That was the second week in a row for the weakening US Dollar. As the global economic growth perspective is clouded by the news from Japan and the Eurozone, traders are delaying their expectations of the Fed’s first move on interest rate to the second half of 2015.

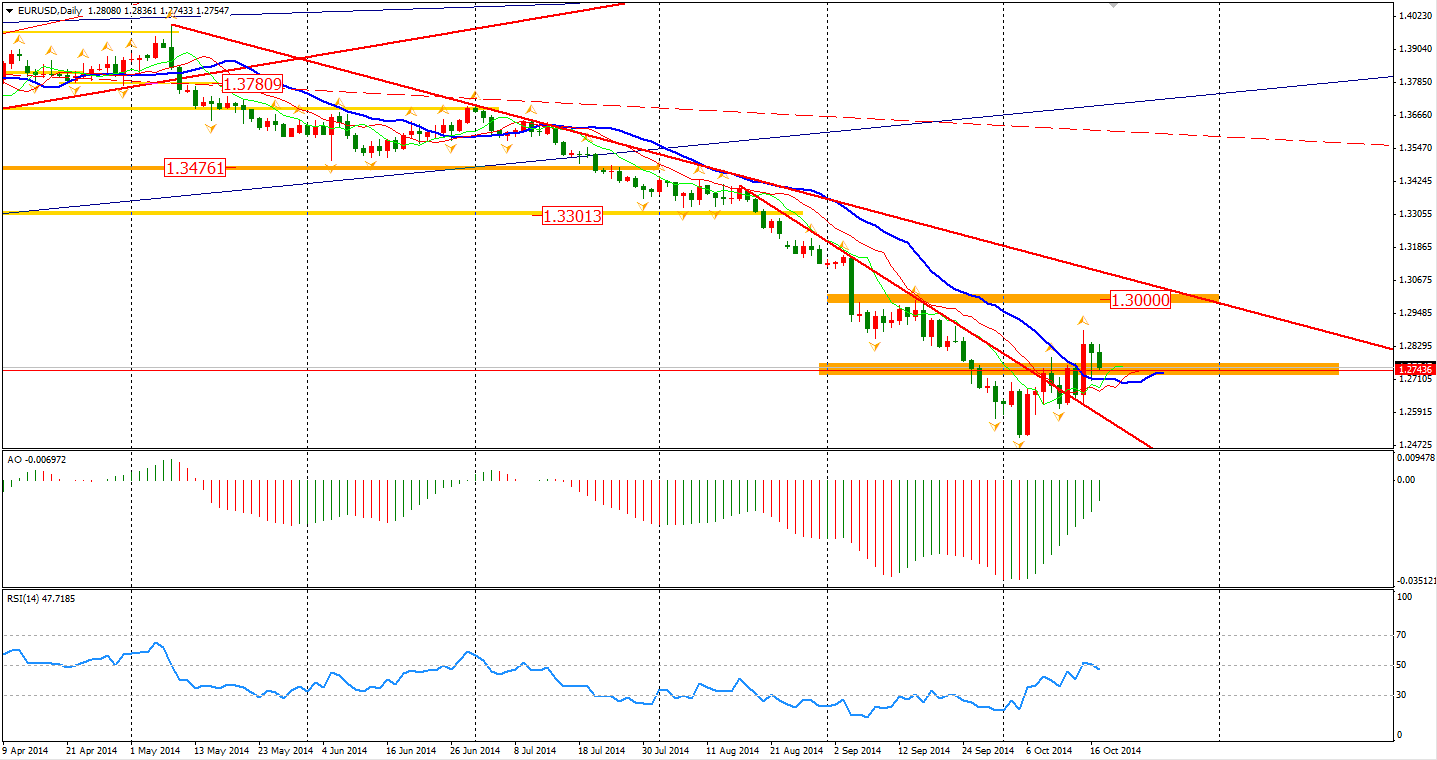

During the last week, the Euro rose 1.1% against the Dollar to 1.2760 – the biggest rally of the last six months. The pair is positioned beyond the 1.2740 level after it upwardly breaking this level and the previous trend line of last week. Technically, the rebound may continue and head to 1.30. However, considering the softening German economy and hiking Greek bond yield, traders shall be cautious when betting on the long side of the Euro.

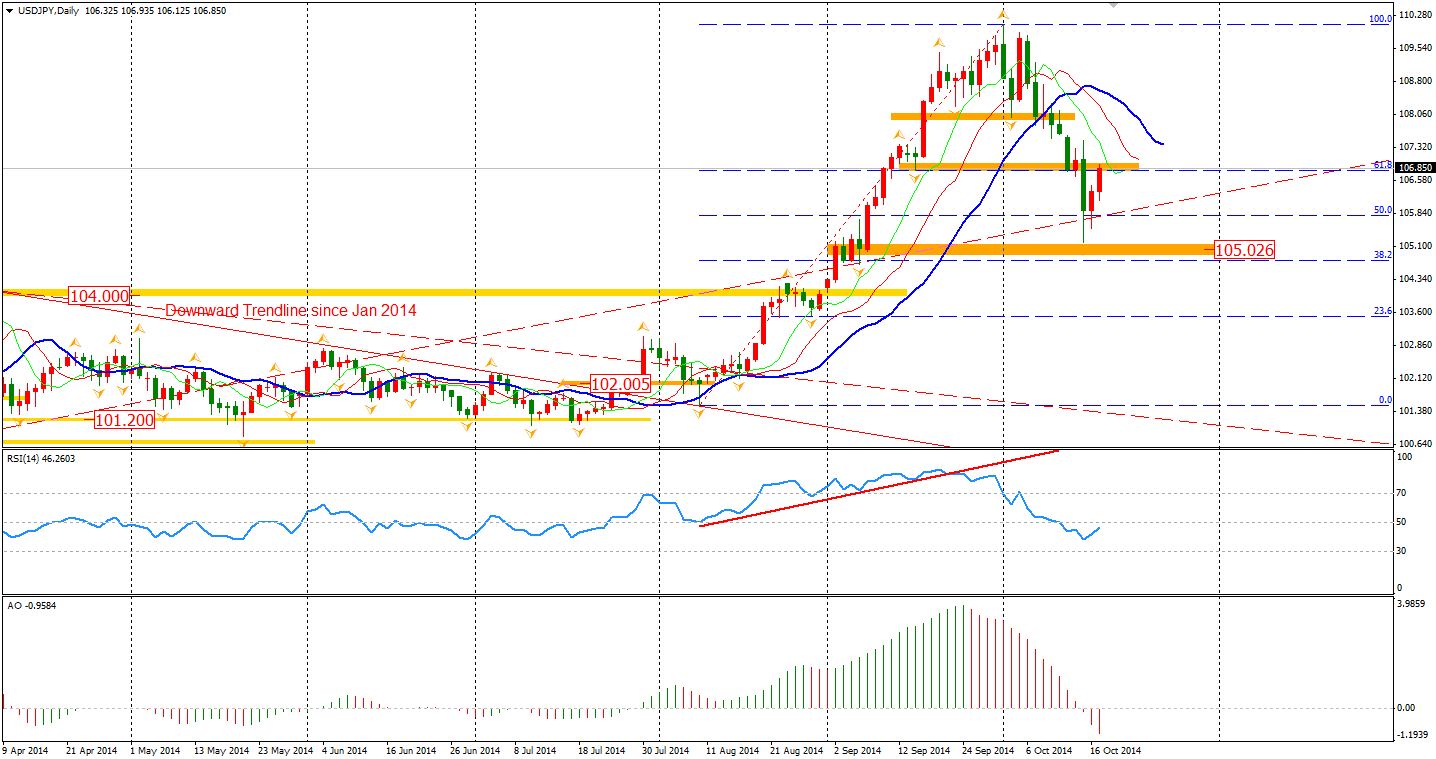

The Dollar Yen rebounded last Friday but remained below the 107 Yen level. Japan may delay the further easing policy as the benefits of a weaker Yen on the Japanese economy have been disappointing. Hence, the Yen may continue its strength for a while retesting the 105 level.

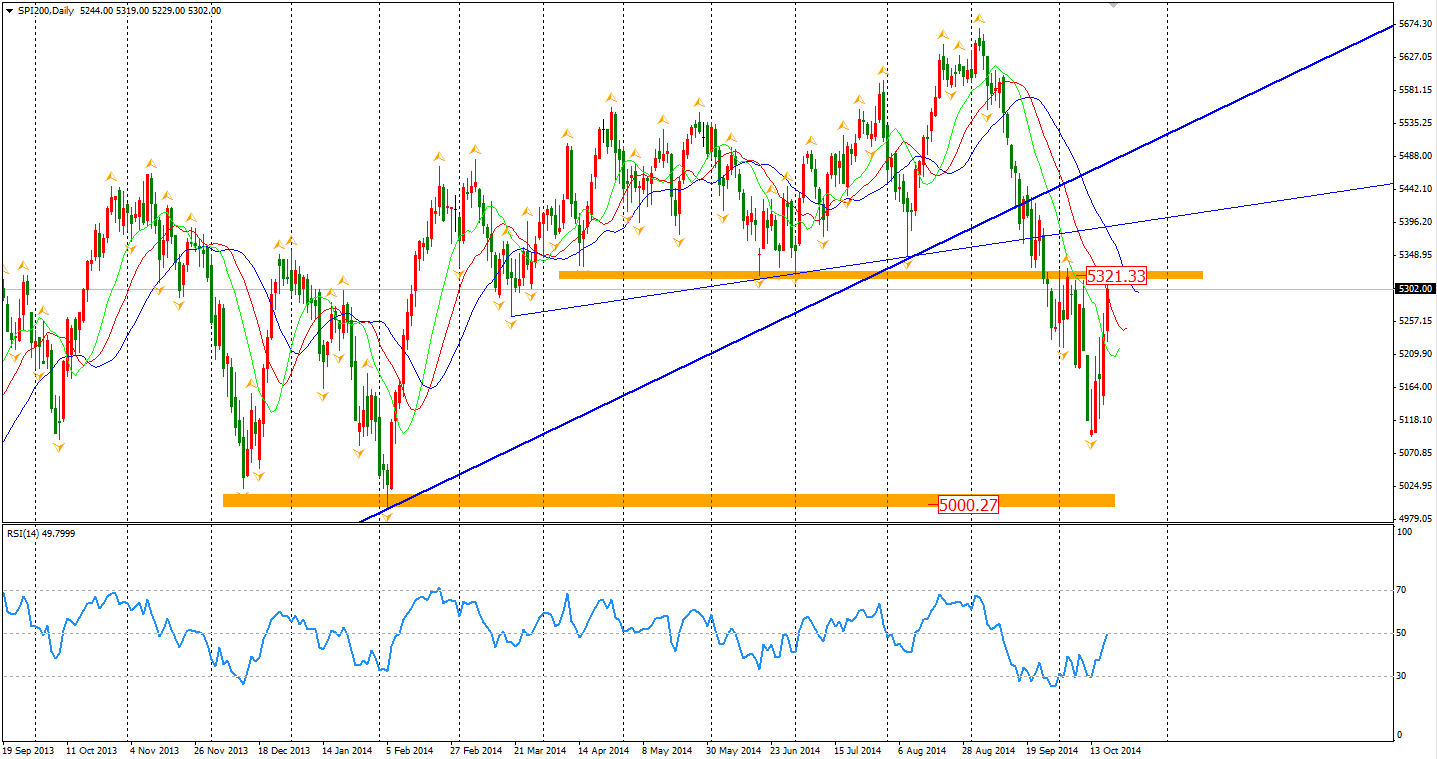

Asian stock markets performed weakly following the overnight US market on Friday. The Nikkei Stock Average slumped by 1.4%. Shanghai Composite also lost 0.6% to 2341. ASX 200 rebounded by 0.32% to 5272 as investors began purchasing oversold stocks. The index once again reached an area as high as 5320- the former critical level we previously mentioned a couple of times. Will this level again become the end of this round of rally?

The Western market was inspired by Central Banks’ officials making dovish statements to support the financial market stability. In European stock markets, the UK FTSE surged by 1.85%, the German DAX rocketed by 3.12% and the French CAC Index rebounded 2.92%. The US market bounced as well. The Dow once gained 1.63% to 16380, while the Nasdaq Composite Index edge up 0.92% to 4258. The S&P 500 surged by 1.29% to 1889.

Today’s only important data will be the Canadian Wholesale Sales release at 23:30 AEST.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.