New technologies may raise demand for silver

Demand for silver may rise due to new industrial technologies, according to GFMS and The Silver Institute. Will silver edge up?

Demand for silver to produce the film tumbled 3 times in recent 10 years. At the same time, the demand for silver for photovoltaics soared roughly the same. It increased 23% last year compared to 2014. Global political and economic instability make people use silver for investment objectives. Thus, production of silver coins and bullions has increased from 10mln ounces to 300mln ounces in recent 10 years. The global increase in demand is being anticipated due to developing technologies of “Internet of things”, OLED sources of light, jewellery and clothing emblems production, in aerospace industry and in nanotechnologies. At the same time, global silver production steadied at +2% in recent 2 years having increased 38% in recent 10 years. Nevertheless, despite such a significant rise in production volumes, high demand for silver pushed its prices up almost twofold. Historically, silver prices copy gold price fluctuations. In 1975-2015 average ratio of gold to silver was 55.4. Now it reached 70.7, which may signify that silver is lagging behind.

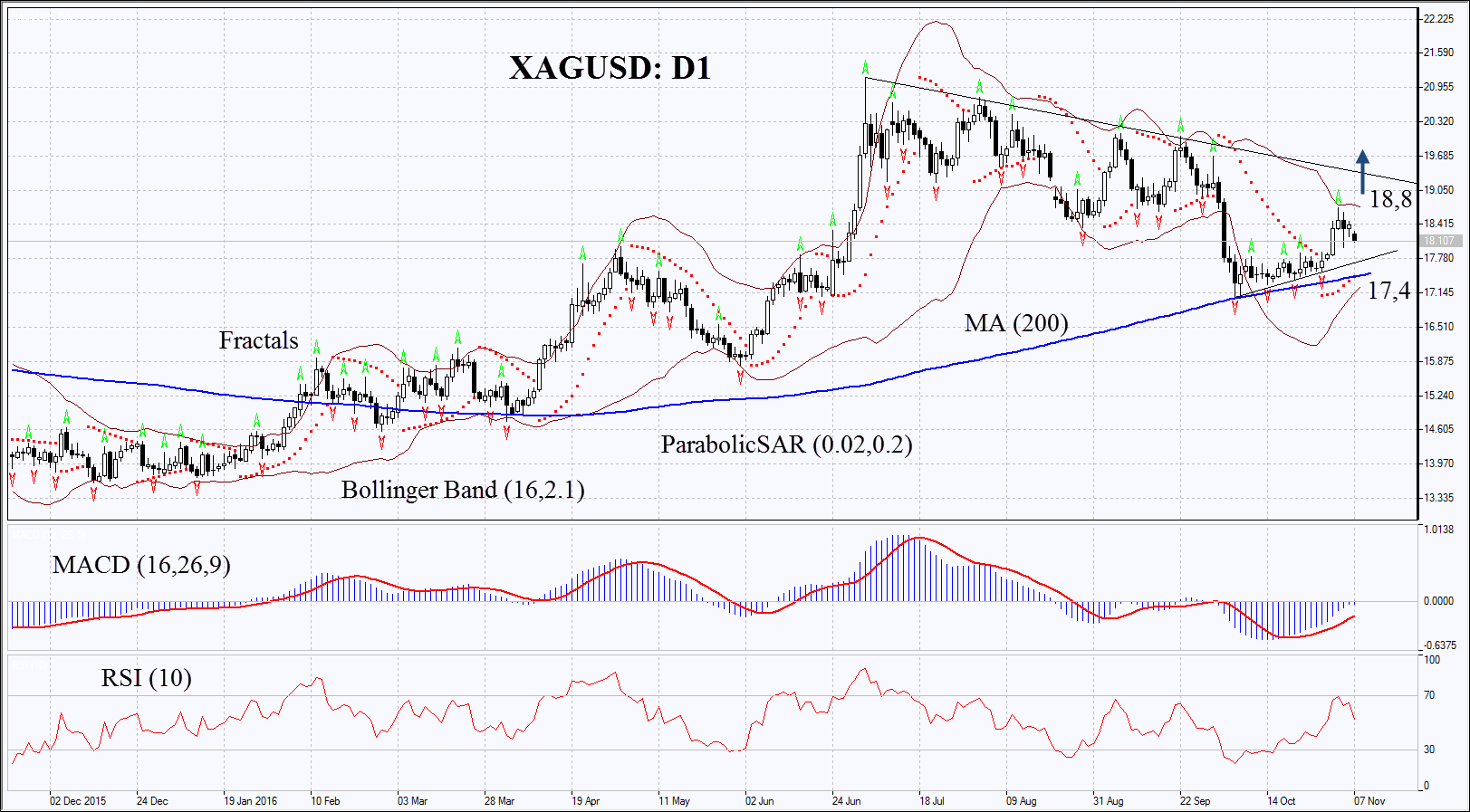

On the daily chart XAGUSD: D1 is rising from its 200-day moving average through which it failed to break down about a month ago. Further growth is possible in case of general increase in precious metals and gold prices as well as in case of higher demand from global industry and producers of solar batteries.

-

Parabolic gives bullish signals.

-

Bollinger bands have contracted which means lower volatility.

-

RSI is above 50. It has left overbought zone, no divergence.

-

MACD gives bullish signals.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.