Rising supply a headwind for Brent crude price

Brent crude price has been declining on continued excess of supply over global demand. Will the price resume advancing?

Brent crude oil price has been rebounding after hitting multi-year low in January. It has gained more than 68% since. However the rebalancing of global oil market has not proceeded at a pace initially hoped for as global supply still outstrips demand. Last week reports from the Organization of the Petroleum Exporting Countries, the Paris-based International Energy Agency and the US Energy Information confirmed the continuing oversupply of crude. The news last week that Nigeria and Libya are planning to increase oil exports was additional bearish factor for oil prices. Royal Dutch Shell and Exxon Mobil announced they have resumed Nigerian exports after militants had caused the shut-in of supply. Libya is also planning to resume exports from its Ras Lanuf port. The increased exports could result in additional supply of 1 million barrel per day, pressuring oil prices.

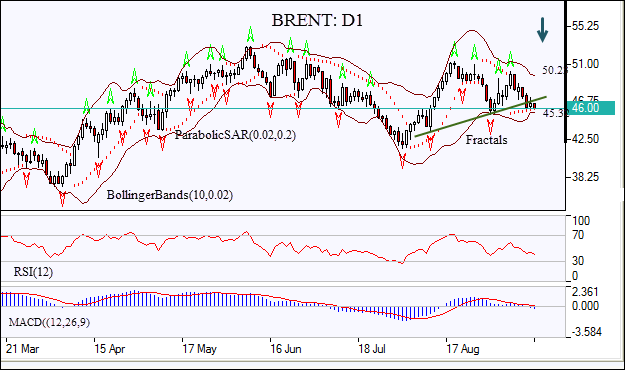

On the daily chart the BRENT: D1 has been retracing after rebounding to one-and-half month high in mid-August.

The price has fallen below the neckline of a head-and-shoulders pattern, which is a bearish signal.

The Parabolic indicator gives a buy signal.

The Bollinger bands have narrowed, indicating decreasing volatility.

The RSI oscillator is falling but hasn’t reached the oversold zone yet.

The MACD indicator is below the signal line and the gap is rising which is also a bearish signal.

We expect the bearish momentum will continue after the price breaches below last fractal low at 45.32. This level can be used as an entry point for a pending order to sell. The stop loss can be placed above the last fractal high at 50.23. After placing the pending order, the stop loss is to be moved to the next fractal low, following Parabolic signals. By doing so, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop loss level (50.23) without reaching the order (45.23), we recommend canceling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position Sell

Sell stop Below 45.23

Stop loss Above 50.23

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.