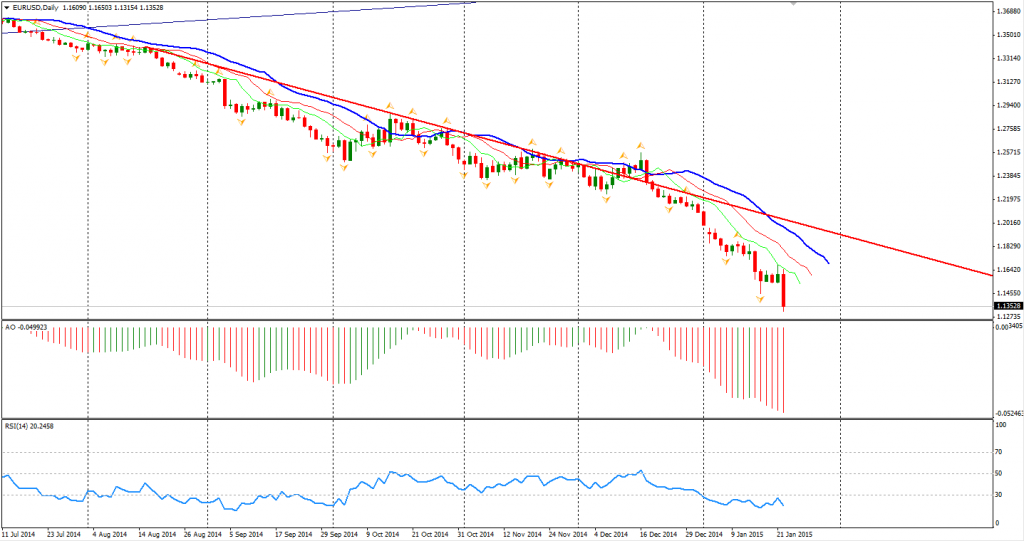

We have been expecting the result of this ECB decision for quite some time now. Many see this announced asset purchasing program as a chance to temporarily allow market participants to have some faith in that the ECB is serious on fighting deflation. The release though subdued the Euro down to a refreshed low below 1.1350 and pushed up the global stock markets. In fact, the Euro hit a 11 year low.

The total amount of the program is no less than 1.1 trillion Euro – 60 billion Euro per month, starting in March and until at least the end of September, 2016. Mr. Draghi emphasises that the program is open-ended like the QE3 of the US and will continue until the inflation level of Eurozone returns to 2%. As aforementioned, this QE was expected but the amount was actually twice as much as any prediction had set out. Traders now are mostly satisfied.

The falling Euro also helped the USD rise against other majors. A breakout just happened as I was writing this report. The Aussie Dollar slumped below its former mouth low of 0.8030 – finishing the over-a-month consolidation. The 0.8000 integer level is being tested and may not support the currency for long. The Australian Dollar still is the strongest currency among other commodity pairs. After NZDUSD broke the bottom of its three-month consolidation and the Bank of Canada just cut its interest rate, the Aussie Dollar won’t be able to defy gravity on its own. The next target may be 0.78 and 0.75.

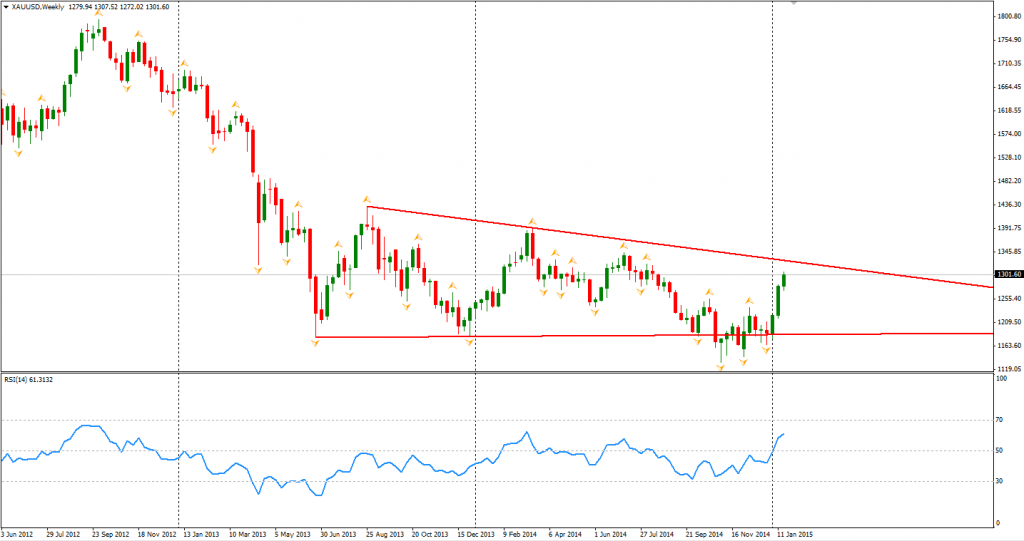

Gold prices surged to $1304 refreshing recent highs as the newly announced QE provided enough funds for the market. In the weekly chart, we can see a downward trendline connecting the highs of 2013 and 2014. The next target of gold may be this trendline and the price level is around $1325.

Stock markets were in a sea of green. The Shanghai Composite rose 0.59% to 3343. ASX 200 bounced 0.49% to 5420. The Nikkei Stock Average gained 0.28%. In European markets, the UK FTSE was up 1.02%, the German DAX gained 1.32% and the French CAC Index rose 1.52%. The US market closed inspired by QE as well. The S&P 500 closed 1.53% higher to 2063. The Dow gained 1.48% to 17813, and the Nasdaq Composite Index surged 1.78% to 4750.

On the data front, China HSBC Flash Manufacturing PMI will be released at 12:45 pm AEDST. PMIs of Euro area will also be out in this afternoon. UK retail sales will be at 8:30 AEDST and Canada CPI and retail sales will be at midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.