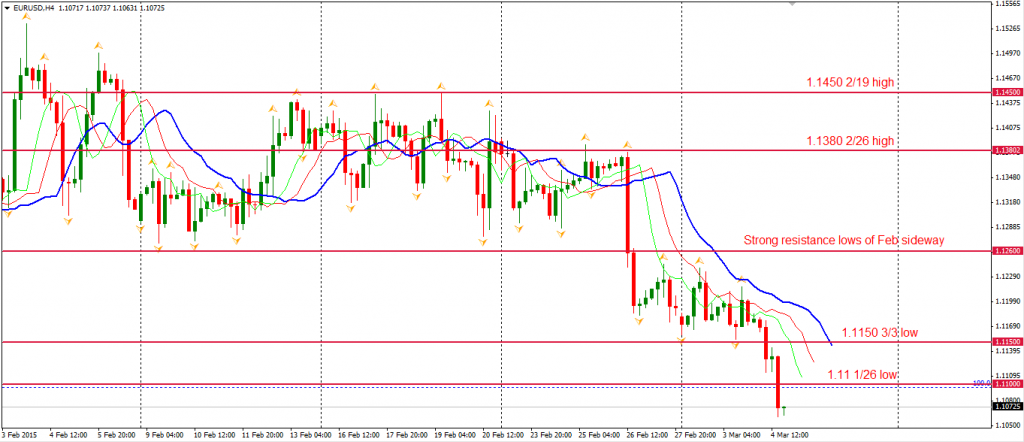

No matter how pleasant the recent improving data in the Euro area is looking, it cannot seem to stop the falling Euro. The Eurozone retail sales rose for the fourth month in a row with the expansion speed at a 9-year high. Data shows how the tumbled oil prices have supported consumption and economic recovery. However, the CPI still fell by 0.3% in February, increasing speculations that ECB may be forced to purchase more assets. The EURUSD yesterday refreshed recent lows to 1.1060, breaking two support levels and former lows nearing 1.11. The alligator is in bearish order, implying the short term trend may continue.

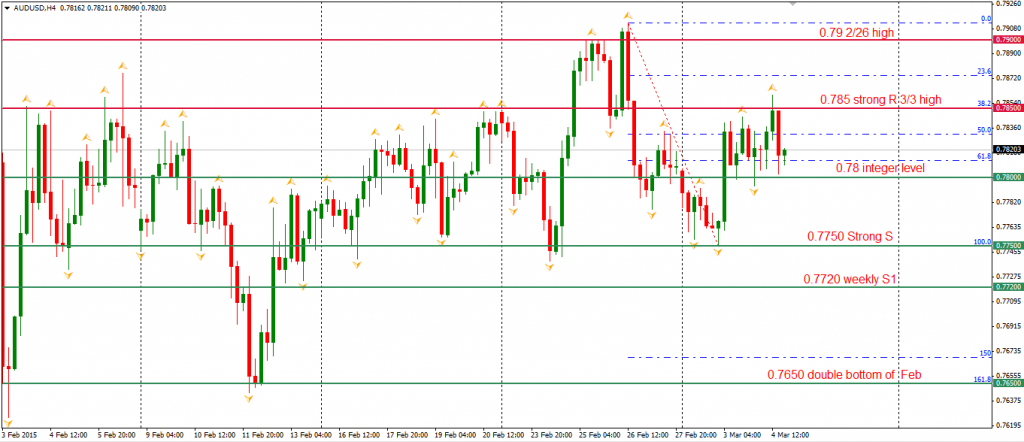

Australian Q4 GDP rose by 0.5% and expanded by 2.5% in 2014, mostly in line with forecasts. Aussie Dollar maintains its consolidation within the range between 0.78-0.7850. The currency is supported by real money but the offers at 0.7850 are still very strong. The larger sideway range will be 0.7750-0.79.

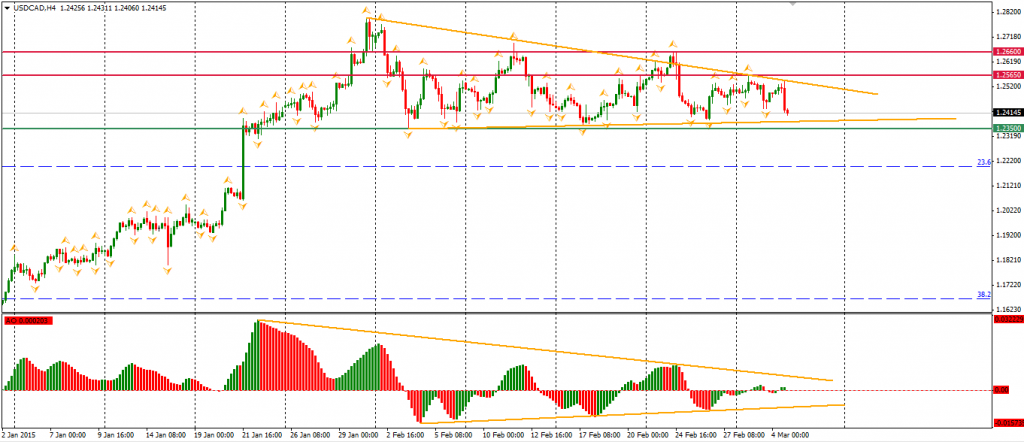

The Canadian Dollar jumped after Bank of Canada held its interest rate at 0.75%, the result disappointed some traders who were betting on an upward breakout of a recent USDCAD triangular pattern. The rebound of oil prices also supports the strength of CAD. Although, it seems unlikely the BOC will cut the rate in the near future, the lessened oil exports still put heavy pressure on CAD. The bottom of the triangle pattern is at 1.2350.

Looking to the stock markets, the Shanghai Composite rebounded by 0.51% to 3280. The Nikkei Stock Average slid by 0.6%. The Australian ASX 200 lost 0.54% to 5902. In European markets, the UK FTSE was up 0.44%, the German DAX gained 0.73% and the French CAC Index rose by 1%. The US stock indices’ retracements continued. The S&P 500 closed 0.44% lower at 2098. The Dow slid by 0.58% to 18097, and the Nasdaq Composite Index fell 0.26% to 4967.

On the data front, Australia retail sales and trade balance will be released at 11:30 AEDST. Bank of England and ECB will disclose their March decision tonight. US weekly Unemployment Claims will be out at 0:30 AEDST after midnight.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.