Analysis for December 16th, 2014

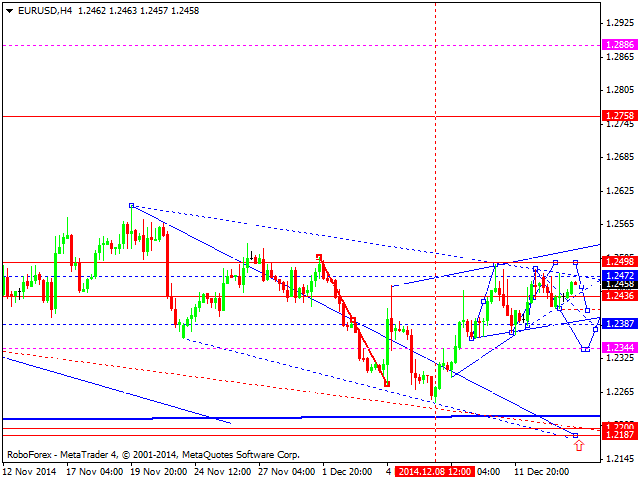

EURUSD, “Euro vs US Dollar”

Eurodollar is trying to form an ascending structure again. If the price fails to stay above level of 1.2470, it may result in an alternative scenario and a new descending movement towards level of 1.2344 or even 1.2200. However, according to the main scenario, the pair may test level of 1.2498 and then resume falling towards level of 1.2344.

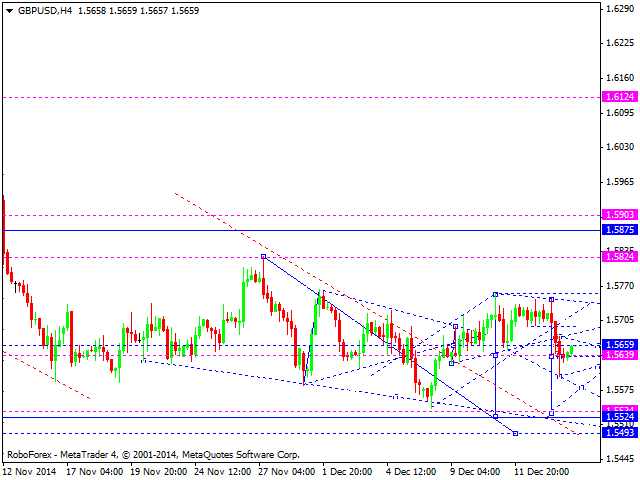

GBPUSD, “Great Britain Pound vs US Dollar”

Pound has expanded its consolidation channel downwards. Such scenario implies that the pair may continue forming a descending wave with the target at level of 1.5535. We think, today the price may form a consolidation channel as a downside continuation pattern.

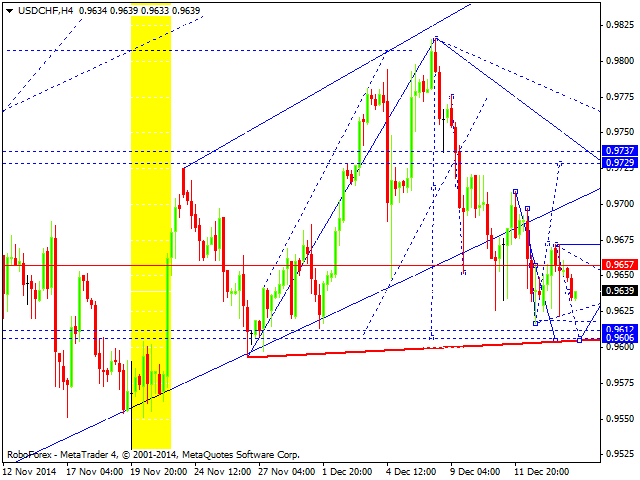

USDCHF, “US Dollar vs Swiss Franc”

Franc is making another attempt to reach level of 0.96. If it fails, the price may return to level of 0.9735. Later, in our opinion, the market may continue falling to break the minimum.

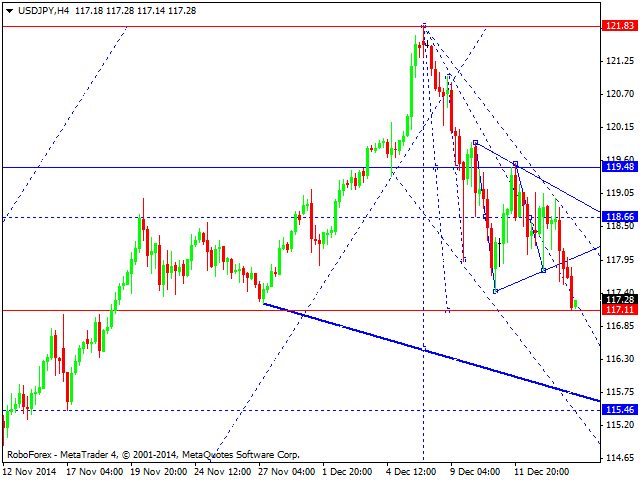

USDJPY, “US Dollar vs Japanese Yen”

Yen has reached the target of its descending wave. We think, today the price may extend this wave towards level of 115.50 and then return to level of 118.66 as a correction towards the first descending wave. We should note that such decline may continue without serious correctional structures. The next downside target is at level of 113.

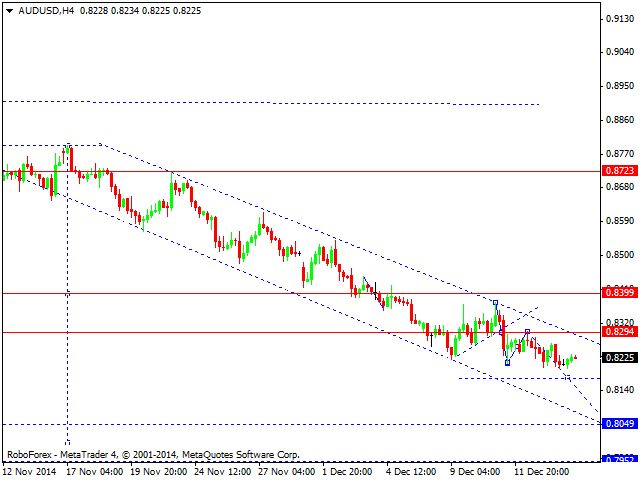

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is still falling inside the downtrend and reaching new lows. We think, today the price may reach level of 0.850. The main downside target is at level of 0.7800.

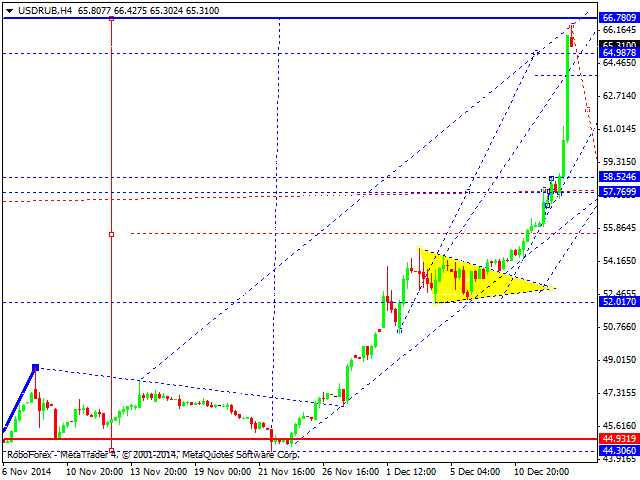

USDRUB, “US Dollar vs Russian Ruble”

As Crude Oil continues falling, Ruble continues moving upwards. We think, today the price may make a fast descending movement to reach level of 57.80, break it, and move towards the next target at level of 52. After that – fall towards level of 44.90.

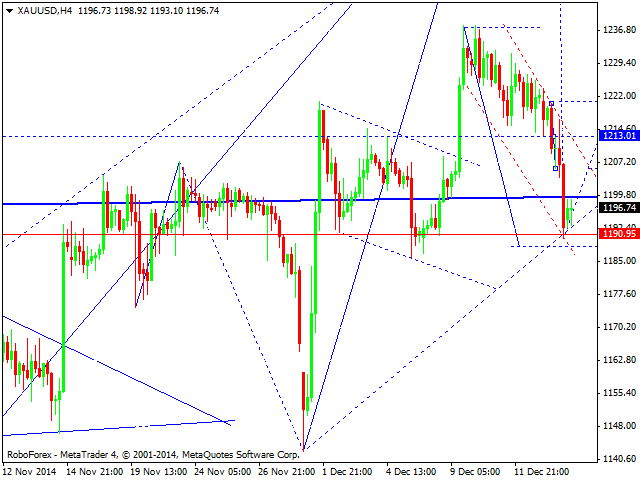

XAUUSD, “Gold vs US Dollar”

Gold hasn’t been able to form a reversal structure and right now is still falling. We think, today the price may extend this correction towards level of 1188. Later, in our opinion, the market may leave its descending channel and start growing towards level of 1250.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.