Analysis for February 8th, 2016

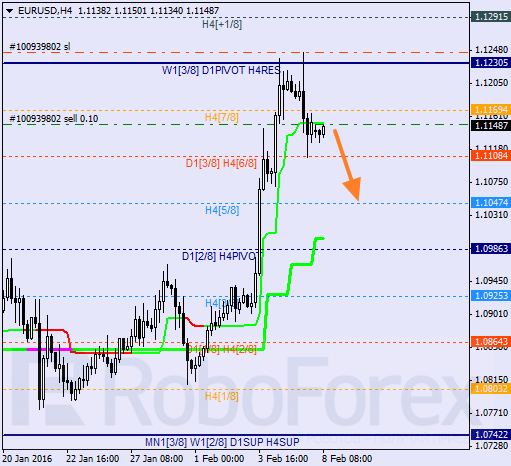

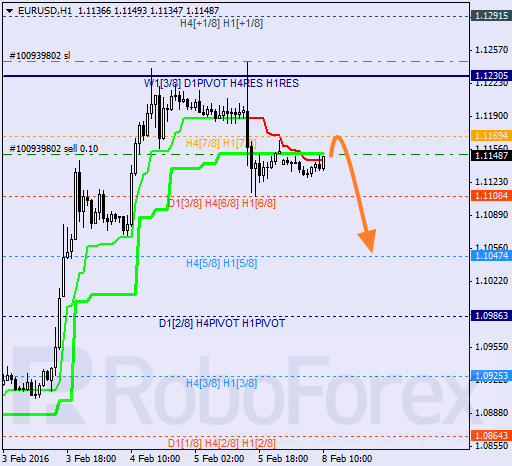

EUR USD, “Euro vs US Dollar”

Eurodollar has rebounded from the 8/8 level twice, which means that it may start a new descending correction. If the market is able to stay below the H4 Super Trend during the day, the price may continue falling towards the 5/8 level.

The lines at the H4 and H1 charts are completely the same. Super Trends have formed “bearish cross” and, as a result, the correction has started. It’s highly likely that on Monday the price will break Friday’s low.

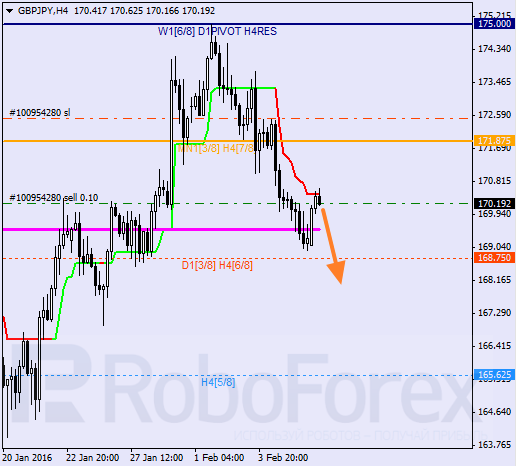

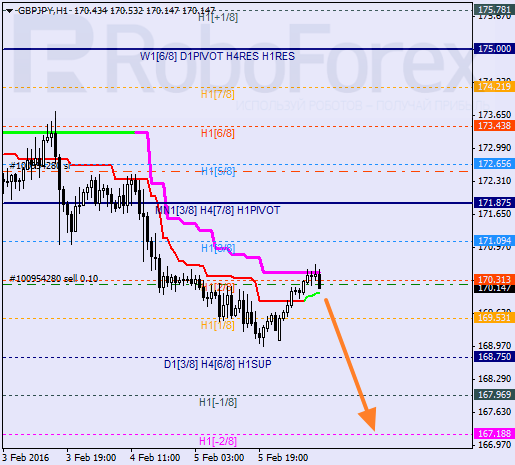

GBP JPY, “Great Britain Pound vs Japanese Yen”

The pair is moving between Super Trends. Earlier, the price rebounded from the 8/8 level and started a new descending correction. If the market is able to stay below the 6/8 level, it may resume its descending movement.

At the H1 chart, the local correction has been supported by the 2/8 level. If later the pair is able to stay under Super Trends, the price may continue falling and break the 0/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.