Analysis for July 2nd, 2015

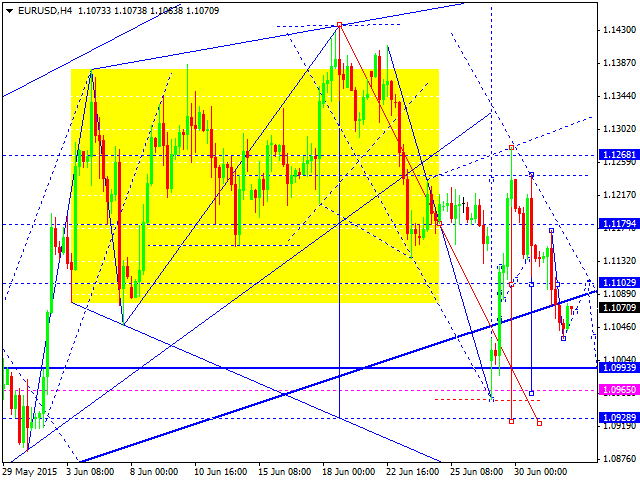

EUR USD, “Euro vs US Dollar”

Eurodollar is under pressure and continues falling; it has formed the central part of its continuation pattern. We think, today, the price may test level of 1.1100 from below and then fall towards level of 1.0965. After that, the pair may return to level of 1.1100 once again and then continue falling to reach level of 1.0930.

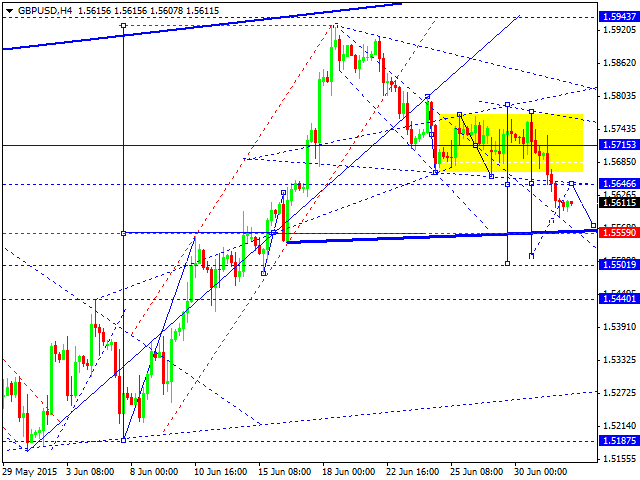

GBP USD, “Great Britain Pound vs US Dollar”

Pound has broken its consolidation channel downwards right now is extending this descending structure. We think, today, the price may reach level of 1.5560, at least. Later, in our opinion, the market may return to level of 1.5715.

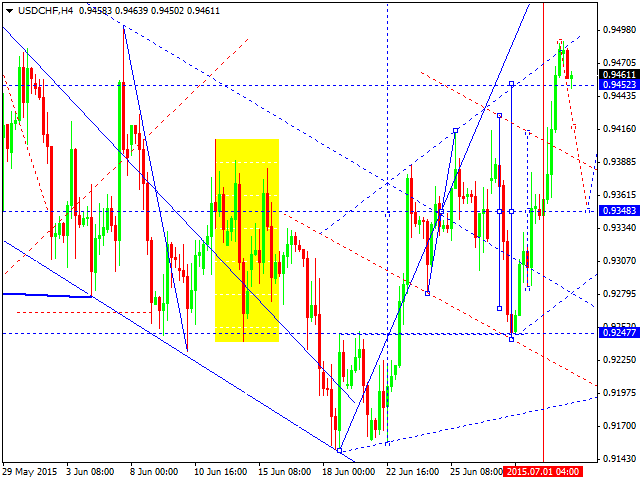

USD CHF, “US Dollar vs Swiss Franc”

Franc has reached its target inside triangle pattern. We think, today, the price may fall to reach level of 0.9350 and then grow towards level of 0.9545. Later, in our opinion, the market may return to level of 0.9350 again.

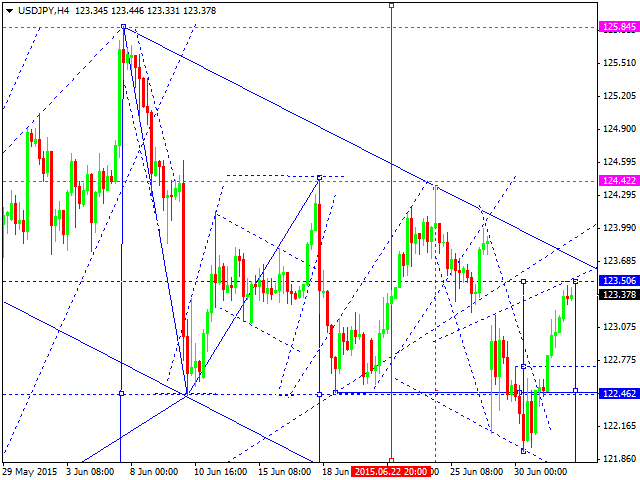

USD JPY, “US Dollar vs Japanese Yen”

Yen is moving to return to the center of its consolidation channel. We think, today, the price may continue forming the current descending wave to break the minimum and reach level of 120.60. Later, in our opinion, the market may grow to return to level of 122.22 to test it from below and then form another descending structure to reach level of 119.00.

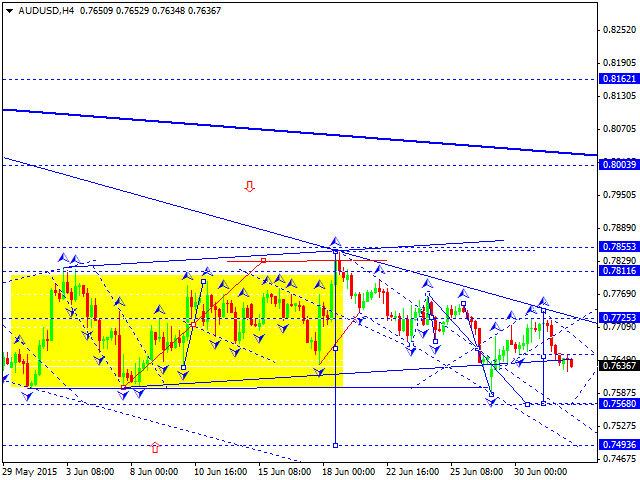

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming another descending wave towards level of 0.7568. After that, the price may return to level of 0.7650 to test it from below and then continue falling to reach level of 0.7500.

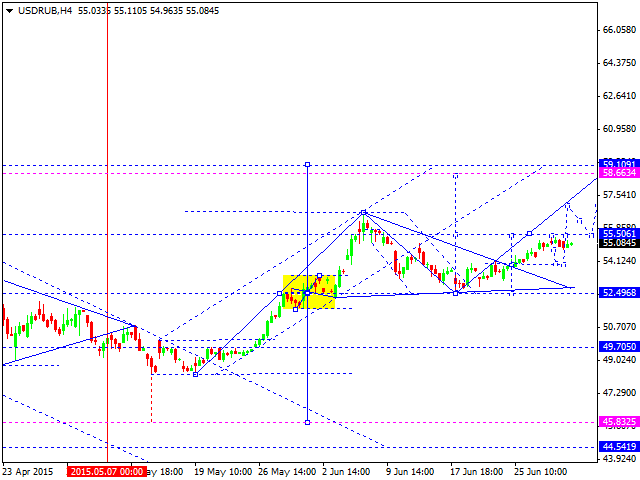

USD RUB, “US Dollar vs Russian Ruble”

Ruble is consolidating below level of 55.50. We think, today, the price may grow to break the channel upwards and then form another consolidation channel. After that, the pair may break this channel upwards as well and reach level of 58.50. Later, in our opinion, the market may start falling towards level of 52.50.

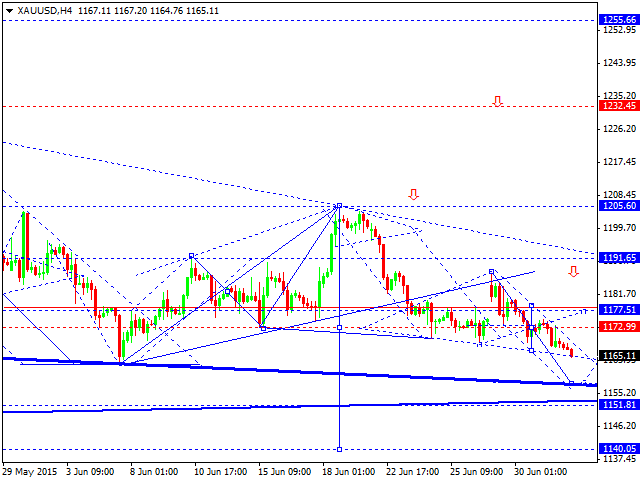

XAU USD, “Gold vs US Dollar”

Gold is still falling towards level of 1150. After reaching it, the price may form a correction towards level of 1173 to test it from below. Later, in our opinion, the market may continue falling with the target at level of 1140.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

No tap dancing around inflation concerns

Tuesday saw U.S. stocks closing considerably lower as investors grappled with economic indicators indicating increasing labour costs and a decline in consumer confidence, all coming ahead of a crucial Fed policy meeting aimed at determining the trajectory of interest rates.