Analysis for August 01st, 2014

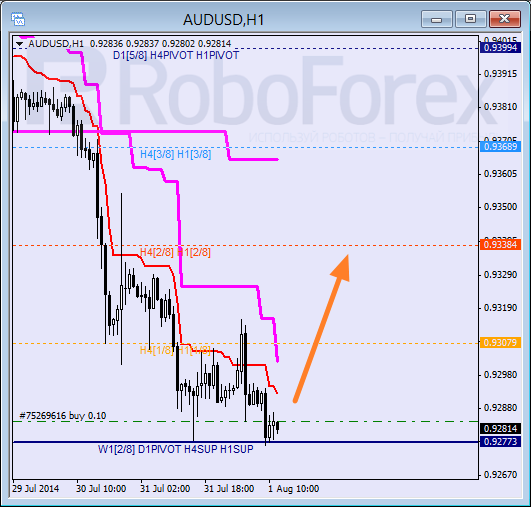

AUD USD, “Australian Dollar vs US Dollar”

Recently, AUDUSD had touched 0/8 level and take profit order was executed in my trade. Price now is testing 0/8 again and in case it pulls back from this level, correctional move to 2/8 can follow.

At H1 we see the same structure as at H4. It’s not excluded that pullback from 0/8 will happen in a few hours and price will be able to hold above Supertrend lines before trading week is finished.

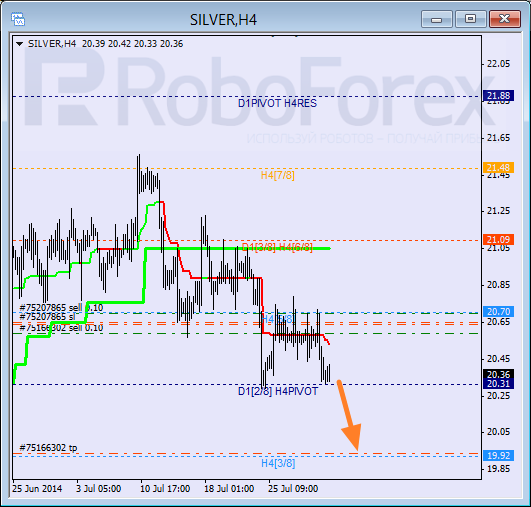

SILVER

Silver is trying to resume downtrend and testing 4/8 level. Before that, we could see series of pullbacks from 5/8 and acceptance below Supertrend line. Stops my my trades are set to breakeven point, I expect that 3/8 level will be achieved.

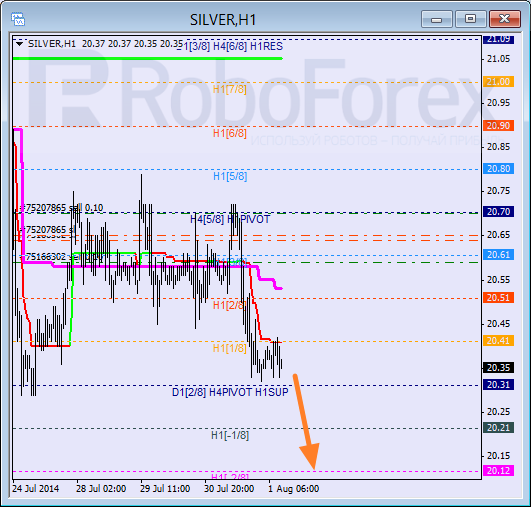

At H1 chart, price is located at the lower side of the whole structure. Supertrend line is providing support. Probably, 0/8 level can be broken today and price can go down in the «overbought» area.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

No tap dancing around inflation concerns

Tuesday saw U.S. stocks closing considerably lower as investors grappled with economic indicators indicating increasing labour costs and a decline in consumer confidence, all coming ahead of a crucial Fed policy meeting aimed at determining the trajectory of interest rates.