Analysis for June 16th, 2014

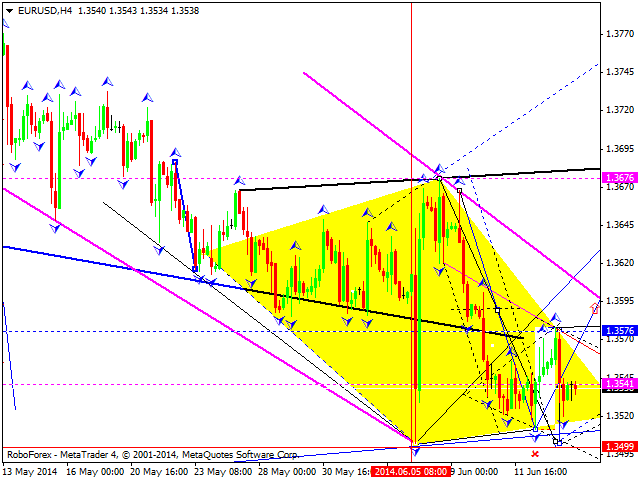

EUR USD, “Euro vs US Dollar”

EURUSD continues to hold within a bullish structure, violation of level 1.3576 will possibly confirm existing trend and lead to ascending impulse with target around 1.4100. One of possible scenarios – liquidation to the downside with a new low, then rally to the upside.

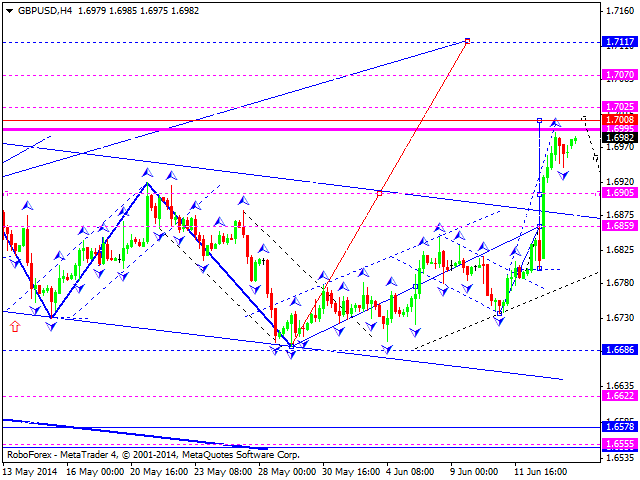

GBP USD, "British pound vs US Dollar"

GBPUSD is attempting to continue ascending trend, bullish structure becomes elongated. We anticipate 1.7110 as possible target, after reaching this level more solid correction can follow, up to 1.6550 level. After that price can reach 1.7730 or higher.

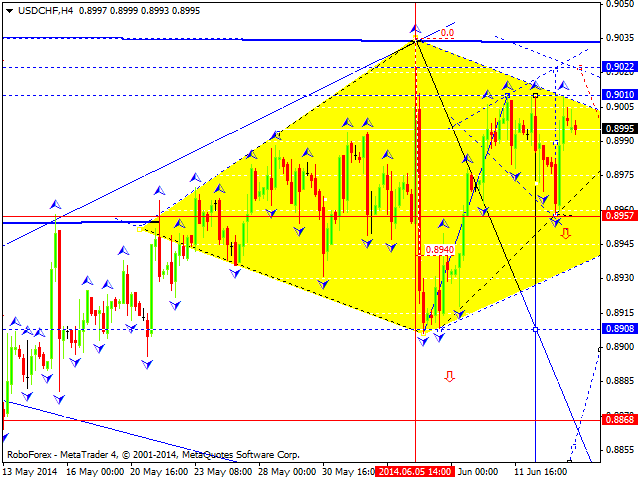

USD CHF, "US Dollar vs Swiss Frank"

USDCHF is developing within bearish structure. We assume this structure as a part of descending trend with targets of 0.8300 or lower. As possible alternative, price can first rally to 0.9020 area, then reverse and resume descending trend.

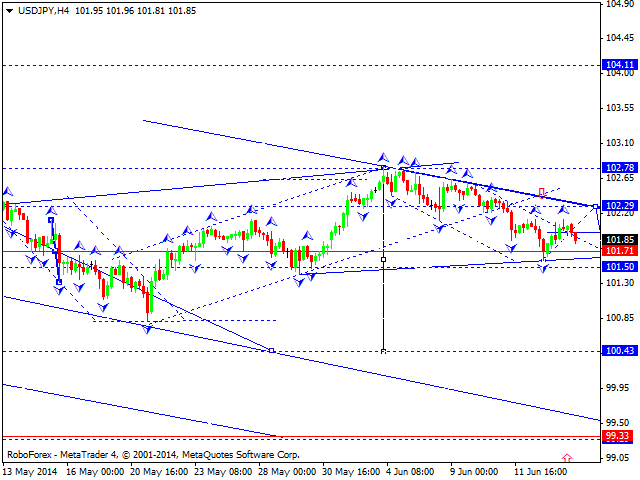

USD JPY, "US Dollar vs Japanese Yen"

USDJPY continues to decline. We assume that 3rd wave will be continued with targets on 99.30 or lower. In the present time, 100.50 is considered to be a short-term target. We do not exclude that first 102.20 area will be revisited, and main trend will be resumed only after that.

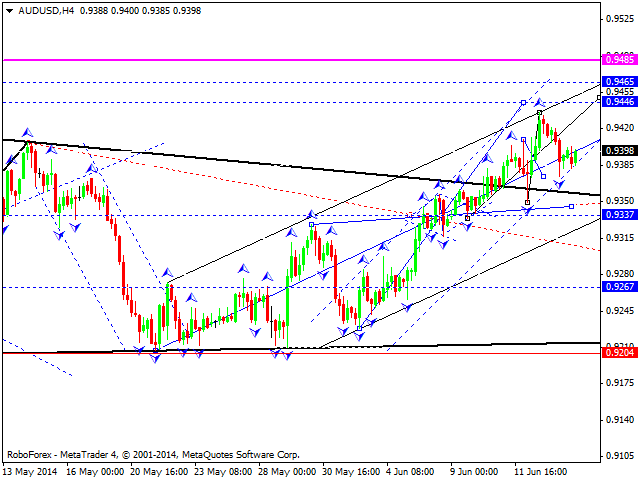

AUD USD, "Australian dollar vs US dollar"

AUDUSD continues to build elongated bullish structure with possible target of 0.9460 or higher. Pullback to 0.9265 is possible.

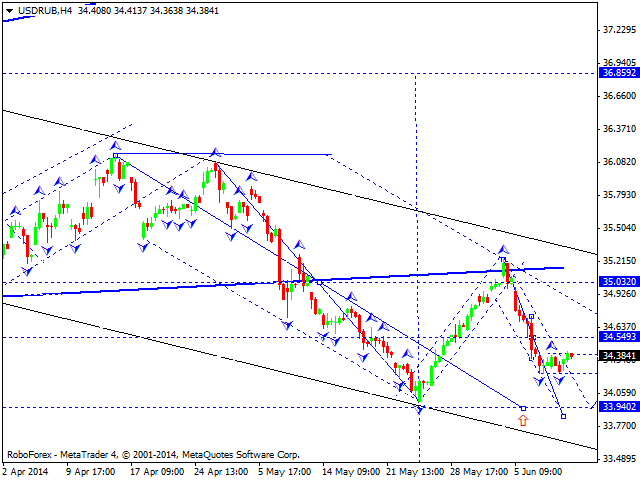

USD RUB, "US Dollar vs Russian Rouble"

Russian rouble is headed to 33.94 according to our view. This level can be revisited as soon as today, then it may be heading to 35.00 area. After that we expect another descending wave with target of 33.20 or lower. In case it happens, it might be the final stage of the correctional phase. After that we will expect price to go to 38.50.

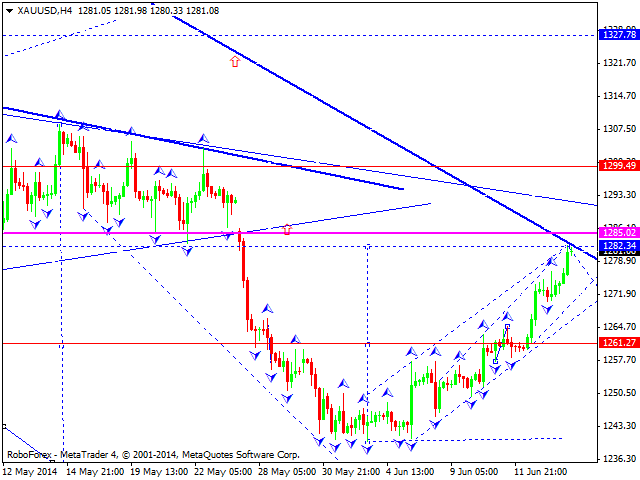

XAU USD, "Gold vs US Dollar"

Gold had crossed 1282 level as a result of the recent bullish structure. Correctional phase can follow with target of 1208 or lower. Then bullish structure can develop with retest of higher border of the triangle. 1360 area is considered to be a target.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.