GROWTHACES.COM Forex Trading Strategies:

Trading Positions

EUR/USD: long at 1.1915, target 1.2060, stop-loss 1.1875

GBP/USD: long at 1.5255, target 1.5480, stop-loss 1.5175

USD/JPY: long at 118.70, target 121.80, stop-loss 117.80

USD/CHF: short at 1.0085, target 0.9960, stop-loss 1.0120

EUR/GBP: short at 0.7850, target 0.7700, stop-loss 0.7880

EUR/CHF: long at 1.2025, target 1.2090, stop-loss 1.1995

AUD/NZD: short at 1.0530, target 1.0320, stop-loss 1.0580

AUD/JPY: long at 96.80, target 99.00, stop-loss 96.10

Pending Orders

USD/CAD: buy at 1.1660, if filled target 1.1990, stop-loss 1.1580

EUR/USD: Stay Long Ahead Of US ISM And FOMC Minutes

(long for 1.2060)

Head of the San Francisco Federal Reserve Bank John Williams, who is a voting member this year on the Fed's policy-setting committee, said yesterday that the pace of interest-rate hikes after an initial liftoff should be gradual to preserve flexibility and to help a U.S. economy that still may need stimulus to have above-trend growth.

Dovish comment from Williams helped the EUR/USD to recover slightly in yesterday’s U.S. session and in today’s Asian session. The EUR/USD reaches a daily’s high of 1.1969 but then fell again below 1.1900 following sharp drops in crude oil, stocks and political uncertainty in Greece ahead of a snap election this month. Moreover, poor Euro zone PMI readings were released today.

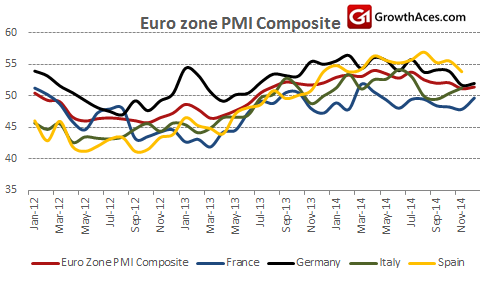

Composite PMI based on surveys of thousands of companies across the region and seen as a good indicator of growth, missed an earlier flash reading of 51.7, coming in at 51.4. The reading beat November’s 16-month low of 51.1. The PMI is consistent with economic growth of just 0.1% qoq in the fourth quarter.

Weakness was again evident in the big three economies of Germany, France and Italy. German economic output posted a mild acceleration at year-end, but the rate of expansion was still lackluster compared with earlier quarters of 2014.

The weakness of the PMI will add to calls for more aggressive central bank steps supporting economic recovery. However, the European Central Bank may say that lower oil prices reduce businesses’ costs and improves consumer spending and give the opportunity for brighter economic activity in the future. The central bank may choose to wait and see if the economic growth strengthens before deciding on full-blown quantitative easing.

We keep our EUR/USD long position in anticipation for some corrective moves. In our opinion the EUR/USD is likely to rise after today’s release of U.S. ISM reading (15:00 GMT) and tomorrow’s FOMC minutes.

Significant technical analysis' levels:

Resistance: 1.1969 (hourly high Jan 6), 1.2006 (high Jan 5), 1.2100 (10-dma)

Support: 1.1860 (low March, 2006), 1.1826 (low February, 2006), 1.1800 (low January, 2006)

GBP/USD: PMI Reading Suggests Weaker Growth In Q4

(long for 1.5480)

Britain’s services PMI suffered its biggest decline in more than three years in December, falling to 55.8 from 58.6 in November to touch its lowest level since May 2013. The index remained comfortably above the 50 mark that signals growth.

PMI signalled Britain's economy grew by 0.5% qoq in the fourth quarter of 2014, slowing from 0.7% in the third quarter.

The composite purchasing managers index combining surveys of the services, manufacturing and construction industries hit its lowest level in 19 months. The GBP/USD fell to its weakest since August 2013 after the data. The GBP is also suffering as investors are pushing back bets on when the Bank of England will start raising interest rates, with many now reckoning that will not happen at all this year.

The Bank of England’s quarterly Credit Conditions Survey showed lenders reported the sharpest fall in household demand for mortgages since the third quarter of 2008. But at the same time, there was the biggest increase in demand for credit card lending since records began in early 2007. Bank lending to businesses continues to remain soft, with lenders forecasting no significant pick-up in credit provision, largely due to fears of a sharply worsening economic outlook.

The GBP/USD almost hit the stop-loss of our long position (today’s low at 1.5177). We stay long and expect weaker U.S. ISM reading today that would be negative for the USD bulls. We expect also more dovish FOMC minutes on Wednesday. That is why in our opinion some corrective moves on the GBP/USD are likely in the days ahead.

We used weaker GBP to get short on the EUR/GBP at 0.7850. The target of our short EUR/GBP position is 0.7700 and the stop-loss is 0.7880.

Significant technical analysis' levels:

Resistance: 1.5319 (hourly high Jan 5), 1.5355 (high Jan 5), 1.5584 (high Jan 2)

Support: 1.5104 (low Aug 2, 2013), 1.5080 (low Jul 17, 2013), 1.5045 (low Jul 16, 2013)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.