Major currencies rebounded against the Dollar yesterday as Fed Chairwoman Yellen showed a slight dovish tone in her testimony to the Senate bank committee. AUD and CAD led the rises by over a 1% gain after the speech. On the other hand, the GBP barely changed as it is still suppressed by the 1.5480 level.

As I mentioned yesterday, Yellen’s monetary standpoint is biased to mild dovish. Yesterday’s testimony was in line with her position. She said Fed will stay patient and the rate hike is unlikely to happen in the next couple of meetings, which weakened the US Dollar. However, the chairwoman also mentioned that the change of guidance means Fed will discuss raising the interest rate once the economic data is strong enough. Market interprets this speech as a reminder that ‘patience’ will be deleted in March FOMC meeting.

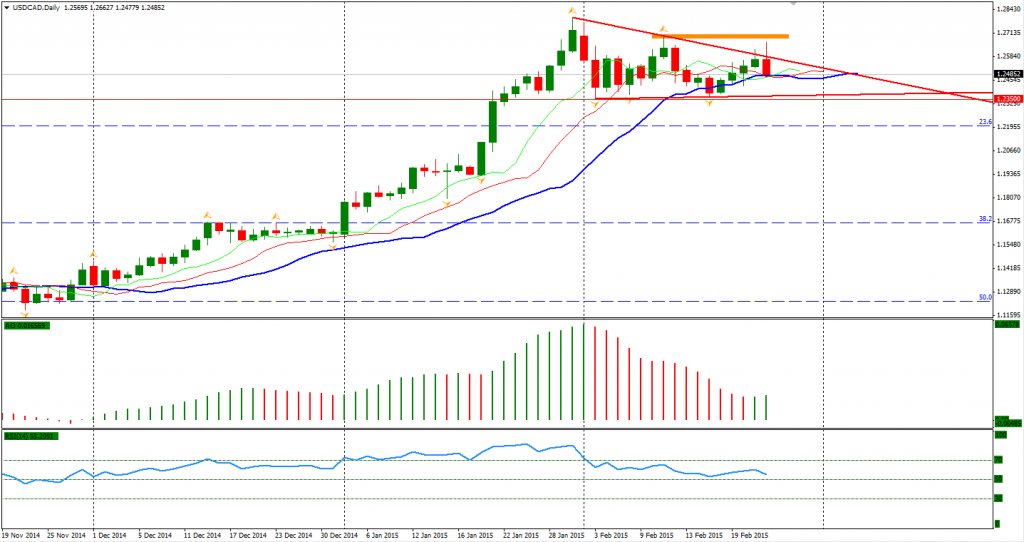

A major reversal of the USD did not happen last night as the reactions of the FX market were limited. The USDCAD once broke the upside line of its recent triangle pattern but fell back later. It is still unclear whether the temporary breakout was successful. The consolidation can be seen as over if the pair moves above 1.27.

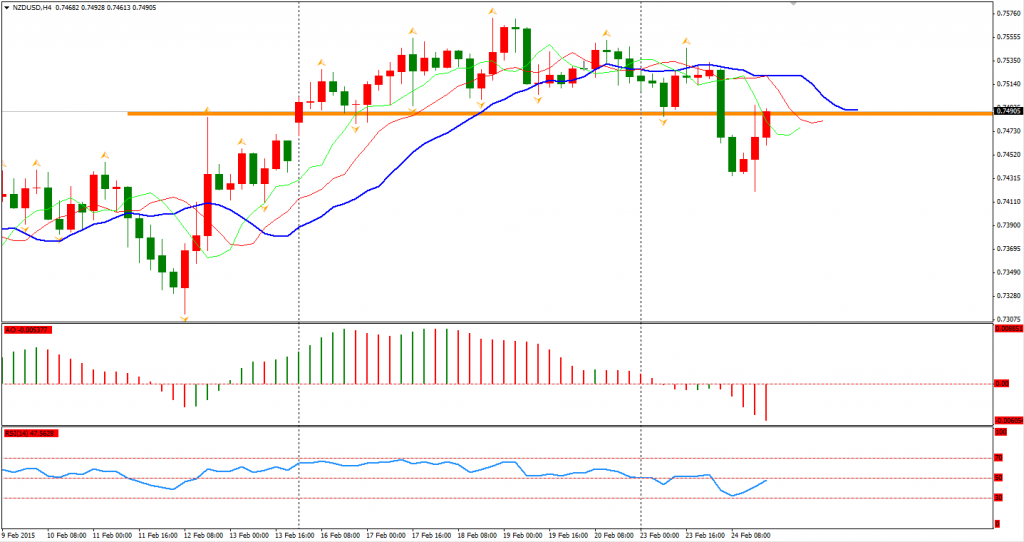

The New Zealand Dollar once slid almost 100 pips versus the USD after inflation expectations fell to 1.8% from 2.1% of previous quarter’s reading. It recovered half of its loss after Yellen’s speech but still cannot rise back above the 0.75 level. A head-and-shoulders pattern has been formed and NZDUSD remains bearish and may fall to previous lows of 0.73.

Looking to the stock markets, the Nikkei Stock Average gained 0.74% to 18603, once again refreshing its highest level of 15 years. Australian ASX 200 rebounded 0.32% to 5927. In European markets, the UK FTSE was up 0.54%, the German DAX climbed 0.67% and the French CAC Index gained 0. 5%. The US stock indices broadly rose on Yellen’s dovish testimony. The S&P 500 closed 0.3% higher at 2115. The Dow gained 0.51% to 18209, and the Nasdaq Composite Index rose 0.14% to 4968.

On the data front, China HSBC Flash Manufacturing PMI will be released in the afternoon 12:45 AEDST. BOE Governor Carney will speak at 21:00 AEDST and Fed Chairwoman Yellen will testify before the House Financial Services Committee at 2:00 AEDST.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.