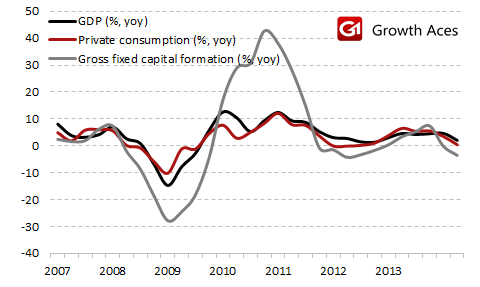

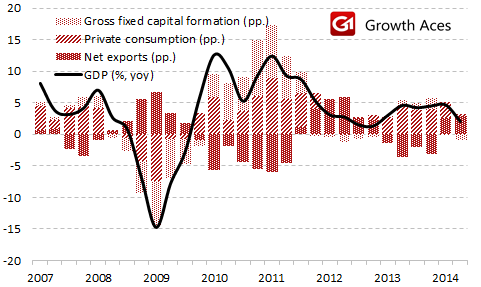

Turkey's economy grew 2.1% yoy in the second quarter vs. the median forecast of 2.8% yoy. The statistics institute revised its first quarter GDP growth figure to 4.7% yoy from an initial 4.3% yoy.

Household final consumption expenditure increased by 0.4% yoy vs. growth of 3.2% in the first quarter. Gross fixed capital formation decreased by 3.5% yoy vs. a decrease by 0.2% in the previous quarter. Exports of goods and services increased by 5.5% yoy and imports went down by 4.6% yoy. Contribution of net exports to real GDP growth amounted to 2.9 pp. vs. 2.6 pp. in the first quarter.

Finance Minister Mehmet Simsek is the opinion that Turkey risks missing its growth target of 4% this year after a slowdown in the second quarter on the back of economic weakness in European export markets and geopolitical tensions. He added that drought, which has hit agricultural output, as well as economic weakness in European export markets and wars in Ukraine and Iraq heightened the risk of growth remaining below the target.

Turkish Economy Minister Nihat Zeybekci said that too high interest rates had led domestic demand to negatively impact growth.

The figures are likely to increase political pressure on the central bank to cut interest rates. The central bank unexpectedly lowered its overnight lending rate at its last meeting on August 27, more as a signal to a government that it is supporting the economy.

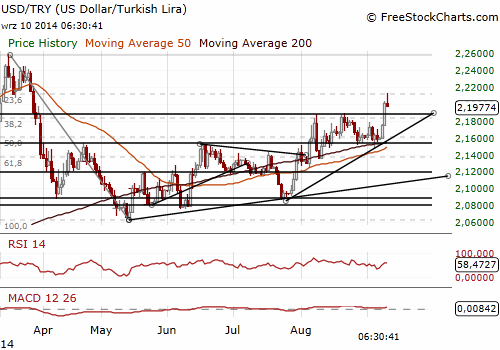

Turkey's central bank will probably support TRY by restricting liquidity in the 1-week repo auctions. A shift towards more hawkish monetary policy is unlikely given economic slowdown. Important data on current account balance for July are scheduled for tomorrow. Turkish lira is under pressure of early US rate hike, as Turkey is a country with wide current account deficit and large external debt.

At GrowthAces.com we remain flat on the USD/TRY. The short-term outlook is bullish.

Significant technical analysis' levels:

Resistance: 2.2220 (high Mar 26), 2.2400 (high Mar 25), 2.2430 (high Mar 24)

Support: 2.1920 (session low Sep 10), 2.1670 (session low Sep 9), 2.1550 (low Sep 8)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.