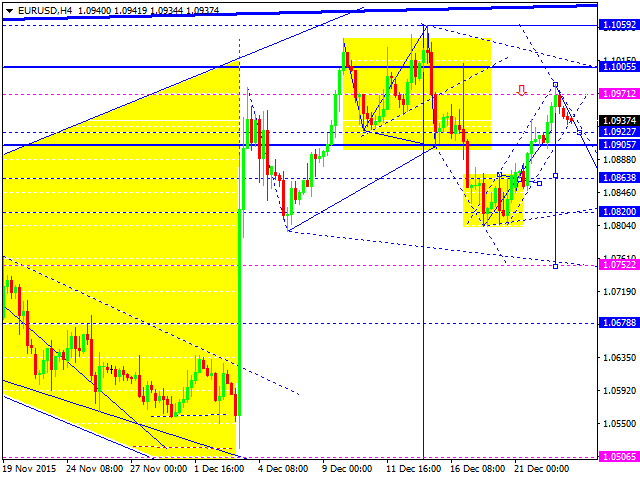

The euro dollar currency is trading with a decline today. The channel of the fourth component of growth is breaking through. The next step is the fifth with a target at the level of 1.0752. Next, we consider the possibility of the correction returning to the level of 1.0900.

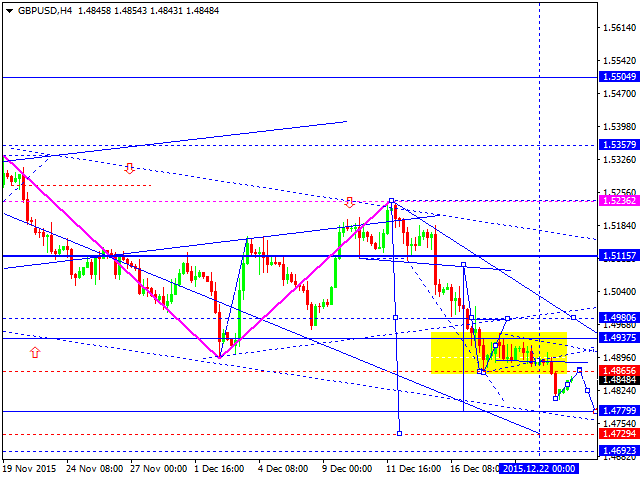

The pound dollar currency pair broke through the consolidation down. Today we consider a return to the breakdown, the test from below. And then, again the decline to the target of 1.4730. Then the correction at least to the level of 1.5120.

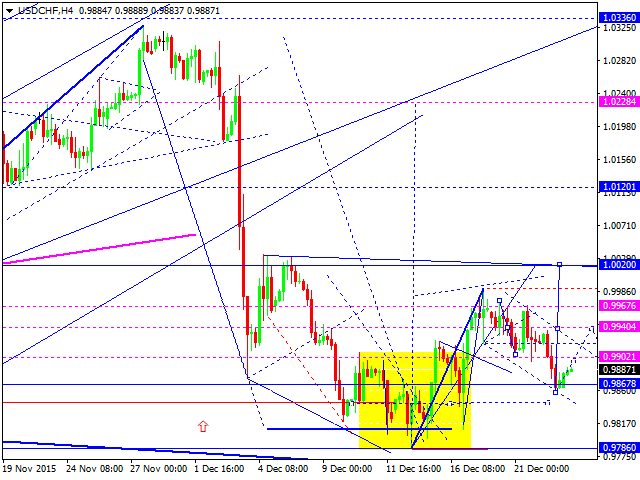

The Dollar Franc currency pair is now trading with growth. We consider the possibility of growth in the fifth structure to the refinement of the level of 1.0020. Next in line – is the correction returning to the level of 0.9900.

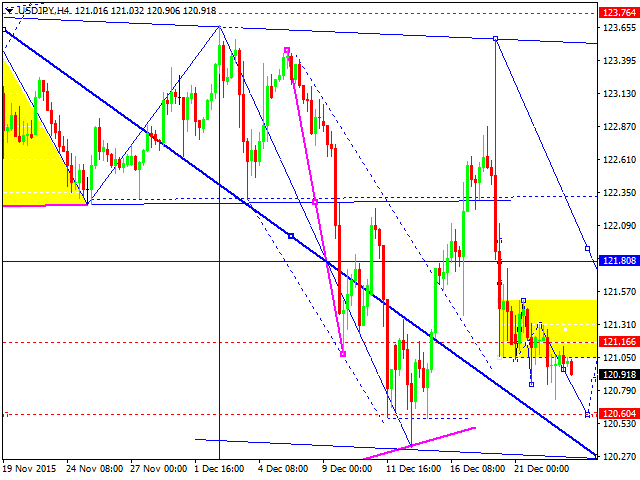

The dollar yen currency pair is trading with the exit from consolidation. We consider a reduction to the level of 120.60. Next in line is a correction to the level of 121.16.

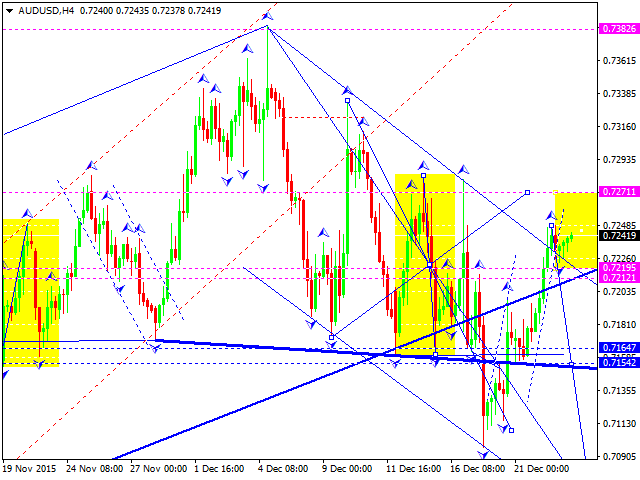

The Australian dollar against the US dollar continues to trade under pressure to increase. We consider the possibility of overlapping the level of 0.7272. Next - a reduction to the level of 0.7058.

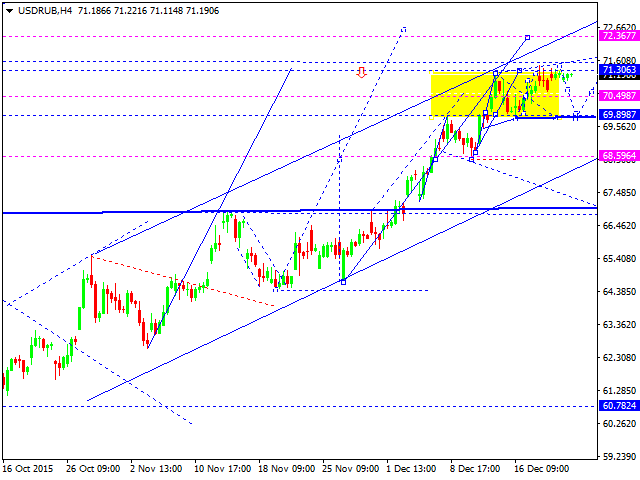

The Russian ruble is trading at the top of the structure of growth. A narrow consolidation is forming. Next in line we consider the reduction of at least a correction to the level of 70. The structure of the decline will give a hint about the future intentions of the market.

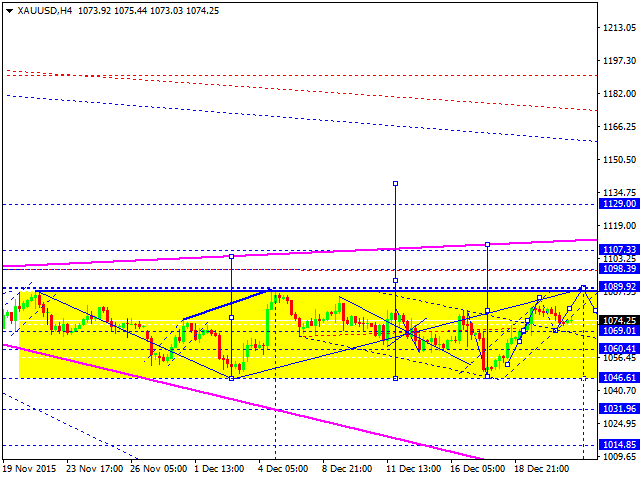

Gold is trading at a reduction to the level of 1069. We expect the rebound in growth to the level of 1090. Then, again a fall to the center, at 1069.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.