GROWTHACES.COM Trading Positions

USD/JPY: long at 115.00, target 118.50, stop-loss 116.40

USD/CHF: long at 0.9560, target 0.9760, stop-loss 0.9530

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

EUR/GBP: short at 0.7990, target 0.7840, stop-loss 0.8060

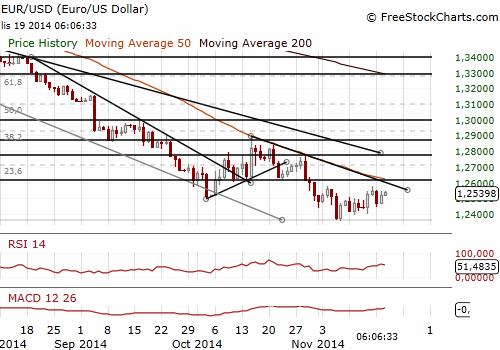

EUR/USD: Focus On The FOMC Minutes

(sell at 1.2580)

Minneapolis Federal Reserve President Narayana Kocherlakota (voter, dove) said yesterday the Federal Reserve is risking its credibility by not acting aggressively enough to bring inflation back up to its 2% target. Kocherlakota was the only Fed policymaker to dissent on the Fed's decision last month to end its bond-buying stimulus, repeated his view that inflation won't rise back to 2% until 2018. In his view a rate hike next year would be inappropriate unless inflation shows signs of heading back to 2% within a year or two.

Investors’ focus turns to the Federal Reserve which will release minutes of its latest policy review today. The Fed minutes are likely to sound relatively more hawkish which could give a boost to the USD.

Our trading strategy for today is to sell EUR/USD before the FOMC minutes. We placed our sell order at 1.2580. Our target will be 1.2400 near the lows from last Friday.

Significant technical analysis' levels:

Resistance: 1.2580 (high Nov 17), 1.2591 (hourly high Oct 31), 1.2617 (high Oct 31)

Support: 1.2470 (200-hma), 1.2467 (10-dma), 1.2442 (low Nov 18)

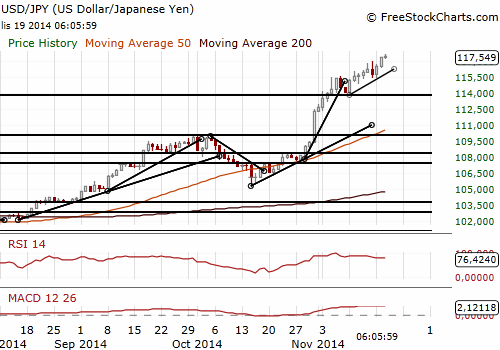

USD/JPY: Will The 117.95 Be Broken Today?

(we have raised the target to 118.50)

The Bank of Japan kept monetary settings and its upbeat economic view unchanged today. As widely expected, the central bank voted to continue its purchases of government bonds and risky assets, maintaining its pledge of increasing base money, or cash and deposits at the central bank, at an annual pace of JPY 80 bn. The BOJ said in a statement: “Japan's economy continues to recover moderately as a trend, although some weaknesses remain mainly in output.”

The BOJ voted 8-1 for steady policy against 5-4 vote for easing last month. Board member Takahide Kiuchi, a sceptic of the current quantitative easing programme, dissented to the policy decision in a show of his continued disapproval to last month's surprise monetary easing that was made by a closely split vote. The other three of the four dissenters of the October 31 easing voted for today's policy decision.

BOJ Governor Haruhiko Kuroda in reaction to sales tax postponement said: “I understand that whether to raise the sales tax is something the government and parliament decides, taking into account economic and other conditions. Speaking in general terms, it's important for Japan as a nation to maintain market trust in its finances.”

The USD/JPY and most JPY crosses rose in Asia. A larger majority of the BOJ supporting current monetary easing gave a boost to the USD/JPY. The market expects also an acceleration of monetary easing next year given determination of the authorities to achieve the inflation target of 2%.

The USD/JPY broke above the level of 117.00. The nearest support level is at today’s session low of 116.81. The strong resistance is at 117.95 – October 2007 high. In case of breaking above this level the USD/JPY is likely to go near 118.50 (levels not seen since August 2007).

We have raised the target of our long USD/JPY position to 118.50. We expect hawkish FOMC minutes, supportive for the USD bulls.

Significant technical analysis' levels:

Resistance: 117.95 (high Oct 15, 2007), 118.00 (psychological level), 118.52 (high Aug 14, 2007)

Support: 116.80 (session low Nov 19), 116.33 (low Nov 18, 116.00 (psychological level)

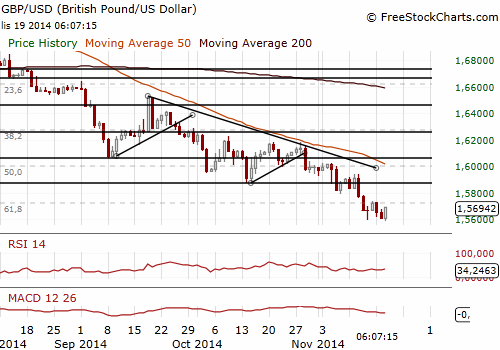

GBP/USD Firmer After BOE Minutes

(we stay sideways, outlook is bearish)

The Bank of England released minutes of the Monetary Policy Committee's November 5-6 meeting. Two BOE policymakers (Ian McCafferty and Martin Weale, who have voted for a rate hike since August) voted again for an increase in interest rates this month. They continued to point out that below target inflation was largely the result of a higher exchange rate and lower raw material prices.

The minutes said some members thought there was a risk that economic growth might soften further than anticipated and inflation might stay below target for longer. Let’s remind that last week, the BoE issued new forecasts that showed British inflation will likely fall below 1% in the next six months. Yesterday’s figures showed inflation edged up to 1.3% in October from 1.2% in September. BOE Governor Mark Carney suggested markets were right to rule out an interest rate hike any time soon.

The GBP/USD firmed after the release of the minutes. The median forecast for the minutes outcome was 7-2 vote, but there was quite high risk that one or both of the hawks supported the majority. The GBP/USD bulls were relieved to see an unchanged minutes outcome. The rate went up to 1.5676, near yesterday’s high.

We are looking to use upticks to get short on the GBP/USD. The next target for the currency bears could be near 1.5400.

Significant technical analysis' levels:

Resistance: 1.5737 (high Nov 17), 1.5751 (10-dma), 1.5780 (high Nov 13)

Support: 1.5593 (low Nov 13), 1.5563 (low Sep 6, 2013), 1.5556 (low Sep 4, 2013)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.