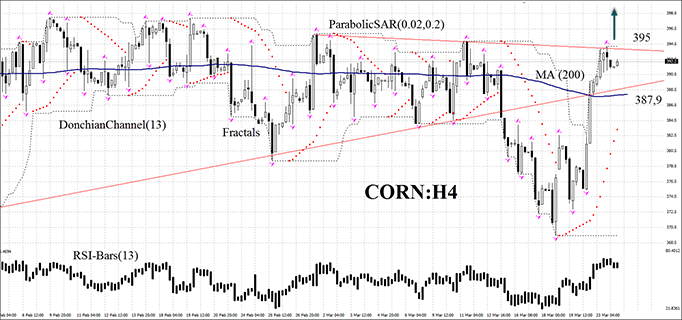

We would like to draw your attention to the CORN futures H4 chart. In the previous overview we pointed out that increase and decrease were equally probable. Eventually, due to the strengthening dollar, corn quotes declined but now they start growing again. We are considering buying the futures. This decision may be confirmed by the dropping dollar and estimated drought in the US. Grain crops may show a sharp growth in the future because of the potential onset of El Niño this year. Competent weather agencies haven't released forecasts yet but anything is possible. We remind that El Niño was last seen in 2010. The natural phenomenon boosted food prices back then. On March, 26 US Department of Agriculture (USDA) will publish a weekly report on food export. It may dramatically affect corn, wheat, soy, cotton and beef quotes.

Let us consider the CORN futures on the H4 time frame. It is traded in a mid-term range. The graph has recently shaped a triangle figure and continued moving down. However, there were no significant drop and corn returned into the neutral trend rather fast. RSI-Bars latest signals rebounded from the overbuy zone which is located above 70. At the same time the oscillator didn't breach 50. Donchian Channel expanded and the curve reached its upper boundary. The Donchian upper level is above 200-day moving average (MA 200). We do not rule out further bullish momentum if the latest bar of the CORN futures closes above the “old triangle” - 395. A pending buy order may be placed there. Stop loss may be placed at MA 200 level which can be considered as a support line – 387.9 mark. After pending order activation, Stop loss is to be moved every four hours near the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes which were not considered.

- Position Buy

- Buy stop above 395

- Stop loss below 387,9

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.