Edging Closer:

USD Advance GDP (2.3% v 2.6% expected)

USD Unemployment Claims (267K v 268K expected)

With these US numbers overnight fairly close to expectations, the market has interpreted them as not missing by enough to slow down the Fed’s target of raising rates by the end of the year. An important revision was made to the Q1 GDP number, signalling economic growth and giving Yellen yet another excuse to forge ahead.

Of course the strength of this data helped the US dollar index continue to kick off the trend line support level that we spoke about yesterday. How much any decision from the Fed has been priced into the market is now the important question. With the truckload of US data to be released next week, direction on the back of numbers might get a little confusing.

IMF Pulls Support:

The International Monetary Fund overnight pulled its support for any new Greek bailout program. Although this isn’t exactly breaking news, it seems to have exploded in the headlines overnight.

The IMF doesn’t want to get involved until conditions for debt sustainability, including debt relief and economic reforms are clearly assured.

“The IMF probably won’t get paid back, and that creates all kinds of problems.”

“Difficult decisions in Greece regarding reforms, and difficult decisions among Greece’s European partners about debt relief.”

The IMF’s support and participation is critical because without it, German officials would not approve any bailout plans and a whole lot of snowballing would occur from here. Keep an eye on the next deadline of August 20.

To add to another weekend of Euro uncertainty, Greece’s ruling Syriza party will hold an internal referendum to settle a dispute between Prime Minister Tsipras’ support for Austerity measures and the party’s powerful left wing.

It might be wise to close out any EUR/USD trades before the weekend.

———-

On the Calendar Friday:

NZD ANZ Business Confidence

AUD PPI

CAD GDP

USD Chicago PMI

USD Revised UoM Consumer Sentiment

———-

Chart of the Day:

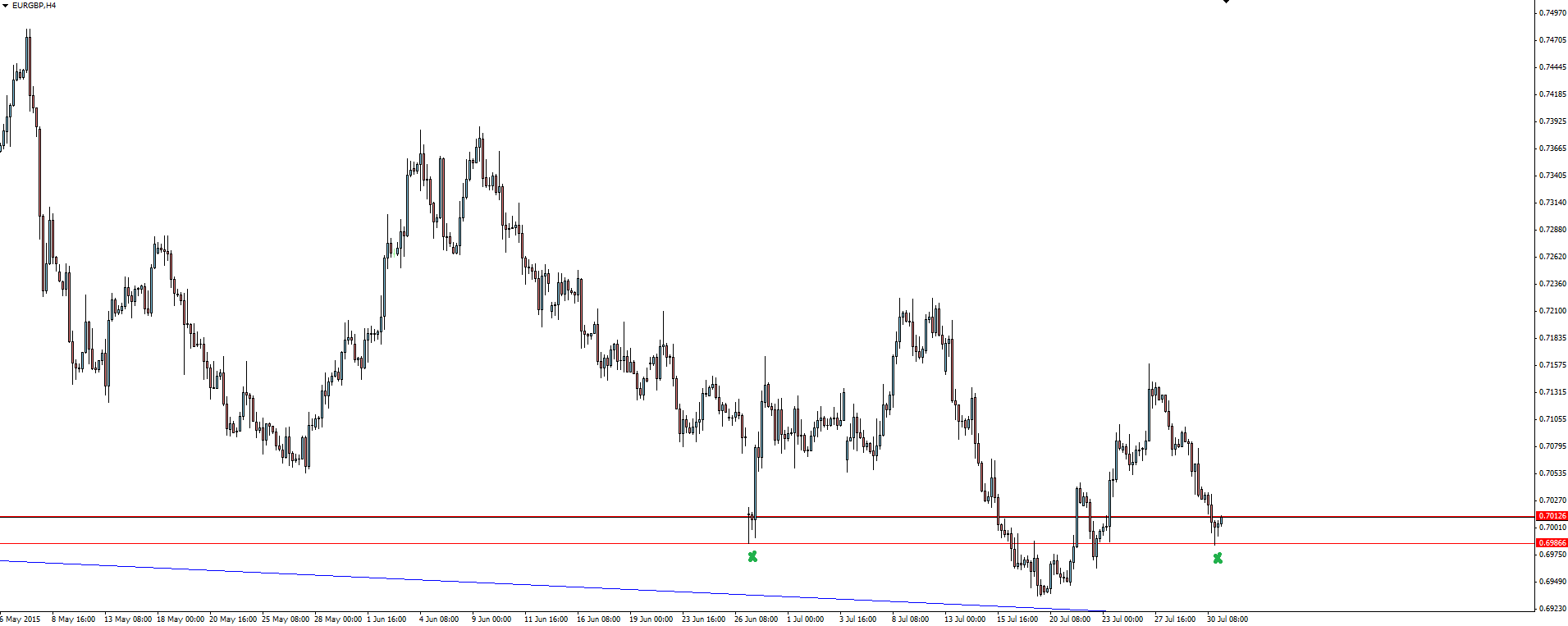

Another cross today with EUR/GBP in focus. We’ve been following this level for a while now with price just unable to make any meaningful bounce off it.

EUR/GBP Weekly:

Click on chart to see a larger view.

This weekly level has been in play for a while now, with price forming a bit of a short term range at its bottom.

EUR/GBP 4 Hourly:

Click on chart to see a larger view.

The fact that price hasn’t bounced up out of this level with any sort of momentum is concerning for bulls, but the level is there to manage your risk around if you like playing the crosses.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.