Analysis for December 17th, 2015

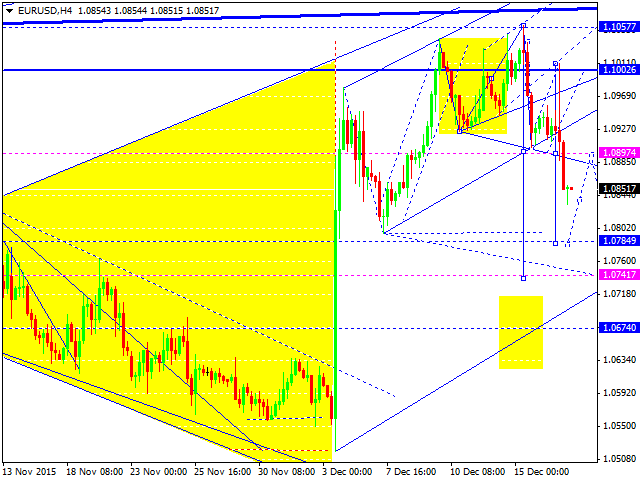

EUR USD, “Euro vs US Dollar”

Being influenced by the news, Eurodollar has corrected the first impulse and broken the minimum. We think, today, the price may form the third structure of its descending wave with the target at 1.0785. Later, in our opinion, the market may test 1.0890 from below and then form another descending structure towards 1.0742.

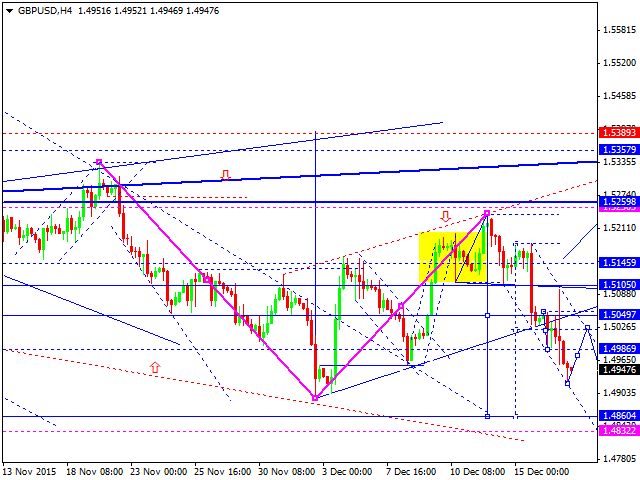

GBP USD, “Great Britain Pound vs US Dollar”

Being under pressure, Pound is falling. We think, today, the price may reach 1.4860 and then return to 1.5050 to test it from below.

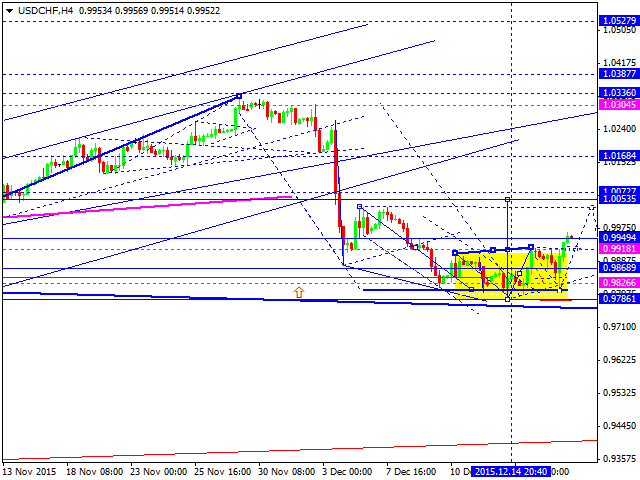

USD CHF, “US Dollar vs Swiss Franc”

Franc has completed its correction and broken the top of its first ascending impulse. We think, today, the price may form a new consolidation channel, break it upwards, and then continue growing to complete the third wave with the target at 1.0050. Later, in our opinion, the market may return to 0.9918.

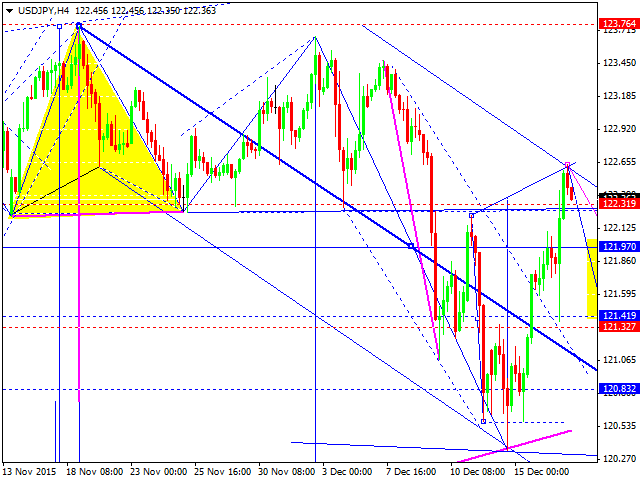

USD JPY, “US Dollar vs Japanese Yen”

Yen has completed its ascending wave and right now is falling towards 121.40. This structure may be considered as a part of the descending wave with the target at 120.20.

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming a wide consolidation channel; the pair has reached the channel’s lower border, moved towards the upper border, and then returned to the lower one again. We think, today, the price may test the center of the channel, rebound from it downwards, and then break the lows to continue falling with the target at 0.7050.

USD RUB, “US Dollar vs Russian Ruble”

Russian Ruble is returning to 70.50. We think, today, the price may reach it and then continue falling towards 68.51. After that, the instrument may return to 69.40.

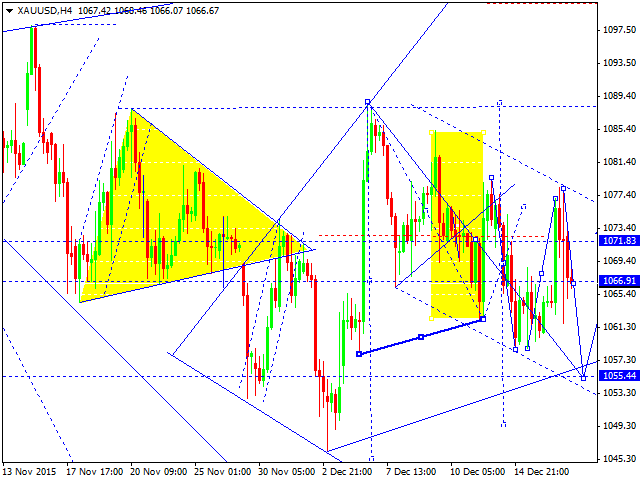

XAU USD, “Gold vs US Dollar”

Gold is forming the fifth structure of the flag pattern. We think, today, the price may reach 1055.44. After that, the instrument may grow to return to 1071.88. The market is forming a new consolidation channel.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.