GROWTHACES.COM Trading Positions

USD/CAD: long at 1.1280, target 1.1480, stop-loss 1.1200

EUR/CHF: long at 1.2085, target 1.2160, stop-loss 1.2045

GBP/JPY: long at 172.00, target 175.00, stop-loss 171.00

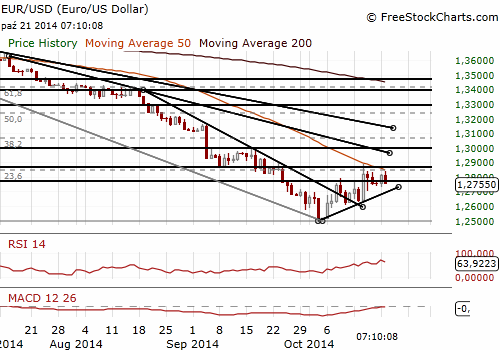

EUR/USD weaker on hint the ECB is looking at buying corporate bonds

The EUR fell after Reuters informed that several sources said the European Central Bank was considering buying corporate bonds on the secondary market. The ECB may decide on the matter as soon as December with a view to starting purchases early next year.

The ECB began buying covered bonds on Monday, part of a private-sector asset-purchase programme that will also see it buy bundled loans known as asset-backed securities later this year.

Our short EUR/USD reached a stop-loss level, but we have taken a small profit. In our opinion fundamentals are EUR/USD negative and short positions are more justified. However, we will wait for higher levels.

Investors are focused now on tomorrow’s U.S. CPI data. Given weak inflation data from other economies that have been released so far, investors will not be strongly surprised if September U.S. CPI will be slightly weaker as well. The potential disappointment in case of lower-than-expected reading after the data is likely to be limited.

Significant technical analysis' levels:

Resistance: 1.2838 (session high Oct 21), 1.2845 (high Oct 16), 1.2887 (high Oct 15)

Support: 1.2744 (10-dma), 1.2731 (low Oct 20), 1.2712 (21-dma)

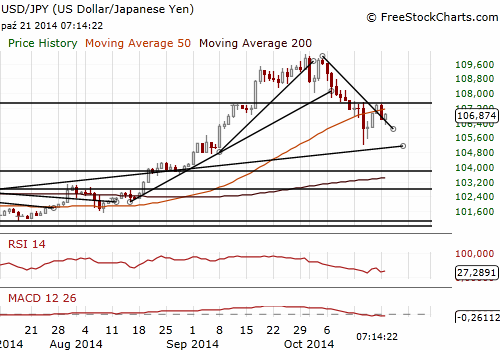

USD/JPY: Yen stronger despite political scandal

Three cabinet members - Defence Minister Akinori Eto, Agriculture Minister Koya Nishikawa and Health Minister Yasuhisa Shiozaki - have already publicly faced questions over alleged influence peddling, improper donations or problems in reporting on political funds. On Monday, Yuko Obuchi, quit as trade and industry minister after acknowledging doubts over whether her support groups misused political funds. Hours later, Midori Matsushima stepped down as justice minister over allegations, which she rejected, that she handed out paper "uchiwa" fans to voters, a violation of election law.

Japan's government cut its overall economic assessment for the second straight month. The government downgraded industrial production after it fell 1.9% in August. The government stood by its view that the economy can recover in the future because companies expect output to increase in September, they have robust capital expenditure plans and because the labour market remains tight.

Weak Japanese equities gave support to the JPY. The USD has lost ground in recent weeks on concerns about slowing global growth and shift in expectations of Fed’s interest rates hikes. The USD/JPY fell to as low as 106.22 today but then recovered. Our long USD/JPY position reached the stop-loss level, but we have taken a profit (105.60-106.50). We went long on the GBP/JPY at 172.00, in line with our strategy. The target of GrowthAces.com is at 175.00 and stop-loss at 171.00.

Significant technical analysis' levels:

Resistance: 107.00 (session high Oct 21), 107.39 (daily high Oct 20), 107.49 (high Oct 15)

Support: 106.14 (low Oct 17), 105.51 (low Oct 16), 105.20 (low Oct 15)

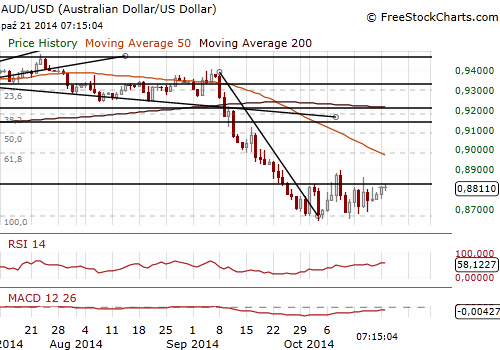

AUD/USD higher after China GDP

In minutes of its October 7 policy meeting, the Reserve Bank of Australia said the labour market remained subdued but had stabilised somewhat this year, adding it had based its assessment on a range of data given the volatility in the official labour force survey. The bank reiterated that the most prudent course was to maintain a period of stability in interest rates. The minutes revealed that Board members had noted a further pick up in lending to housing investors in recent months.

On the AUD, the central bank said it remained high by historical standards, particularly given the recent declines in key commodity prices. Member also noted a recent pick up in financial market volatility from very low levels, predominantly in currency markets.

Reserve Bank of Australia Deputy Governor Philip Lowe said that very low global interest rates are likely to persist for some time yet and investors, in their chase for yield, need to be wary of the risks in pushing asset prices too far ahead of economic fundamentals.

China's economic growth fell to a five-year low of 7.3% in the third quarter. That was slightly above the median forecast of 7.2% but slower than 7.5% in the second quarter. The data added to expectations that growth will come in below the official 2014 target of 7.5%, which would be the first miss since 1999.

The AUD/USD rose strongly after growth figures from China slightly exceeded market expectations. The rate broke above the level of 0.8800 and reached the stop-loss on our short position, but we have taken a small profit. We are looking to get long on the AUD crosses: AUD/JPY and AUD/NZD.

The release of Australian Q3 CPI data is scheduled for tomorrow (0:30 GMT). The median forecast is at 2.3% yoy, but our estimate is at 2.2% yoy. The data should not be AUD supportive.

Significant technical analysis' levels:

Resistance: 0.8828 (session high Oct 21), 0.8830 (high Oct 16), 0.8860 (high Oct 15)

Support: 0.8765 (session low Oct 21), 0.8742 (low Oct 20), 0.8730 (low Oct 17)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.