Analysis for July 21st, 2014

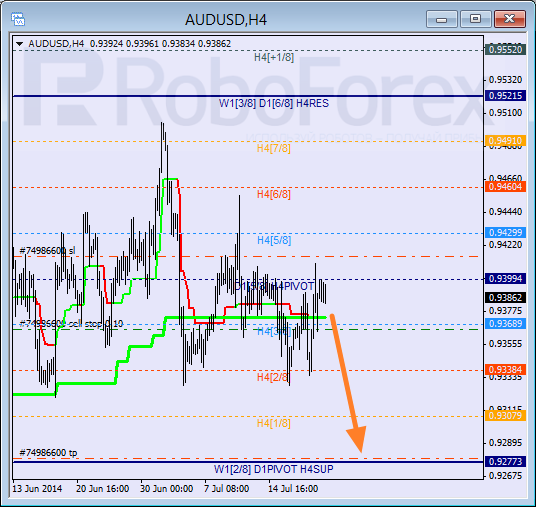

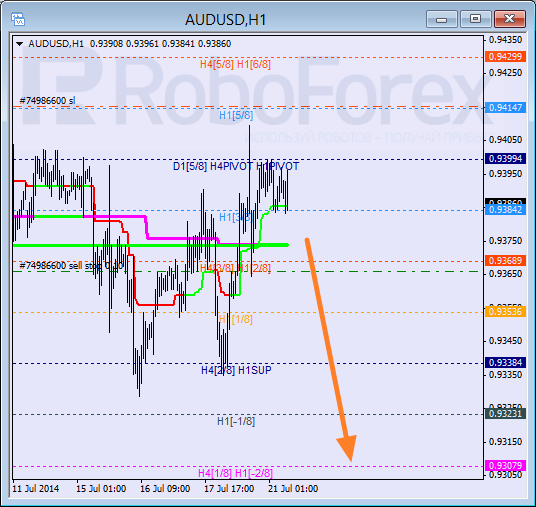

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is still consolidating. Last week, pair rebounded from the 4/8 level several times, which means that it may continue falling down. If later price breaks the 3/8 level downwards, market will continue moving downwards to reach the 0/8 one.

Pair is moving in the middle of H1 chart; Super Trends are influenced by “bullish cross”. However, in the nearest future they may reverse in bearish direction. I’m staying out of the market so far and have only one pending order.

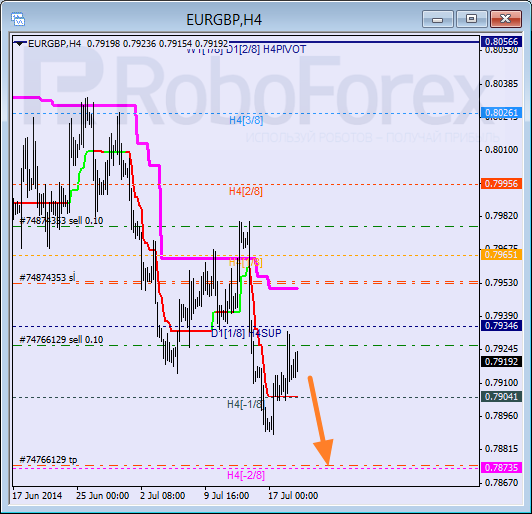

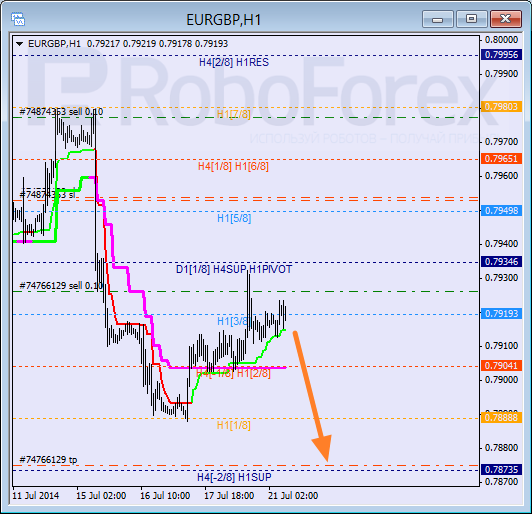

EUR GBP, “Euro vs Great Britain Pound”

Pair is still moving inside “oversold zone”. Last Friday, price tested the 0/8 level and rebounded from it. Target is at the -2/8 level. If market breaks it, lines at the chart will be redrawn.

At H1 chart, price is trying to stay below the 3/8 level. Possibly, Super Trends may form “bearish cross” during the day. Main target here is the 0/8 level, which may later become starting point of new correction.

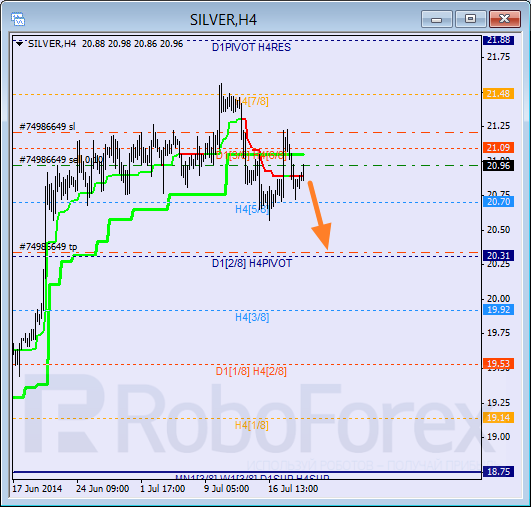

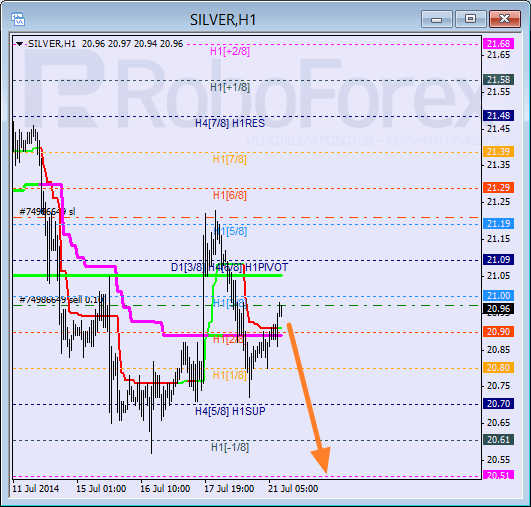

XAG USD, “Silver vs US Dollar”

At H4 chart, current correction is supported by Super Trends. If price rebounds from them, Silver will continue falling down towards the 4/8 level. If this level is broken later, next target will be at the 3/8 one.

As we can see at H1 chart, price wasn’t able to stay inside “oversold zone”. Possibly, Silver may rebound from the 3/8 level during the day. If later market breaks Super Trends downwards, Silver will break the ‑2/8 level and lines at the chart will be redrawn.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.