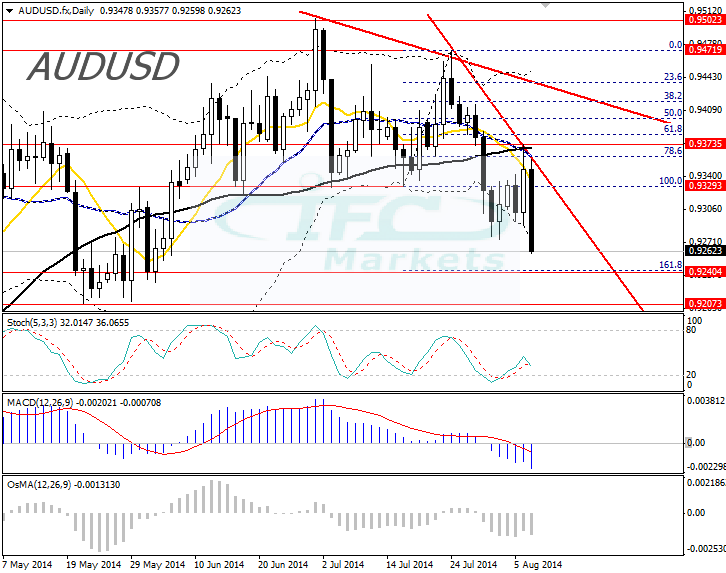

Hello, dear traders. Today we are going to analyze the Aussie against the US dollar chart. The currency pair comes from a long term uptrend but a reversal pattern is created in the daily timeframe with prices falling to 2-month low. Currently the forex pair is below the both of the tentative falling trend lines and as we can see there is a likely bearish formation establishment. Moreover, the Moving Averages are creating negative triple cross which increases bearish expectations. The current candle of the currency pair is a bearish engulfing and has made a substantial down move in the current daily trading session also it has breached the lower Bollinger Band. However, the candle is not yet finished and therefore its signal is not valid, we have to wait to see the close of the day to make the appropriate conclusions. Towards the next support which is the 161.8% Fibonacci extension of 0.9329 to 0.9471, at 0.9240 there are not any obstacles blocking the way. Thus, based on the price analysis we would expect the currency couple to move lower at 0.9240.

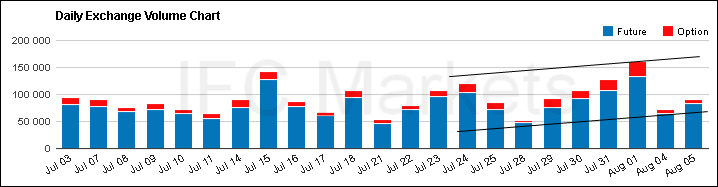

At the below chart we can see the daily volumes of futures and options traded on the Chicago Mercantile Exchange. We can see that on the 28th, 29th and 30th of July volume has been increasing and on the 30th of July, at the highest of volume, prices breached support at 0.9329. Then a slight bounce up took place in the AUDUSD with volumes of trading remaining the same or even falling. Eventually leading to today’s bearish trading and we would be expecting the CME release of today’s volume of trading to confirm the validity of the bearish candle.

Looking at the oscillators, MACD is gradually declining and has room for lower levels suggesting that downside could continue. The Stochastic crossed its signal line from above and OsMA is mostly neutral. In our opinion, the downside would most likely continue towards 0.9240 and if the current candle close as a big bearish engulfing then chances are for succeeding 0.9207 as well. Moreover, should the volumes of trading increase then our downside expectations would be confirmed by another analysis tool. Lastly, trading below 0.9207 there will be a double top long term reversal pattern which would signify falling structure.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.