Analysis for February 8th, 2016

EUR USD, “Euro vs US Dollar”

Eurodollar is falling towards 1.1080. After reaching it, the pair may return to 1.1165 and then fall towards 1.1000. This entire descending movement may be considered as a correction.

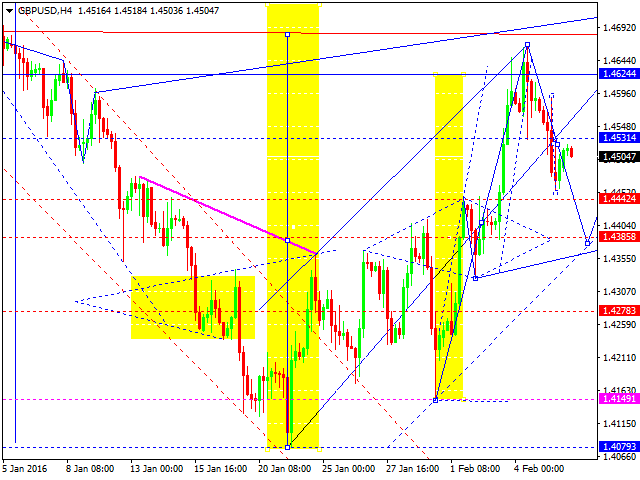

GBP USD, “Great Britain Pound vs US Dollar”

Pound is moving downwards to reach 1.4385; this descending structure may be considered as a correction. Later, in our opinion, the market may form another ascending wave towards 1.4720.

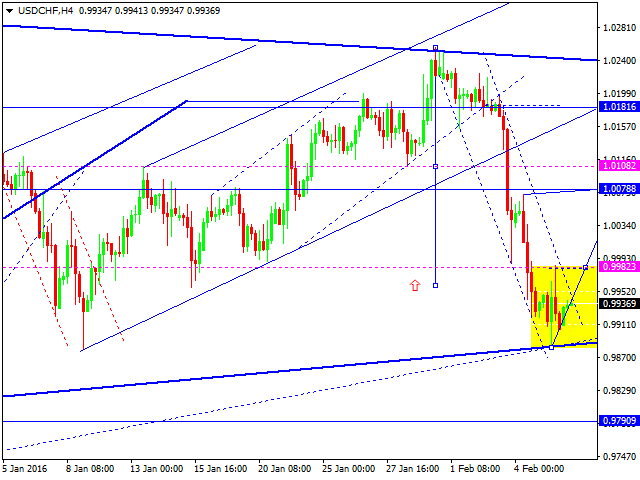

USD CHF, “US Dollar vs Swiss Franc”

Franc is moving near the lows of its consolidation channel. We think, today the price may grow towards 1.0080 and then return to 0.9882.

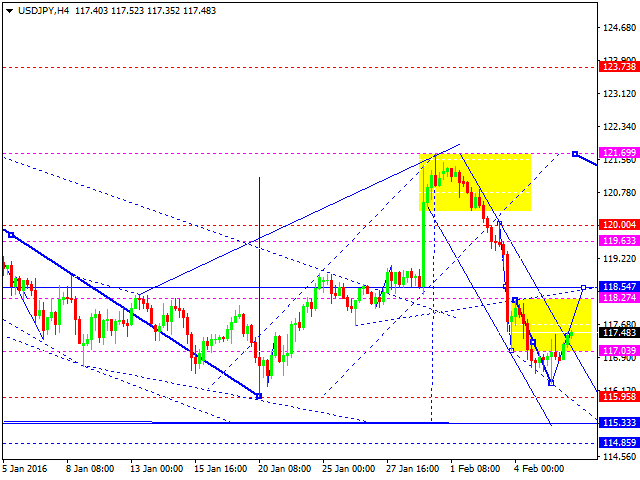

USD JPY, “US Dollar vs Japanese Yen”

Yen is back to its consolidation channel. Possibly, the price may test 118.50 from below. After that, the market may continue falling to reach new lows and 115.33.

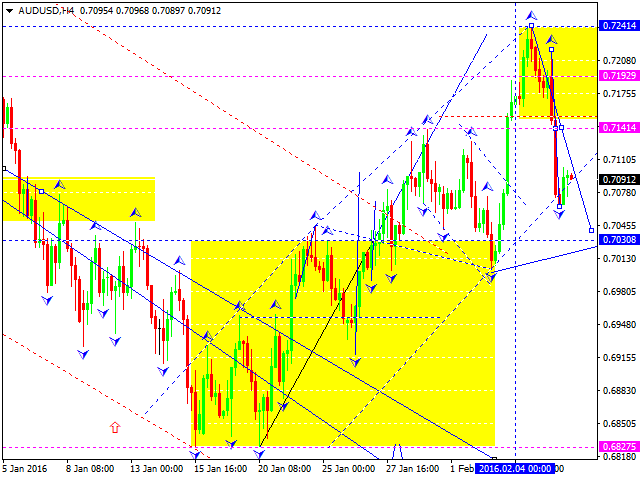

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is falling with the target at 0.7000. Right now, the market is returning to 0.7140. After reaching it, the price is expected to continue falling to reach the above-mentioned target.

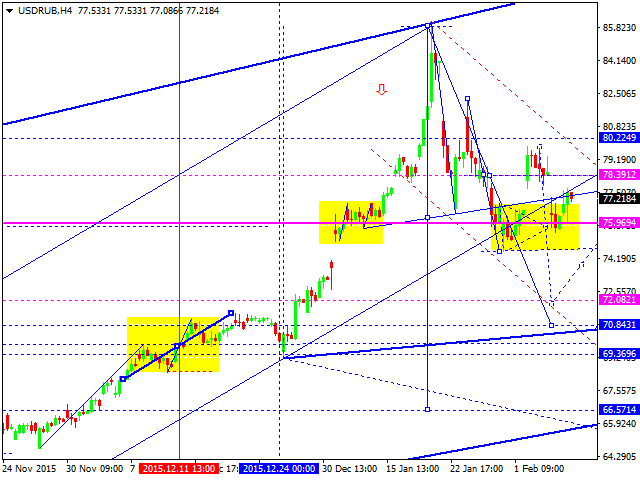

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is consolidating near 78.00. This structure may be considered as a part of the fifth wave towards 70.84.

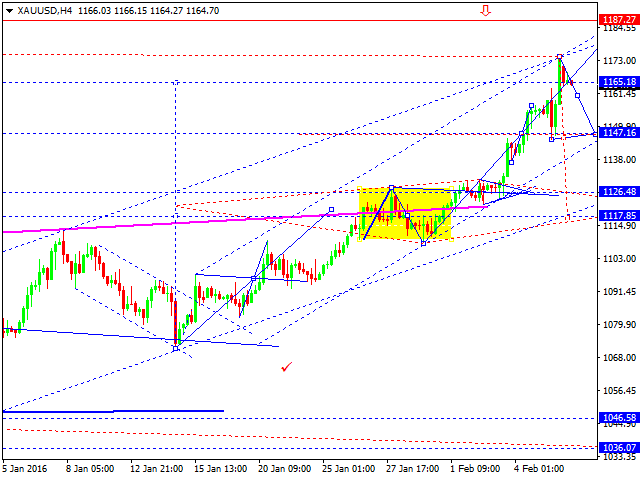

XAU USD, “Gold vs US Dollar”

Gold is moving upwards with the target at 1187. We think, today the price may be corrected towards 1147 or even deeper – 1117. Later, in our opinion, the market may form another ascending structure towards 1190.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.