Today at 14:30 CET Manufacturing sales will be released in Canada. The indicator is published monthly by Statistics Canada. It’s a leading indicator of consumer spending and employment. For this reason the statistics is important for investors who expect the potential dividends from long-term investment. We assume that the indicator release may result in increased volatility of the Canadian dollar against other liquid currencies.

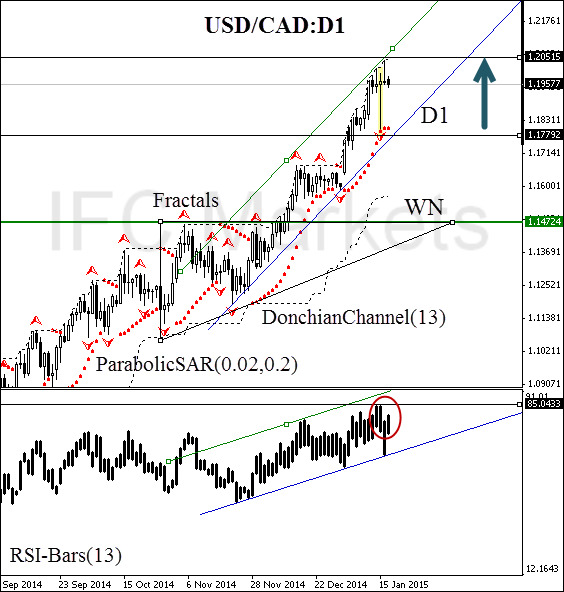

In order to diversify investment possibilities, today we consider USD/CAD on the D1 chart. The price crossed the strong weekly resistance line and formed a new daily uptrend channel. It was accompanied by the breakout of the upper triangle side, which has a bullish bias. ParabolicSAR historical values move along the trend line, increasing its strength. RSI-Bars oscillator also confirms the trend. There is no contradiction on the part of DonchianChannel (13). The price is moving along the upper border, constantly updating the channel peaks. Bulls gained a massive foothold. We deem the next bullish momentum would occur after the fractal resistance crossing at 1.20515. This mark can be used for placing a pending buy order. Conservative investors should wait for the oscillator breakout at 85.0433% to confirm the price breakout. Stop Loss is to be placed below the last support at 1.17792, which is confirmed by the trend line and Parabolic historical values. After order opening, Stop Loss is to be moved after Parabolic values near the next fractal low. Thus, we are changing the probable profit/loss ratio to the breakeven point.

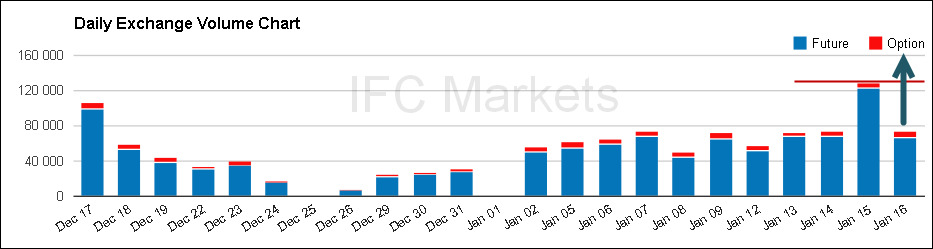

At the moment, the volume of CAD futures traded on the Chicago Mercantile Exchange doesn’t confirm the trend: the level of 120 000 contracts has been outperformed. The most cautious investors are recommended to wait for the breakout of this level to verify the bullish market.

- Position Buy

- Buy stop above 1.20515

- Stop loss below 1.17792

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.