1.5050, risk factor ***

USD/CHF: short at 1.0050, target 0.9920, stop-loss 1.0070, risk factor ***

USD/CAD: short at 1.3305, target 1.3120, stop-loss 1.3325, risk factor **

AUD/USD: long at 0.7030, target 0.7190, stop-loss 0.6990, risk factor **

NZD/USD: long at 0.6520, target 0.6640, stop-loss 0.6480, risk factor **

Pending Orders:

EUR/CAD: sell at 1.4440, target 1.4180, stop-loss 1.4580, risk factor ***

CHF/JPY: sell at 123.70, target 120.20, stop-loss 124.70, risk factor **

AUD/NZD: buy at 1.0690, target 1.0990, stop-loss 1.0570, risk factor ***

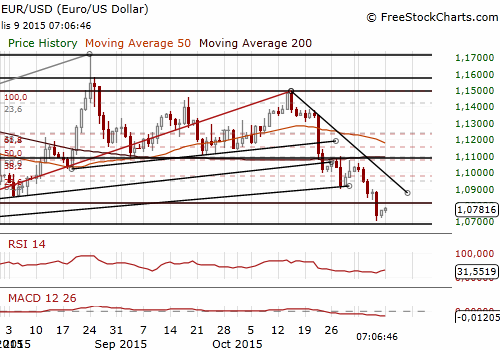

EUR/USD: Long For 1.0890, But Eyes On Draghi This Week

(long at 1.0730)

The EUR/USD is rising slightly as investors are taking profit on EUR-selling positions after robust US employment data on Friday prompted them to bet on an interest rate increase in December. Interest rates futures were pricing in a 70% probability that the US central bank will raise borrowing costs next month.

San Francisco Federal Reserve Bank President John Williams said: “I do think it makes sense to gradually remove the policy of accommodation that helped get the economy to where we are.” Williams said he believes that factors holding inflation down, including weak oil prices and a strong dollar, should soon ebb and allow inflation to bounce back. In his opinion beginning rate hikes sooner than later would allow a smoother, more gradual process of policy normalization. The Fed will likely need to raise rates more slowly than the last time it tightened policy in 2004-2006, because of persistent headwinds holding back growth. Asked how slowly, Williams said investors could draw inferences from the Fed's quarterly economic projections.

We got long at 1.0730 as we expect some EUR/USD recovery in the coming days. However, there is a risk that dovish Draghi on Wednesday will trigger another EUR/USD sell-off.

In our opinion the risk of strong sell-off after Draghi’ speech is lower now, because investors should not be surprised as they were on October 22, when Draghi indicated that the ECB was seriously considering expanding its bond purchase programme and perhaps even lowering its already-negative deposit rate. Draghi’s dovishness may be also less explicit, as the EUR/USD is much lower now than it was on October 22.

What is more, the Fed needs to communicate now that rate hike path will be gradual to stop the USD appreciation that may hurt the economy. Fed Chair Janet Yellen’s speech is scheduled for Thursday.

In our opinion the EUR/USD recovery will be limited. The target of our long is 1.0890. Further strategy depends on the rhetoric of central bankers (Draghi, Yellen) later this week.

Significant technical analysis' levels:

Resistance: 1.0894 (high Nov 6), 1.0898 (high Nov 5), 1.0918 (10-day ema)

Support: 1.0705 (low Nov 6), 1.0666 (low Apr 23), 1.0660 (low Apr 21)

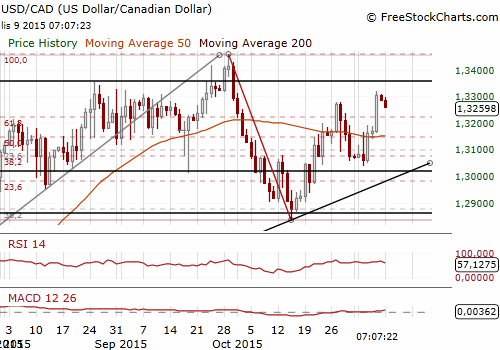

USD/CAD: Strong Candian Jobs Report Overshadowed By US Data

(short at 1.3305)

Canada added 44.4k jobs in October, the biggest gain in five months, sending the unemployment rate down to 7.0% from 7.1%, as employment in the public administration sector jumped on hiring related to last month's election. The figures topped market expectations for a gain of 10k.

Employment in the public administration sector increased by 32k positions in October, coinciding with temporary hiring related to the federal election.

Still, hiring picked up in other sectors, including a 17.6k increase in trade, and a 12.9k gain in accommodation and food services.

The overall job gains also came as the participation rate increased to 66.0% and brought the number of employed Canadians to over 18 million for the first time.

But the natural resources sector, which has been hurt by the drop in commodity prices, continued to shed jobs with employment falling by 8k. Over the past 12 months, the industry has lost 25.6k jobs.

The loonie weakend strongly against the USD on Friday, as the Canadian report was overshadowed by strong US non-farm payrolls. What is more the details of the Canadian report were not so rosy – more jobs were added in part-time than full-time employment and a lot of this growth was related to the election and may be unwound soon.

Our medium-term view on the loonie is still constructive. In our opinion the Bank of Canada will not cut interest rates soon, especially when the Fed is tightening its policy. What is more, the CAD may get support from recovering oil prices as we expect over the medium term. We got USD/CAD short at 1.3305.

Significant technical analysis' levels:

Resistance: 1.3309 (76.4% of 1.3457-1.2832), 1.3318 (high Nov 6), 1.3331 (high Oct 1)

Support: 1.3177 (10-day ema), 1.3158 (low Nov 6), 1.3142 (low Nov 5)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.