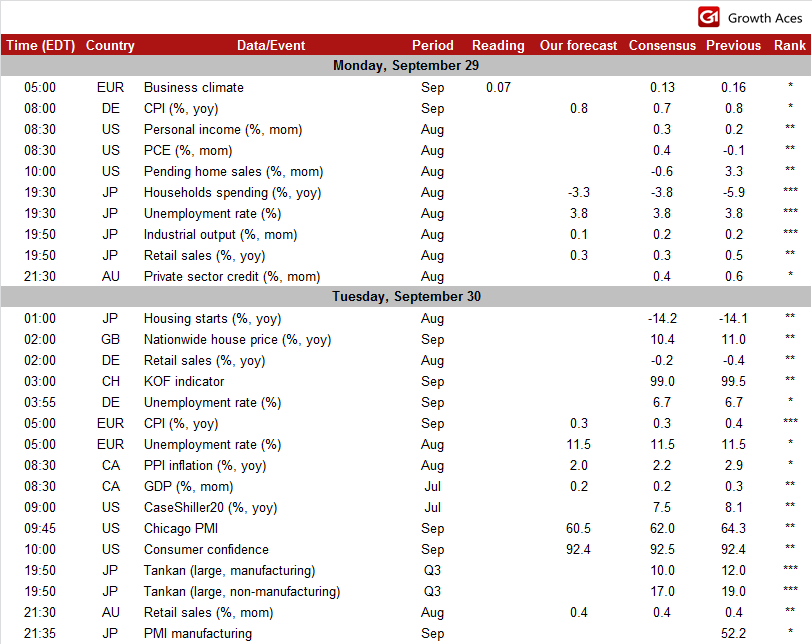

ECONOMIC CALENDAR

EUR/USD: The USD rally goes on.

Euro zone economic sentiment deteriorated in September to levels last seen in late 2013.

The European Commission said that economic sentiment in the Euro zone fell to 99.9 this month from 100.6 in August. The index was weighed down by less optimistic consumers, retailers and industry. The only sectors where sentiment improved slightly in September were services and construction. The declining optimism was mirrored by a fall in the business climate indicator for the euro zone, which the Commission said stood at 0.07 in September, down from 0.16 in August.

Inflation expectations among households and producers alike continued to fall. The index of inflation expectations fell to 4.0 this month from 6.6 in August.

CPI data from five German states point to unchanged inflation at just 0.8% in September. Germany is the strongest economy of the Euro zone but inflation is much weaker than the target of the ECB (close but below 2%). It means that the central bank is far from reaching its aim. Euro zone inflation data will be released tomorrow and GrowthAces.com expects a fall of CPI to 0.3% yoy in September from 0.4% yoy in August.

The ECB meeting on Thursday and US labor data on Friday are expected to be the main market movers next week and not just for the EUR/USD, but for the entire forex market. The ECB governor Mario Draghi is expected to give more details on the ABS purchases. Even if the currency bears are disappointed after the ECB meeting, which is possible in the opinion of Growth Aces, any attempt of the EUR/USD recovery can be swept by strong US Non-Farm Payrolls data on Friday.

The EUR/USD is trending lower and multiple bearish candlestick lines weigh on the market.

We have lowered our sell offer to the 1.2725. The nearest support level is 1.2664 (2014 low) Beyond, we see 1.2502 (76.4% of 1.2041-1.3995) – the next target for the currency bears.

Significant technical analysis' levels:

Resistance: 1.2728 (hourly high Sep 26), 1.2761 (high Sep 26), 1.2783 (high Sep 25)

Support: 1.2664 (low, Sep 29), 1.2661 (low, Nov 3, 2012), 1.2627 (Sep 7, 2012)

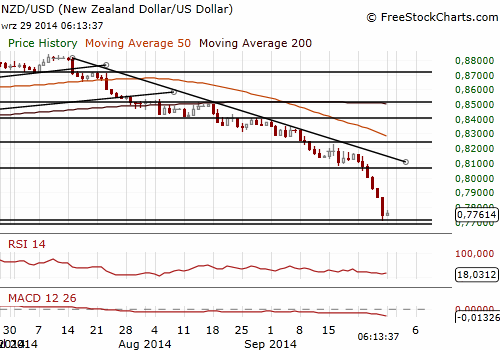

NZD/USD: The RBNZ showed it sold the currency.

The Reserve Bank of New Zealand released figures that showed the bank had intervened in currency markets last month by selling a net NZD 521 mn, stoking speculation that the central bank may act again. The move underlined the RBNZ's discomfort with the currency's strength and comes days after governor Graeme Wheeler renewed his warning that the NZD was at unjustified and unsustainable levels. The RBNZ has said intervention might be used when market conditions are opportune and it believed there was a good chance of influencing the exchange rate.

Prime Minister elect John Key said before the data was released that he backed the RBNZ's assessment of the currency and said it would have been "fairly logical" to intervene.

He said a reasonable "goldilocks" level for the NZD/USD was around 0.6500.

The NZD/USD fell to a fresh post 5 Aug 2013 low of 0.7708. In the opinion of Growth Aces the USD strength and possible further interventions against the NZD suggest lower levels for the NZD/USD. We see next support level at 0.7670 (low Aug 5, 2013).

Significant technical analysis' levels:

Resistance: 0.7873 (hourly high Sep 29), 0.7957 (high Sep 26), 0.8000 (psychological level)

Support: 0.7708 (hourly low Sep 29), 0.7706 (low Aug 5, 2013), 0.7694 (low Jul 8, 2013)

EUR/CHF: The SNB determined to defend 1.20 CHF/EUR cap

The Swiss National Bank Chairman Thomas Jordan said the central bank will continue to defend its cap on the value of the CHF at 1.20 per EUR and could act immediately to defend it. He added: “We want to avoid deflation and do not exclude any necessary step including negative interest rates.” Jordan also said the SNB had not intervened to defend the cap on the value of the Swiss franc versus the euro since September 2012.

In September the central bank sharply lowered its inflation forecast for 2016 to 0.5% from 0.9% so an immediate action before December 11 (next SNB meeting) cannot be excluded.

The EUR/CHF is struggling in a very narrow range and unable to get back above 1.2089 (daily high Sep 25). We maintain our bullish outlook and target at 1.2160.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.