Analysis for October 1st, 2014

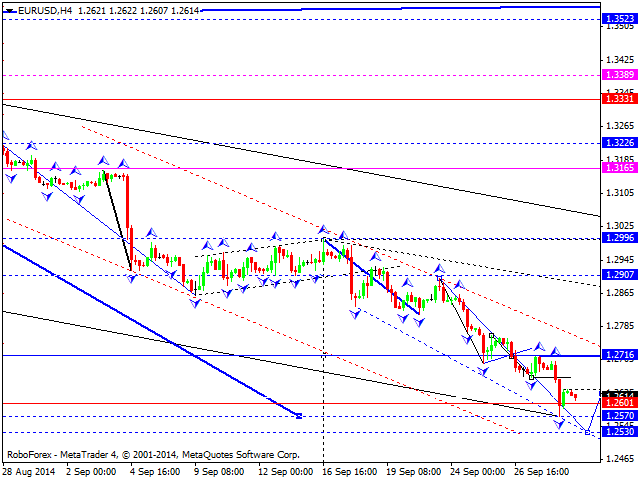

EUR USD, “Euro vs US Dollar”

Euro hasn’t been able to form its first ascending wave; the pair has broken a consolidation channel downwards. We think, today the price may return to level of 1.2660 and then fall towards level of 1.2530. An alternative scenario suggests that the market may form an ascending impulse to return to level of 1.2700.

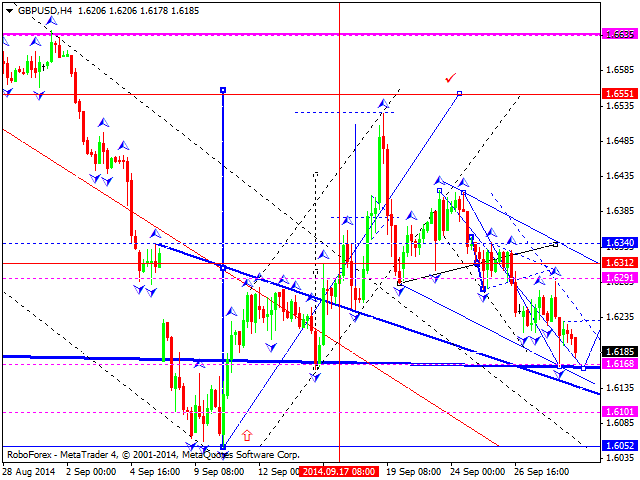

GBP USD, “Great Britain Pound vs US Dollar”

Pound has broken a consolidation channel downwards. We think, today the price may fall towards level of 1.6168 and then try to return to level of 1.6340. After that, the price may form another structure of this correctional wave.

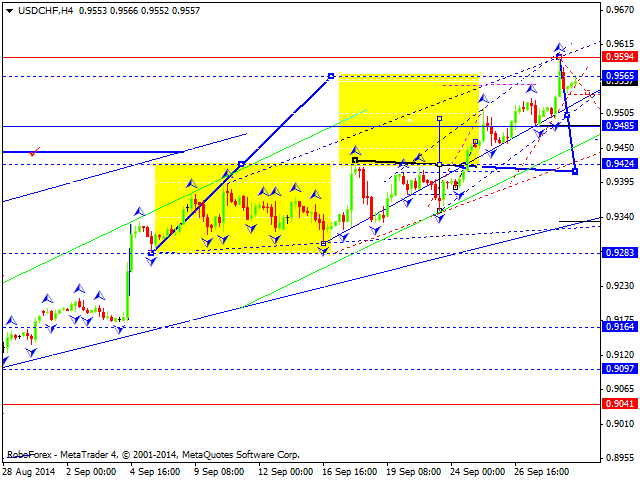

USD CHF, “US Dollar vs Swiss Franc”

Franc hasn’t been able to form a descending wave; instead it has broken a consolidation channel upwards and expanded this trading range. We think, today the price may return to level of 0.9485 and then grow again towards level of 0.9535. Thus, the market is expected to consolidate again, but inside a wider trading range.

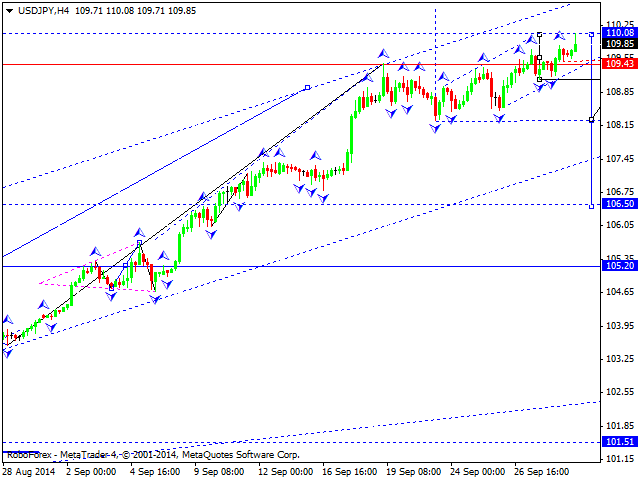

USD JPY, “US Dollar vs Japanese Yen”

Yen has also broken a consolidation channel upwards and may continue growing. We should note that the pair has already reached all important targets. The main scenario implies that the price may form a consolidation channel, break it downwards, and then form a reversal pattern to start a new downtrend.

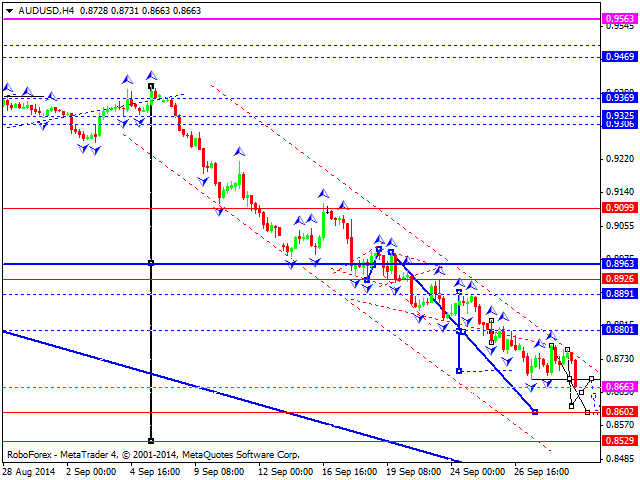

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has broken a consolidation channel downwards and may continue moving towards level of 0.8600. We should note, that the pair has reached its targets and may start a new correction. At any time, the market may form a reversal pattern and start a correction towards level of 0.8800, at least.

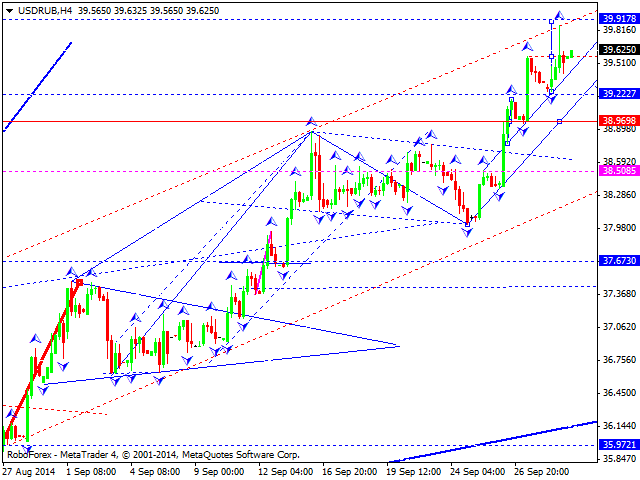

USD RUB, “US Dollar vs Russian Ruble”

Ruble has broken a consolidation channel upwards and almost reached the target. We think, today the price may form another ascending structure to reach a new high and then start falling. The market is expected to consolidate and form a reversal structure at the top of this wave. Later, in our opinion, the pair may start a correction towards level of 34.00.

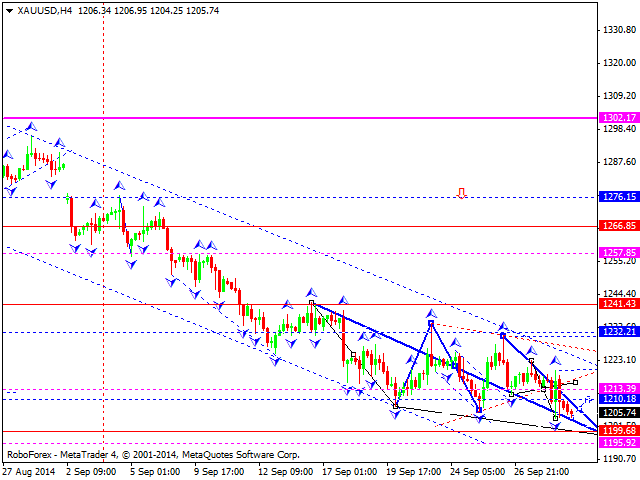

XAU USD, “Gold vs US Dollar”

Gold hasn’t been able to form an ascending wave. We think, today the price may form another consolidation channel by growing towards 1210 first and then falling to 1200. Later, in our opinion, the market may break this consolidation channel upwards. If the price expands this channel up to 1220, the market may form a reversal pattern and start a correction. An alternative scenario suggests that the market may break it downwards and move to reach level of 1190.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.