In a day of intriguing data, we saw the Dollar strengthen after the FOMC meeting minutes. Most of the committee felt that the impact from the global slowdown was fairly limited and should watch for the drop of price expectations.

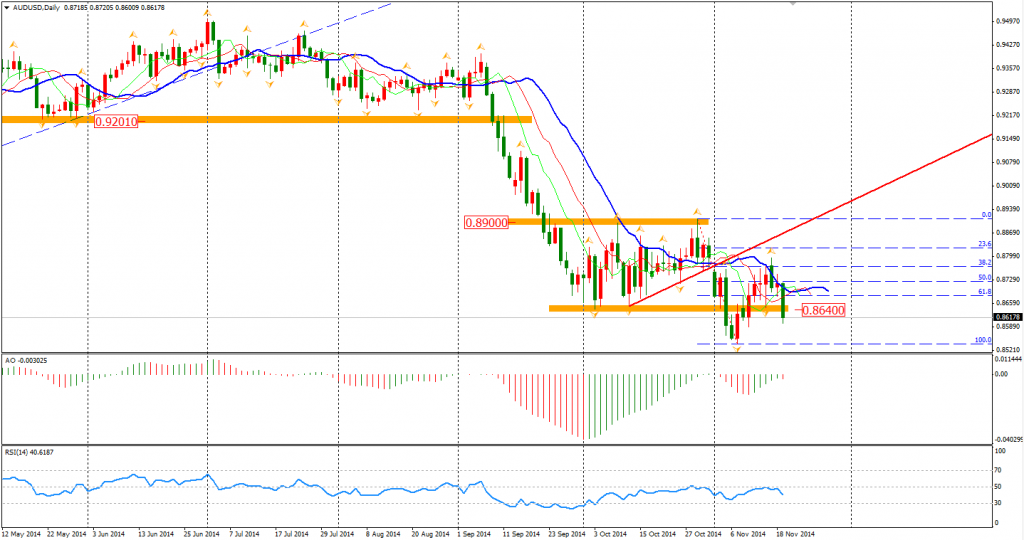

The AUD and JPY were yesterday’s biggest losers to the USD. The Aussie/Dollar declined by more than 1% to 0.86 which we foresaw as written in yesterday’s wrap. A new round of falling has been confirmed. The pair may pull back to 0.8640 testing the breakout of this support, which may see a good entry level for technical traders.

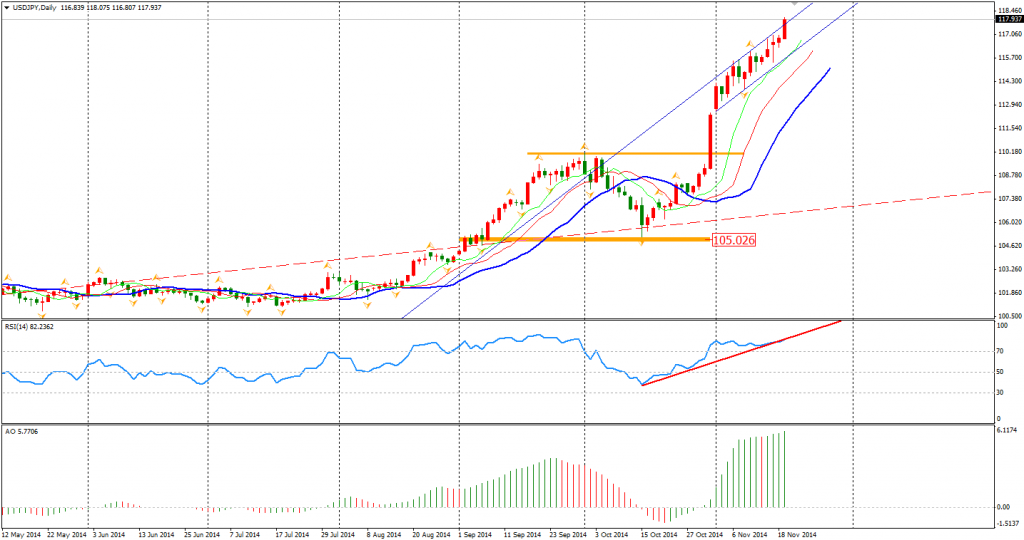

The Yen refreshed its multi-year lower for the second time this week approaching the 118 level. We still see no signs of a cease in the Yen depreciation. The BOJ has decided to maintain the current monetary policy and 80 trillion Yen purchasing program. The Dollar Yen fell a little after the release. The central bank thinks the CPI will keep at its current level and the impact of the sales tax rise is subsiding.

PM Abe may win the re-election in December but the focus of market has moved to the world’s heaviest debt burden as half of the Japanese government spending flows to interest and pensions.

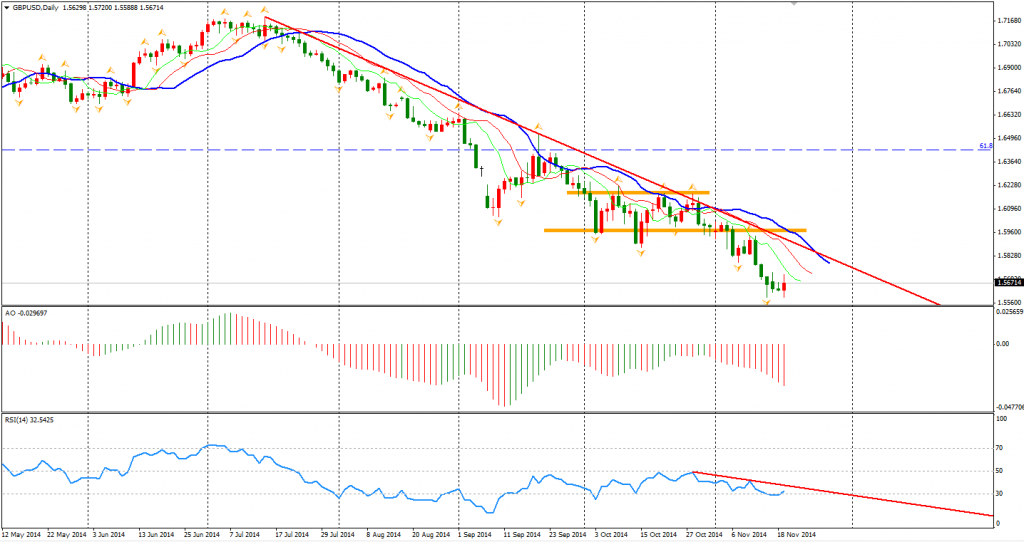

Our winner, the Sterling, on the other side, climbed against the Dollar with BOE minutes more hawkish than expected. The Pound/Dollar once drew back to the 1.57 level after it temporally touched 1.5590. It is the first rise for Sterling Dollar in the last six days, during of which the pair lost 1.8%.

The Asian stock markets closed lower on Wednesday. The Nikkei Stock Average retreated by 0.32%. The Shanghai Composite fell by 0.22% to 2451. The ASX 200 closed by 0.57% lower to 5369. In the European stock markets, the UK FTSE was down 0.19%, the German DAX rose 0.17% and the French CAC Index gained 0.09%.

On the data front, China’s HSBC Flash Manufacturing PMI will be released at 12:45 AEDST. We will see the Euro area Flash Manufacturing PMIs at the beginning of the European session, along with UK Retail Sales at 20:30 AEDST. At midnight, US Unemployment Claims and CPI will be focused.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.