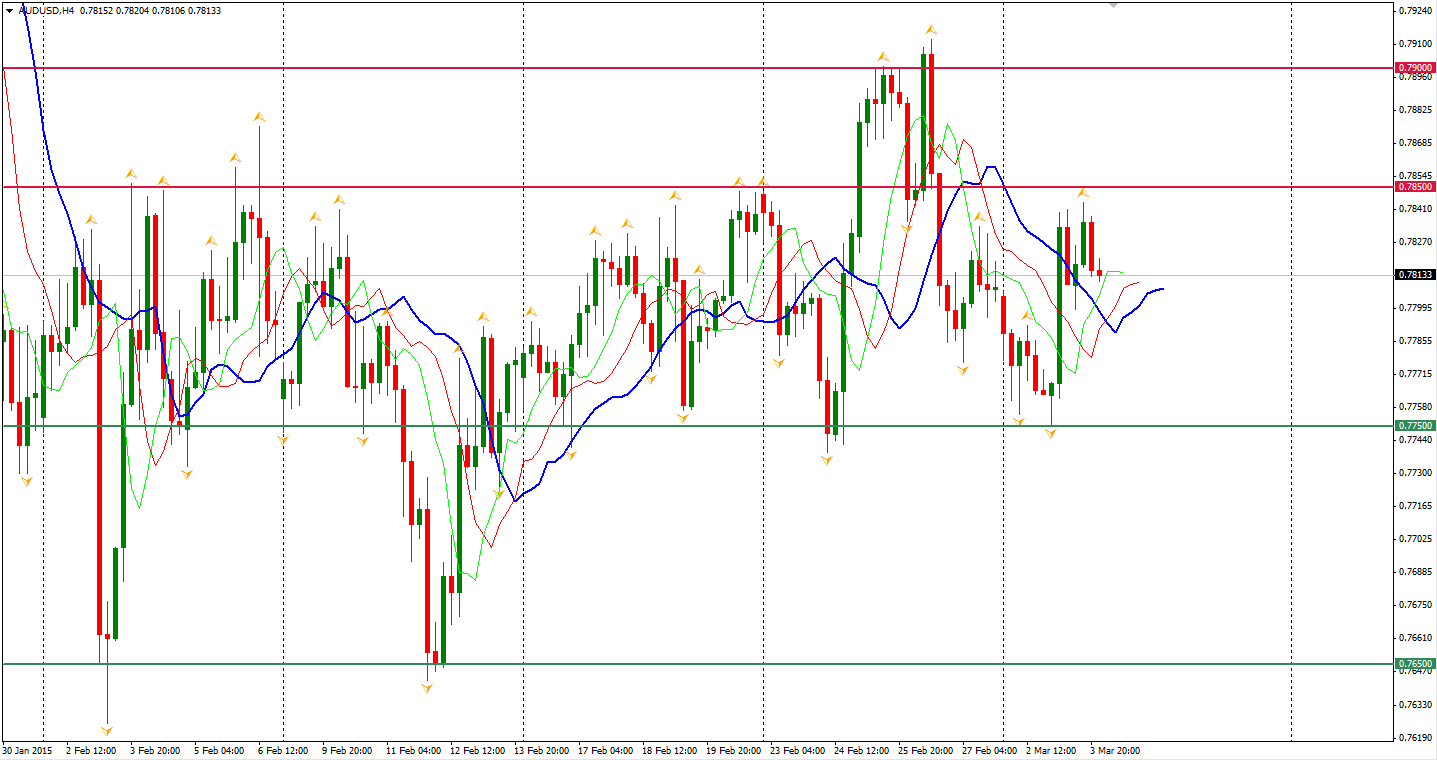

The Aussie Dollar rebounded to a day low of 0.7750 as the RBA paused its rate cutting as announced in the March meeting. This challenged the market expectation which projected over 60% possibility of a cut. Disappointed traders bought back their bearish positions and pushed AUDUSD to an area near 0.7850 which thwarted the pair’s further rally. The wide consolidation continues between 0.7650 and 0.7900. The medium-run outlook is still bearish as the RBA reiterated that ‘a further reduction in cash rate was appropriate’.

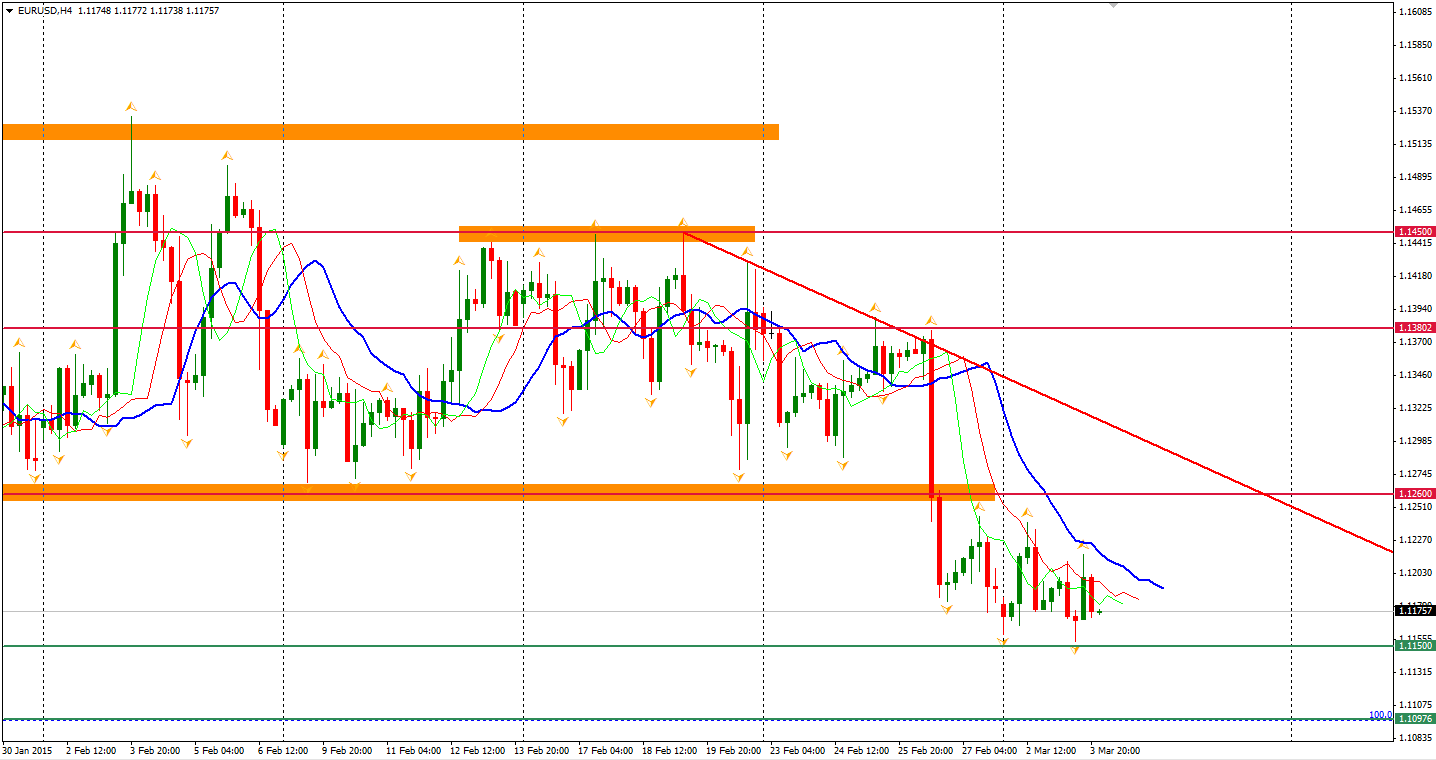

The Euro Dollar maintains its weakness under the 1.12 level. It once refreshed recent lows of 1.1155, but was supported by buying orders around 1.1150. German Retail Sales expanded by 2.9% and Spanish unemployment count decreased by 13,500. Both data results were better than expected. The resistances above are 1.1260, 1.1380 and 1.1450; the support below is 1.1150 and former low around 1.11. The outlook of EURUSD is still bearish as participants have no intention to push the pair back to 1.1250.

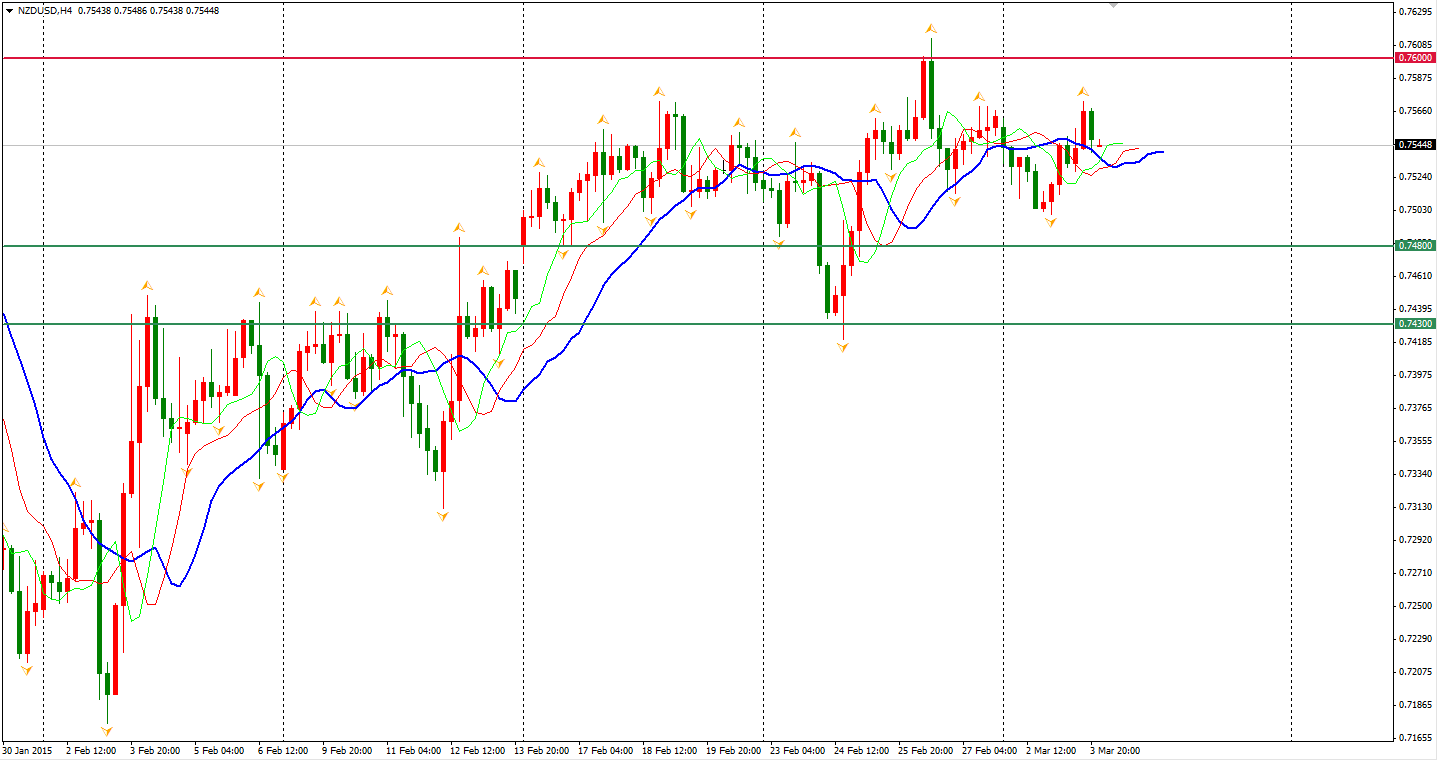

The New Zealand Dollar also bounced with its neighbour but with limited gain. The 0.7600 resistance seems to be strong enough to smash intentions of upward breakouts in short term unless some changes happen from a fundamental aspect. The supports below are 0.7480, 0.7430.

As to stock markets, Shanghai Composite slumped 2.2% to 3263. The Nikkei Stock Average slid by 0.1%. Australian ASX 200 lost 0.42% to 5934. In European markets, the UK FTSE was down 0.74%, the German DAX fell by 1.14% and the French CAC Index lost 1%. The US stock indices retreated from Monday’s gains. The S&P 500 closed 0.45% higher at 2108. The Dow slid 0.47% to 18203, and the Nasdaq Composite Index fell 0.56% back below 5000 and closed at 4980.

On the data front, Australia GDP will be released at 11:30 AEDST. Service PMI of major economies will be released throughout the day today. The most focused attention will probably be on the ADP Non-Farm Employment Change at 0:15 AEDST. Canada’s rate decision will be out at 2:00 AEDST.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.