Morning View:

Good morning from another sunny Monday morning at our Sydney office! No big gaps across the markets this morning as a relatively newsless weekend wraps itself up.

NFP Friday:

The big news being Friday’s Non-Farm Payroll numbers out of the US. The +223K was basically in line with the expected 228K, confusing the algos and giving us some whippy, up and down price action to end the week with no significant change from where we opened the day.

It is important to note that the previous months figure was revised down to 85K from the 126K print, adding yet more fuel to the argument that the Fed will now almost certainly not surprise by raising rates earlier than expected.

UK Election:

Moving across the Atlantic to the UK, David Cameron’s Conservative government looks to have won the UK Election with enough numbers to form government. In my scenarios last week, I spoke about a Cameron win being GBP positive, and that’s exactly what we got with GBP/USD rallying a couple of hundred pips on the day.

It was a shock that the result was as one-sided as it was, with all my expectations going with the polls suggesting the major risk was a move to the downside in GBP on the back of the political uncertainty that a close election and possible hung parliament would bring.

There’s a trading lesson about thinking outside the box here. If everyone is expecting a particular outcome or is trading in a particular direction, where do you think the smart money will be headed? I’ll leave that one with you.

China Cuts Rates:

China again cut interest rates on Sunday by 25 basis points to 5.1% in an attempt to kick start their reportedly (it is China) spluttering economy. This cut will come into effect today. China also cut it’s benchmark deposit rate by the same amount, to 2.25%.

The move was expected and hasn’t had much of an impact on AUD/USD or the wider forex market.

The People’s Bank of China (PBOC):

“China’s economy is still facing relatively big downward pressure”

“At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average”

———-

On the Calendar Today:

Tier 1 data out of Australia today is the NAB Business Confidence survey. We follow that up with central bank action from the BoE who are expected to keep rates on hold but keep a hawkish bias.

Monday:

AUD NAB Business Confidence

EUR Eurogroup Meetings

GBP Official Bank Rate

GBP MPC Rate Statement

———-

Chart of the Day:

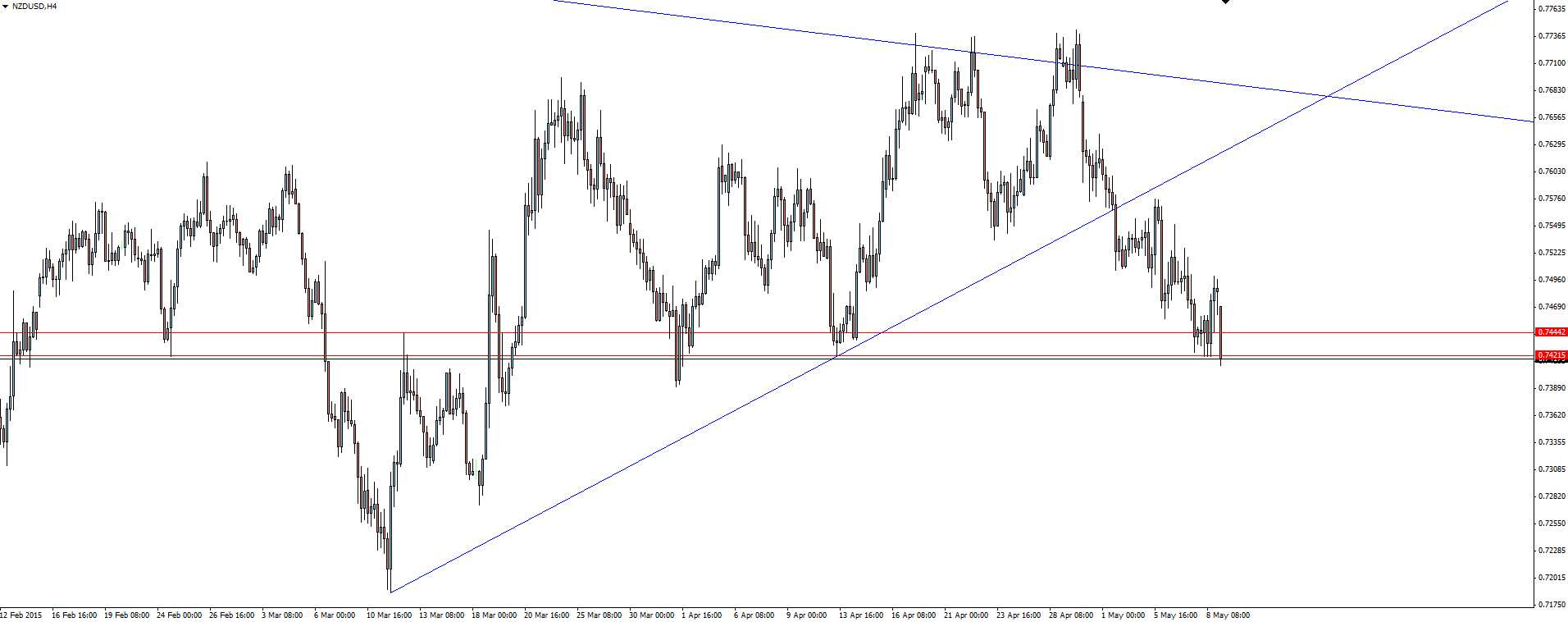

NZD/USD Daily:

Click on chart to see a larger view.

With the RBNZ successfully talking down the currency with the threat of imminent rate cuts, the Kiwi continues to follow through after breaking it’s 4 hour trend line.

Price has come into it’s first buy zone since the break. Keep an eye on how it reacts to this zone and whether we will get a bounce to sell into once again.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.