Analysis for February 5th, 2016

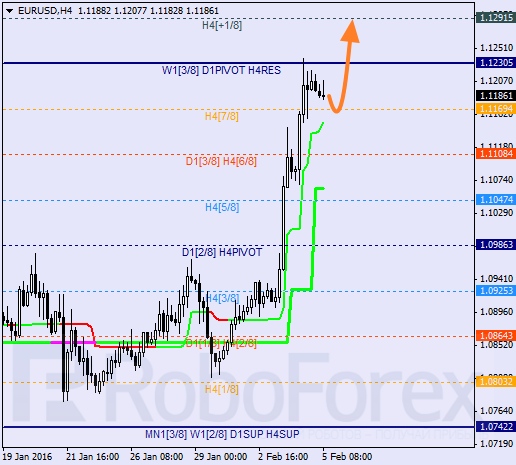

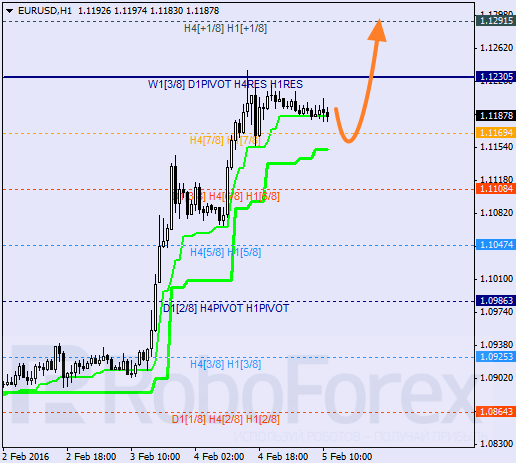

EURUSD, “Euro vs US Dollar”

Eurodollar has reached the 8/8 level and started a new local correction. If this descending movement is supported by the H4 Super Trend, the market may resume growing. in this case, the target will be at the +1/8 level.

The lines at the H4 and H1 charts are completely the same. The current ascending movement is supported by Super Trends. If later the price breaks the 8/8 level and stays above it, the market will continue moving upwards.

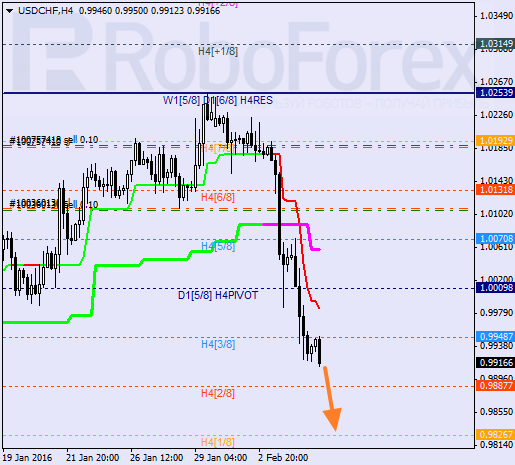

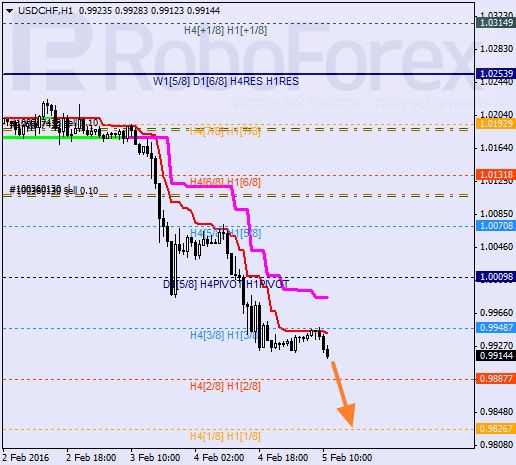

USDCHF, “US Dollar vs Swiss Franc”

After rebounding from the 4/8 level, Franc has started falling. Yesterday, Super Trends formed “bearish cross”. In the nearest future, the pair may continue moving downwards. If later the price rebounds from the 1/8 level fast, it may start a new ascending correction.

At the H1 chart, Franc is supported by Super Trends. This morning, the market has already broken yesterday’s low, and may reach the 1/8 level until the end of this trading week.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.