GROWTHACES.COM Forex Trading Strategies

Taken Positions

EUR/USD: (Full Content - VIP Subscription Only)

GBP/JPY: (Full Content - VIP Subscription Only)

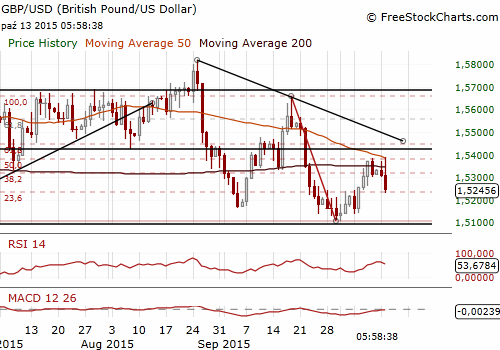

GBP/USD: long at 1.5275, target 1.5440, stop-loss 1.5190, risk factor *

Pending Orders:

USD/JPY: (Full Content - VIP Subscription Only)

USD/CAD: (Full Content - VIP Subscription Only)

AUD/USD: (Full Content - VIP Subscription Only)

NZD/USD: (Full Content - VIP Subscription Only)

EUR/GBP: (Full Content - VIP Subscription Only)

EUR/JPY: (Full Content - VIP Subscription Only)

EUR/CHF: (Full Content - VIP Subscription Only)

AUD/NZD: (Full Content - VIP Subscription Only)

AUD/JPY: (Full Content - VIP Subscription Only)

GBP/USD: Negative British CPI Is An Opportunity To Get Long

(long at 1.5275)

The Office for National Statistics said British consumer price inflation dropped to an annual rate of -0.1%, below market expectations for it to hold unchanged at zero, and along with April the lowest reading since March 1960.

A measure of core consumer price inflation, which strips out changes in the price of energy, food, alcohol and tobacco, held at 1.0% compared with expectations for it to rise slightly to 1.1%.

There was a sharp split between price changes for goods, many of which rely on imports, and services, where costs are more heavily influenced by British rates of pay. Goods prices showed their biggest annual drop on record, falling by 2.4%on the year, while the rate of services inflation picked up to its fastest since October 2014.

Factory gate prices down 1.8% yoy, as forecast and vs. -1.9% yoy in August.

The ONS also released figures for August house price inflation, which showed a 5.2% annual rise across the United Kingdom as a whole unchanged from July.

Unlike policymakers in the Eurozone, the Bank of England is relatively unconcerned about the risk of persistent price falls leading to deflation due to robust consumer demand and rising domestic wages.

Another negative inflation reading in not a big surprise as recent lower oil and commodity prices had risks skewed to the negative. We used a fall in the GBP/USD after the data to get long at 1.5275. We are waiting for tomorrow’s British jobs report. We think British pay growth will likely accelerate faster than expected by consensus. Based on the ongoing tightening in the UK labor market, we expect the BoE to adopt a less dovish stance sooner than the market anticipates. Recent rises in oil prices may also change medium-term inflation outlook soon despite today’s negative reading. The target of our long is 1.5440, just below 61.8% retracement of 1.5659-1.5107 fall.

Significant technical analysis' levels:

Resistance: 1.5388 (session high Oct 14), 1.5400 (psychological level), 1.5448 (61.8% fibo of 1.5659-1.5107)

Support: 1.5223 (low Oct 7), 1.5141 (low Oct 6), 1.5130 (low Oct 5)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.