This behaviour is congruent with how downward trends typically ebb and flow, and it could give us a decent entry point for a sell (especially as we were able to bank profit and are now out of the EURNZD trade). Not only is this potential sell set-up congruent with the EURAUD’s downward trend, the level at 1.4138 also overlaps with the 50 Fibonacci Retracement level.

From a fundamental perspective, the disparity between Australia’s interest rates, held at 2.5%, compared to the 0.5% maintained by the ECB is cause for the inevitable weakening of the Euro and a strengthening Aussie Dollar, by comparison (as investors seek a better rate of return in the currency which corresponds with the most favourable interest rate).

So, how can we play this?

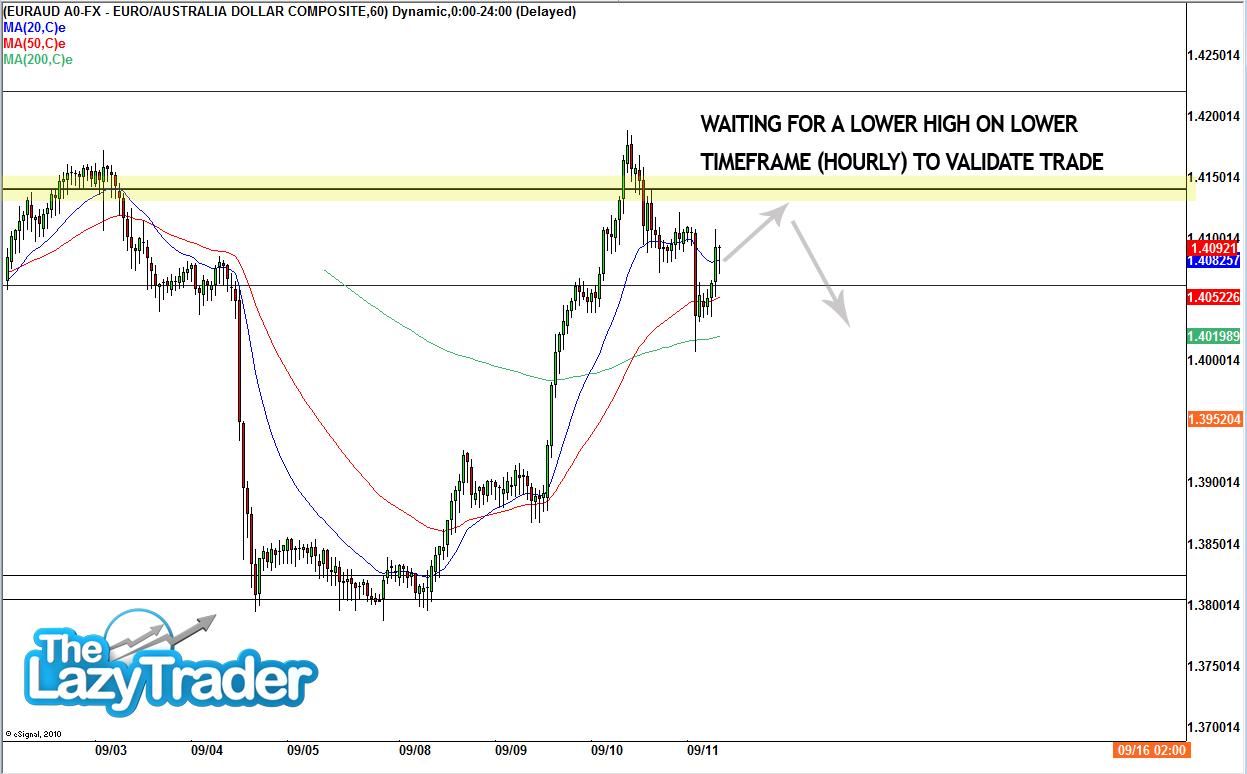

We are going to be slightly cautious when trading this. Not only do we not have bearish reversal divergence on the daily (RSI or Stochastic) to validate this trade, we do not have a reversal on the hourly timeframe to give us an indication that the medium term-buyers are being replaced by sellers. Ideally, we will have a double top/head and shoulders formation on the hourly to correspond with what is a bearish pin bar reversal on the daily – but we don’t! HOWEVER, this could form throughout today.But for now, the hourly continues to trend upwards, having spiked in those who unwittingly took the trade on the daily without waiting for the confirmations (that we looks for).

As EURAUD is currently moving upwards against the dominant trend, many traders will simply set things up so that if the “lower high” on the hourly is confirmed today, then they can catch the move on its way down...but without having to be in front of the screen to manually do it.

Many traders will use the break of yesterday’s low (Wednesday) as their entry point (below the low minus spread) with their stoploss above yesterday’s high (plus spread) for what could be a protracted short-term sell trade with the downtrend on the daily. They will do this under the proviso that they will only be triggered into the trade if the lower high is made on the hourly timeframe.

Target: A quick fire outcome will most likely be sought by many trading this (the previous swing low) at around: 1.3846. This target corresponds with a very strong level of support so, in our opinion, to take the money and exit (supposing we do get triggered and it goes in favour), for a high(er) probability, low(er) reward outcome.

Verdict: One for the brave.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.