GROWTHACES.COM Trading Positions

EUR/USD: long at 1.2175, target 1.2270, stop-loss 1.2160

USD/CHF: short at 0.9880, target 0.9800, stop-loss 0.9895

EUR/CHF: long at 1.2025, target 1.2090, stop-loss 1.1995

EUR/GBP: short at 0.7880, target 0.7770, stop-loss 0.7910

GBP/JPY: long at 186.70, target 189.10, stop-loss 185.80

GROWTHACES.COM Pending Orders

USD/CAD: buy at 1.1570, target 1.1740, stop-loss 1.1540

EUR/JPY: buy at 146.30, target 148.00, stop-loss 145.70

EUR/USD: No Reaction To Greek Voting

(long for 1.2270)

All eyes were fixed today on Greek third and final chance to elect a new president. The Greek Parliament's failed to elect Stavros Dimas as president of Greece in the final round of voting for the presidential election. Under Greek law, a general election must now be called. The radical leftist Syriza party, which wants to renegotiate Greece's bailout agreement with the EU and International Monetary Fund and roll back austerity policies, has held a steady lead in opinion polls for months, although its advantage has narrowed in recent weeks.

The EUR/USD rate did not react significantly to the outcome of Greek voting. The medium-term outlook is bearish as divergent central bank expectations continues to provide excuses to sell EUR/USD. However, some corrective moves are likely in the days ahead. We got long at 1.2175 with the target at 1.2270. However, we keep stop-loss tight at 1.2160.

Significant technical analysis' levels:

Resistance: 1.2256 (high Dec 25), 1.2272 (high Dec 22), 1.2302 (high Dec 19)

Support: 1.2165 (low Dec 23), 1.2133 (low Aug 2, 2012), 1.2118 (low Jul 26, 2012)

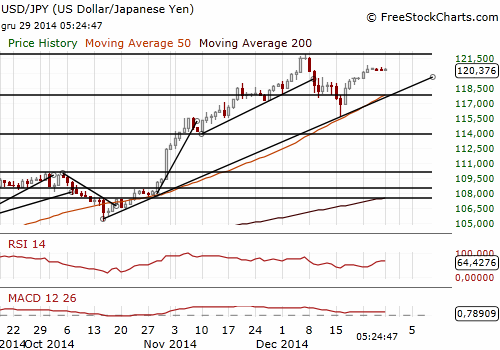

USD/JPY: Profit Taken. Looking To Get Long Again.

(medium-term outlook remains bullish)

Japan's core CPI amounted to 2.7% yoy in November and matched the expectations. In October CPI amounted to 2.9% yoy. Stripping out the effects of a sales tax hike in April, core consumer inflation was 0.7% yoy, slowing from 0.9% yoy in October and far below the 2% target.

The so-called core-core inflation index, which excludes food and energy prices and is similar to the core index used in the United States, rose 2.1% yoy.

Unemployment rate stood at 3.5% in November, steady from the previous month. The jobs-to-applicants ratio rose to 1.12 from 1.10 in October, marking the highest job availability since May 1992, separate data from the labour ministry showed.

Japanese household spending fell 2.5% yoy in November vs. median estimate of a 3.8% yoy drop. Japanese retail sales rose 0.4% yoy in November, less than a median market forecast for a 1.1% yoy increase.

Japanese industrial output unexpectedly fell 0.6% mom in November, down for the first time in three months. A rise of 0.8% mom was expected. Manufacturers surveyed by the Ministry of Economy, Trade and Industry expect output to rise 3.2% in December and increase 5.7% in January.

Japan's government approved on Saturday stimulus spending worth JPY 3.5 trillion aimed at helping the country's lagging regions and households with subsidies, merchandise vouchers and other steps. The government said it expects the stimulus plan to boost Japan's GDP by 0.7%. Of the total, JPY 1.8 trillion will be spent on measures such as distributing coupons to buy merchandise, providing low-income households with subsidies for fuel purchases, supporting funding at small firms and reviving regional economies. The remaining JPY 1.7 trillion will be used for disaster-prevention and rebuilding disaster-hit areas including those affected by the March 2011 tsunami.

We took profit on our long USD/JPY position (116.50-120.10) after the rate reached the stop-loss at 120.10 on Thursday. We are looking to get long again on dips. The overall scope is for gains back towards 121.86 – 2014 high posted on December 8.

Significant technical analysis' levels:

Resistance: 120.75 (high Dec 24), 121.00 (high Dec 9), 121.86 (high Dec 8)

Support: 120.01 (low Dec 23), 119.41 (21-dma), 118.82 (low Dec 19)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.