Let us consider the GBP/USD pair on the daily timeframe. On June 3 the Bank of England decided to keep the interest rate unchanged at 0.5% and to leave the monetary stimulus program unchanged at GBP 375 billion. June 30 final report indicated the UK economy grew 0.4% in the first quarter due to growing domestic demand as the current account deficit of 20.6 billion pounds, or 5.8% of GDP, subtracted 0.6 percentage point from growth. The economic outlook of UK is uncertain as the winning Conservative party plans to hold a referendum on Britain’s membership in European Union by the end of 2017 and possibly as early as 2016. The conservative party has also pledged to close the budget deficit in five years and Chancellor George Osborne is going to announce the austerity measures on July 8 when he presents the government’s budget for the next four years. The fiscal tightening will likely act as a drag on growth. The political and economic uncertainty from the possible Greek exit form euro-zone in turn increase the downside risks for UK economy. On this backdrop US economy appears to be on track of firm recovery, with solid June jobs report increasing the likelihood of September rate hike. The British pound will likely weaken against the US dollar in near term given the divergent growth prospects and monetary policies of the Federal Reserve and Bank of England.

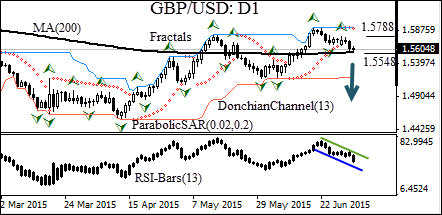

The GBP/USD has been trading with a downward bias since the Greek negotiators failed to reach an agreement on bailout extension with Eurogroup finance ministers on June 19. The Parabolic indicator gives a sell signal. The RSI-Bars oscillator moves in a downtrend channel. The Donchian channel is flat. The pair has crossed below the last fractal low at 1.56672 and is falling toward the 200-day moving average. We believe the bearish momentum will be confirmed after the pair closes below the 200-day moving average at 1.55485. A pending order to sell can be placed below that level. The stop loss can be placed above the last fractal high at 1.57886. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

PositionSellSell stopbelow 1.55485Stop lossabove 1.57886

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.